Question: #6 only please. 2. Provide an analysis to determine the relative product profitability, assuming that the furnace is a bottleneck. PR 11-6A Product pricing using

#6 only please.

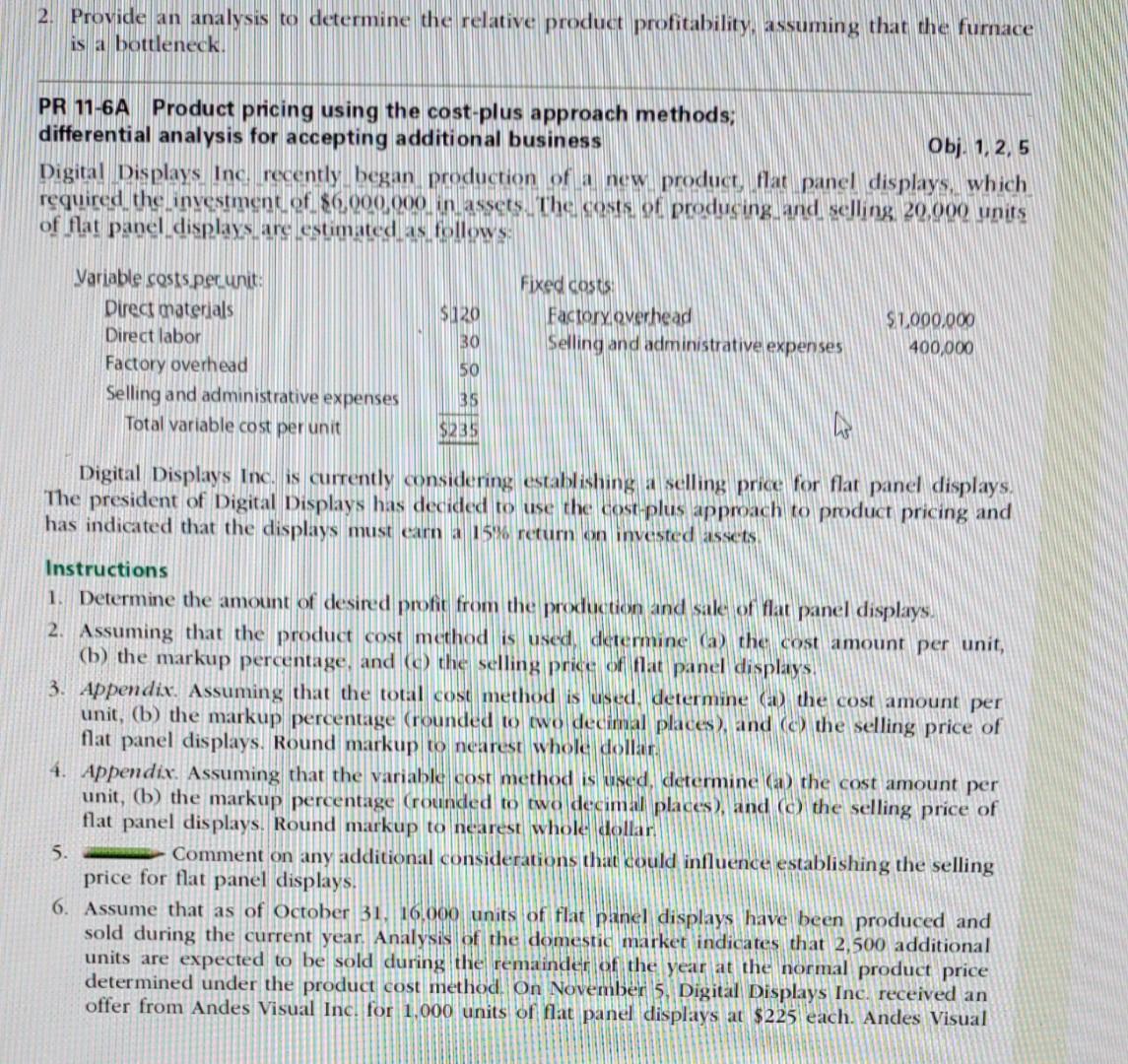

2. Provide an analysis to determine the relative product profitability, assuming that the furnace is a bottleneck. PR 11-6A Product pricing using the cost-plus approach methods; differential analysis for accepting additional business Obj. 1, 2, 5 Digital Displays Inc. recently began production of a new product, flat panel displays, which required the investment of $6,000,000 in assets. The costs of producing and selling 20,000 units of flat panel displays are estimated as follows: Variable costs per unit: Direct materials Direct labor Factory overhead Selling and administrative expenses Total variable cost per unit $120 30 50 35 $235 Fixed costs: Factory overhead Selling and administrative expenses 5. $1,000,000 400,000 Digital Displays Inc. is currently considering establishing a selling price for flat panel displays. The president of Digital Displays has decided to use the cost-plus approach to product pricing and has indicated that the displays must earn a 15% return on invested assets. Instructions MAANDAMANSAREAREN 1. Determine the amount of desired profit from the production and sale of flat panel displays. 2. Assuming that the product cost method is used, determine (a) the cost amount per unit, (b) the markup percentage, and (c) the selling price of flat panel displays. 3. Appendix. Assuming that the total cost method is used. determine (a) the cost amount per unit, (b) the markup percentage (rounded to two decimal places), and (c) the selling price of flat panel displays. Round markup to nearest whole dollar. 4. Appendix. Assuming that the variable cost method is used, determine (a) the cost amount per unit, (b) the markup percentage (rounded to two decimal places), and (c) the selling price of flat panel displays. Round markup to nearest whole dollar. nce establishing the selling Comment on any additional considerations that could price for flat panel displays. 6. Assume that as of October 31, 16,000 units of flat panel displays have been produced and sold during the current year. Analysis of the domestic market indicates that 2,500 additional units are expected to be sold during the remainder of the year at the normal product price determined under the product cost method. On November 5, Digital Displays Inc. received an offer from Andes Visual Inc. for 1.000 units of flat panel displays at $225 each. Andes Visual

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts