Question: 6.) Bugs Corp. has funded its mega project through shares worth $3,000,000. The total funding required was $5,000,000. The rest of funding was achieved through

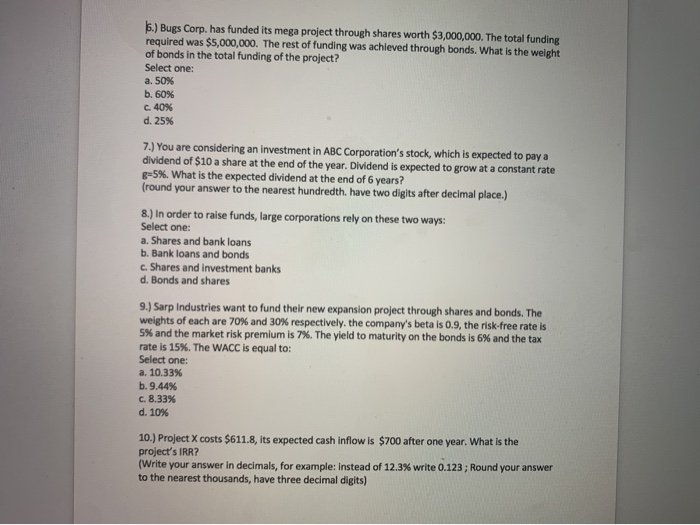

6.) Bugs Corp. has funded its mega project through shares worth $3,000,000. The total funding required was $5,000,000. The rest of funding was achieved through bonds. What is the weight of bonds in the total funding of the project? Select one: a. 50% b. 60% C. 40% d. 25% 7.) You are considering an investment in ABC Corporation's stock, which is expected to pay a dividend of $10 a share at the end of the year. Dividend is expected to grow at a constant rate g=5%. What is the expected dividend at the end of 6 years? (round your answer to the nearest hundredth, have two digits after decimal place.) 8.) In order to raise funds, large corporations rely on these two ways: Select one: a. Shares and bank loans b. Bank loans and bonds c. Shares and investment banks d. Bonds and shares 9.) Sarp Industries want to fund their new expansion project through shares and bonds. The weights of each are 70% and 30% respectively, the company's beta is 0.9, the risk-free rate is 5% and the market risk premium is 7%. The yield to maturity on the bonds is 6% and the tax rate is 15%. The WACC is equal to: Select one: a. 10.33% b. 9.44% c. 8.33% d. 10% 10.) Project X costs $611.8, its expected cash inflow is $700 after one year. What is the project's IRR? (Write your answer in decimals, for example: Instead of 12.3% write 0.123; Round your answer to the nearest thousands, have three decimal digits)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts