Question: 6. (18 points) Suppose your computer screen indicates that you can trade American call options on IBM stock at the values given by the

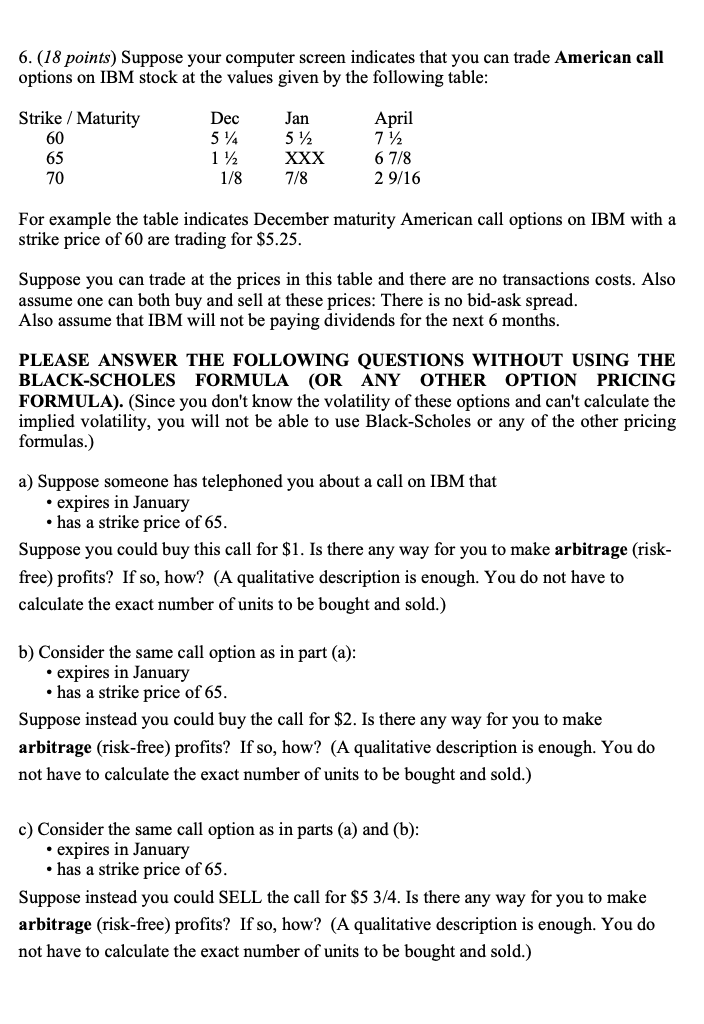

6. (18 points) Suppose your computer screen indicates that you can trade American call options on IBM stock at the values given by the following table: Strike / Maturity 60 65 70 Dec Jan 51 51 April 71 11/2 XXX 6 7/8 1/8 7/8 2 9/16 For example the table indicates December maturity American call options on IBM with a strike price of 60 are trading for $5.25. Suppose you can trade at the prices in this table and there are no transactions costs. Also assume one can both buy and sell at these prices: There is no bid-ask spread. Also assume that IBM will not be paying dividends for the next 6 months. PLEASE ANSWER THE FOLLOWING QUESTIONS WITHOUT USING THE BLACK-SCHOLES FORMULA (OR ANY OTHER OPTION PRICING FORMULA). (Since you don't know the volatility of these options and can't calculate the implied volatility, you will not be able to use Black-Scholes or any of the other pricing formulas.) a) Suppose someone has telephoned you about a call on IBM that expires in January has a strike price of 65. Suppose you could buy this call for $1. Is there any way for you to make arbitrage (risk- free) profits? If so, how? (A qualitative description is enough. You do not have to calculate the exact number of units to be bought and sold.) b) Consider the same call option as in part (a): expires in January has a strike price of 65. Suppose instead you could buy the call for $2. Is there any way for you to make arbitrage (risk-free) profits? If so, how? (A qualitative description is enough. You do not have to calculate the exact number of units to be bought and sold.) c) Consider the same call option as in parts (a) and (b): expires in January has a strike price of 65. Suppose instead you could SELL the call for $5 3/4. Is there any way for you to make arbitrage (risk-free) profits? If so, how? (A qualitative description is enough. You do not have to calculate the exact number of units to be bought and sold.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts