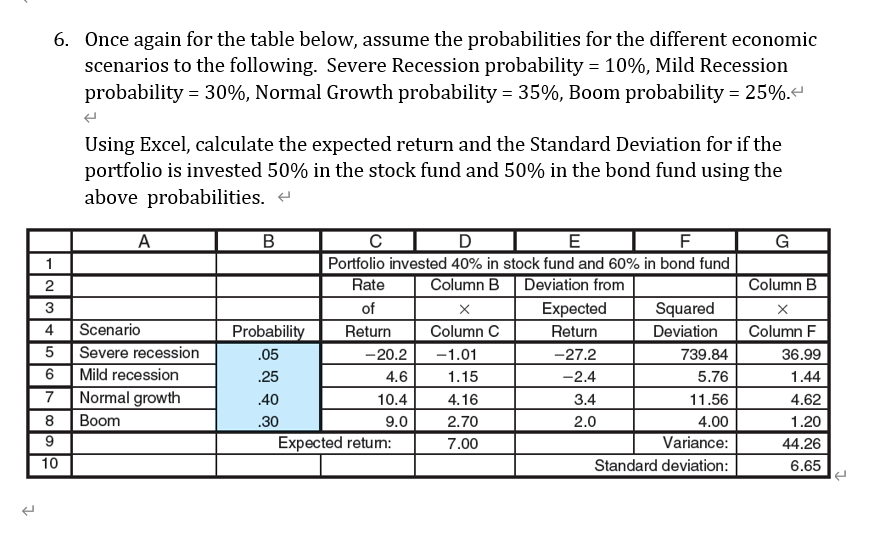

Question: 6. Once again for the table below, assume the probabilities for the different economic scenarios to the following. Severe Recession probability = 10%, Mild Recession

6. Once again for the table below, assume the probabilities for the different economic scenarios to the following. Severe Recession probability = 10%, Mild Recession probability = 30%, Normal Growth probability = 35%, Boom probability = 25%. Using Excel, calculate the expected return and the Standard Deviation for if the portfolio is invested 50% in the stock fund and 50% in the bond fund using the above probabilities. A G - WON Scenario Severe recession Mild recession Normal growth Boom B D E F Portfolio invested 40% in stock fund and 60% in bond fund Rate Column B Deviation from of Expected Squared Probability Return Column Return Deviation .05 -20.2 - 1.01 -27.2 739.84 .25 4.6 1.15 -2.4 5.76 .40 10.4 4.16 3.4 11.56 .30 9.0 2.70 2.0 4.00 Expected retum: 7.00 Variance: Standard deviation: Column B Column F 36.99 1.44 4.62 1.20 44.26 6.65 7 9 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts