Question: 6 Refer to Table 2 and other information Evaluate the most important factors HH's directors should consider when making the strategic choice between option 1

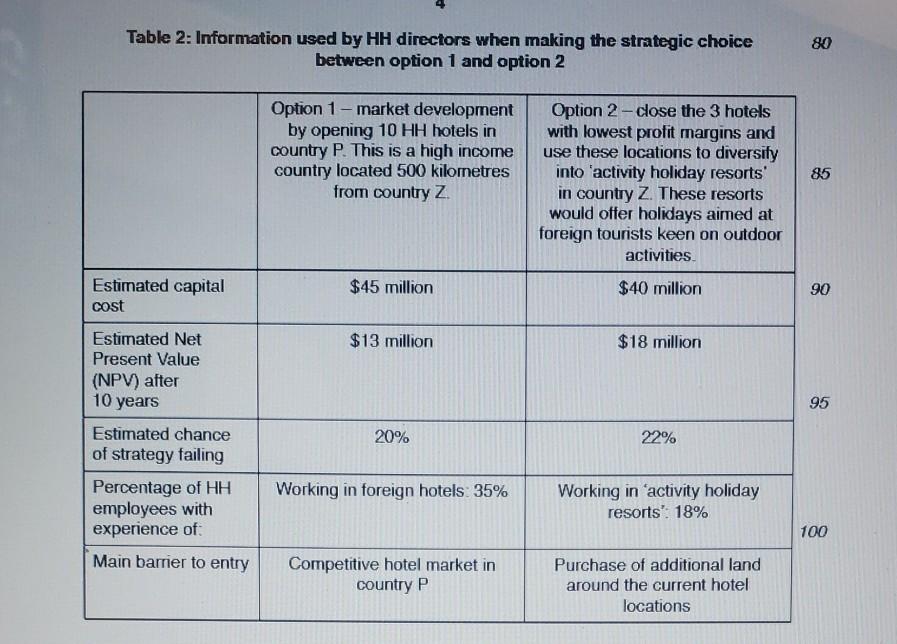

6 Refer to Table 2 and other information Evaluate the most important factors HH's directors should consider when making the strategic choice between option 1 and option 2. [20] Table 2: Information used by HH directors when making the strategic choice between option 1 and option 2 80 Option 1 - market development by opening 10 HH hotels in country P. This is a high income country located 500 kilometres from country Z. 85 Option 2 - close the 3 hotels with lowest profit margins and use these locations to diversity into 'activity holiday resorts in country Z. These resorts would offer holidays aimed at foreign tourists keen on outdoor activities Estimated capital cost $45 million $40 million 90 $13 million $18 million Estimated Net Present Value (NPV) after 10 years 95 20% 22% Estimated chance of strategy failing Percentage of HH employees with experience of Main barrier to entry Working in foreign hotels: 35% Working in 'activity holiday resorts'. 18% 100 Competitive hotel market in country P Purchase of additional land around the current hotel locations

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock