Question: what is the correct answer a, b, c, or d? ! Required information Spartan Company purchased interior decoration material from Egypt for 100,000 Egyptian pounds

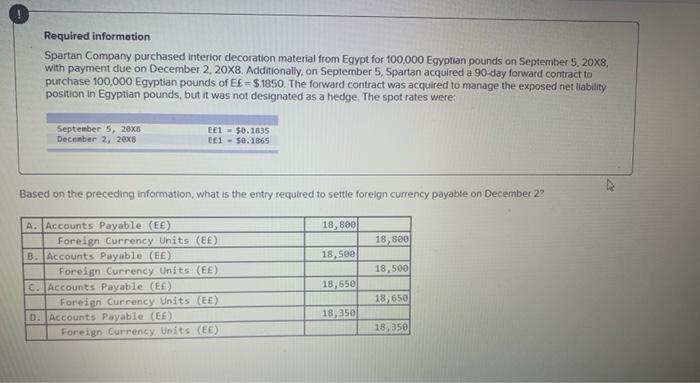

! Required information Spartan Company purchased interior decoration material from Egypt for 100,000 Egyptian pounds on September 5, 20X8, with payment due on December 2, 20X8. Additionally, on September 5, Spartan acquired a 90-day forward contract to purchase 100,000 Egyptian pounds of E - $1850. The forward contract was acquired to manage the exposed net liability position in Egyptian pounds, but it was not designated as a hedge. The spot rates were: September 5, 20X5 December 2, 20x8 EL = 50.1835 EL - 50.1865 Based on the preceding information, what is the entry required to settle foreign currency payable on December 2? 18,800 18,800 18,500 18,500 A. Accounts Payable (EE) Foreign Currency Units (EE) B. Accounts Payable (EE) Foreign Currency Units (EE) C. Accounts Payable (EE) Foreign Currency Units (EE) D. Accounts Payable (EE) Foreign Currency Units (EE) 18,650 18,650 18,350 18,350

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts