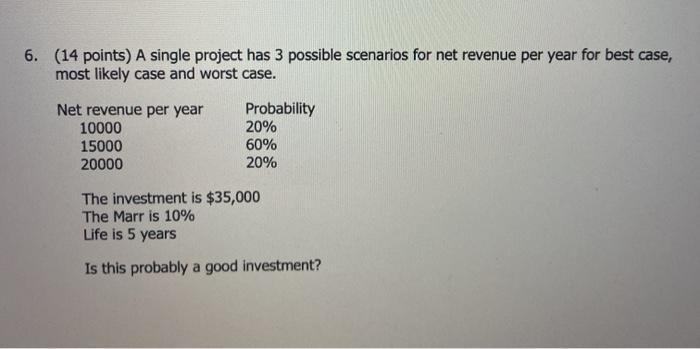

Question: 6. (14 points) A single project has 3 possible scenarios for net revenue per year for best case, most likely case and worst case. Net

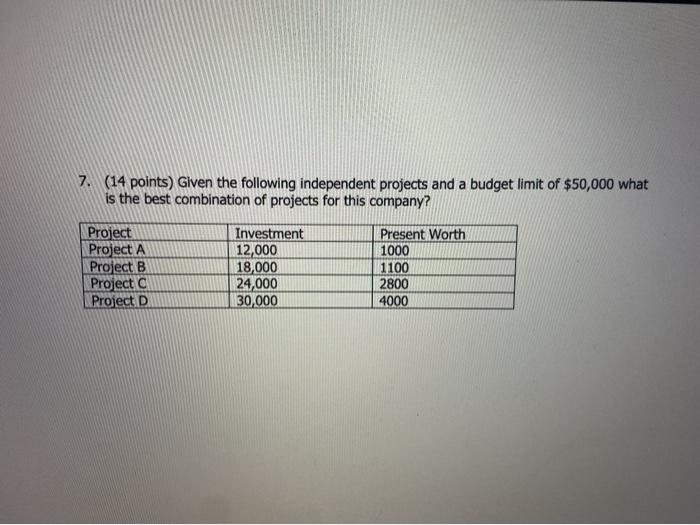

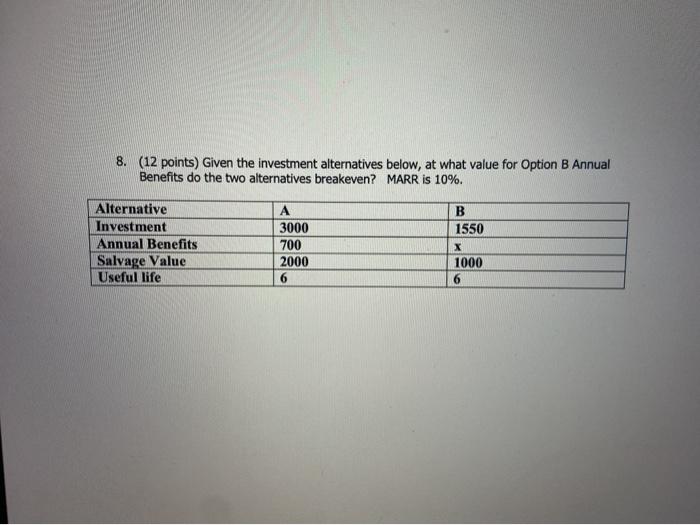

6. (14 points) A single project has 3 possible scenarios for net revenue per year for best case, most likely case and worst case. Net revenue per year 10000 15000 20000 Probability 20% 60% 20% The investment is $35,000 The Marr is 10% Life is 5 years Is this probably a good investment? 7. (14 points) Given the following independent projects and a budget limit of $50,000 what is the best combination of projects for this company? Project Project A Project B Project Project D Investment 12,000 18,000 24,000 30,000 Present Worth 1000 1100 2800 4000 8. (12 points) Given the investment alternatives below, at what value for Option B Annual Benefits do the two alternatives breakeven? MARR is 10%. Alternative Investment Annual Benefits Salvage Value Useful life A 3000 700 2000 6 B 1550 X 1000 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts