Question: do it together Question Answer Marks 6 20 Refer to Table 2 and other information. Evaluate the most important factors HH's directors should consider when

do it together

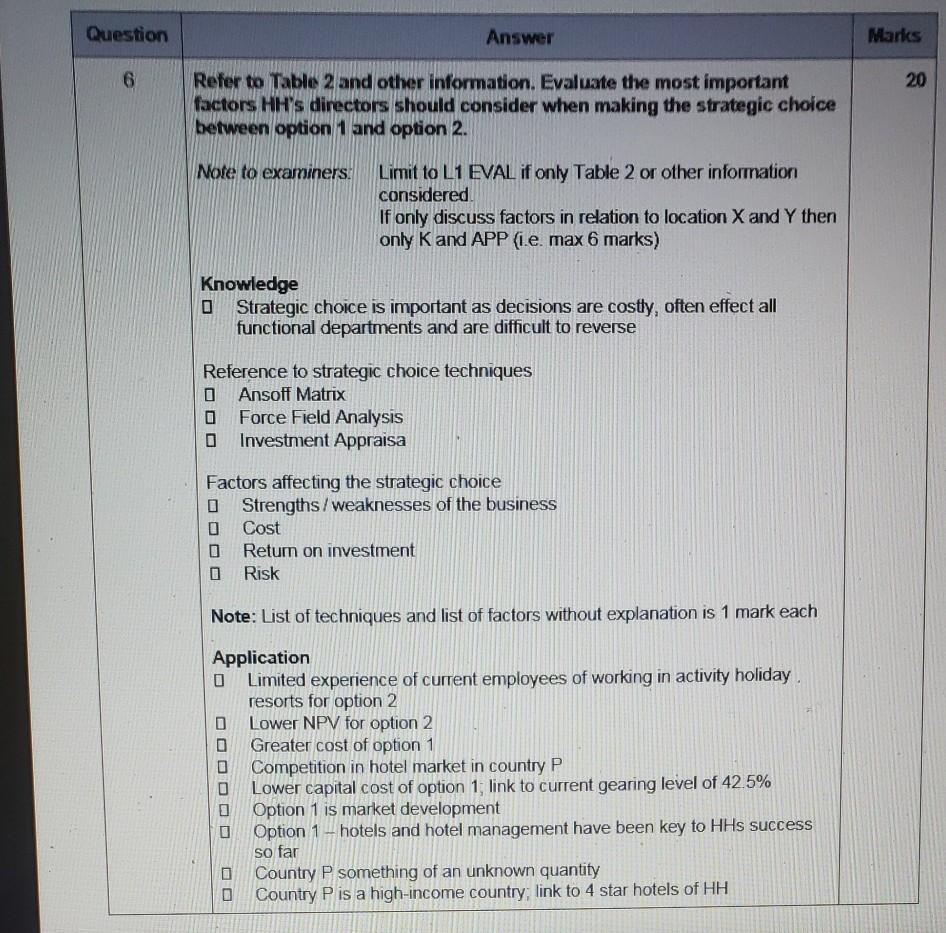

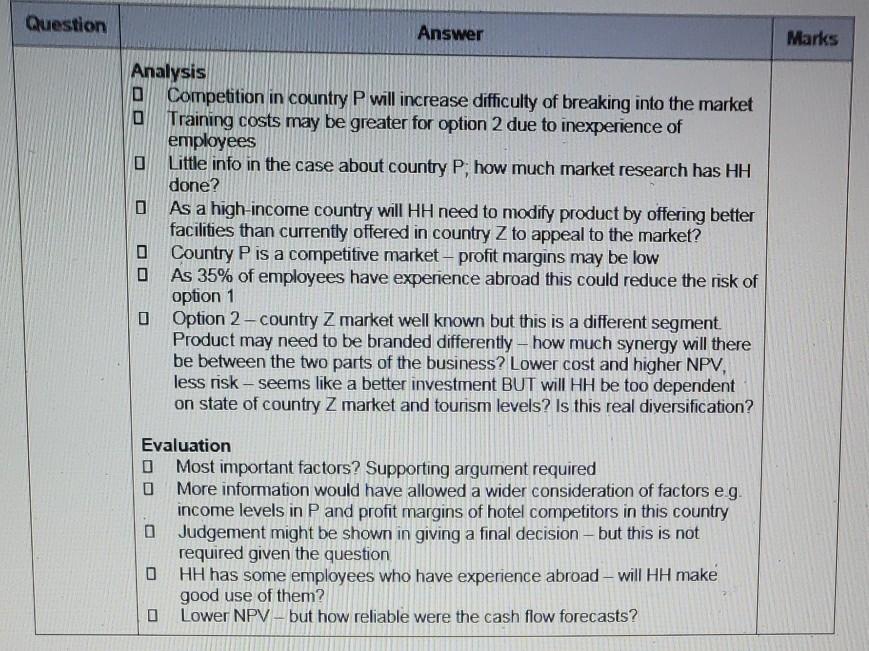

Question Answer Marks 6 20 Refer to Table 2 and other information. Evaluate the most important factors HH's directors should consider when making the strategic choice between option 1 and option 2. Note to examiners. Limit to L1 EVAL if only Table 2 or other information considered If only discuss factors in relation to location X and Y then only K and APP (i.e. max 6 marks) Knowledge a Strategic choice is important as decisions are costly, often effect all functional departments and are difficult to reverse Reference to strategic choice techniques Ansoff Matrix Force Field Analysis Investment Appraisa Factors affecting the strategic choice Strengths/weaknesses of the business Cost Retum on investment O Risk Note: List of techniques and list of factors without explanation is 1 mark each Application Limited experience of current employees of working in activity holiday resorts for option 2 D Lower NPV for option 2 Greater cost of option 1 Competition in hotel market in country P Lower capital cost of option 1, link to current gearing level of 42.5% Option 1 is market development Option 1 - hotels and hotel management have been key to HHs success so far Country P something of an unknown quantity Country P is a high-income country, link to 4 star hotels of HH Question Answer Marks Analysis Competition in country P will increase difficulty of breaking into the market Training costs may be greater for option 2 due to inexperience of employees 0 Little info in the case about country P, how much market research has HH done? As a high-income country will HH need to modify product by offering better facilities than currently offered in country Z to appeal to the market? Country P is a competitive market - profit margins may be low 0 As 35% of employees have experience abroad this could reduce the risk of option 1 0 Option 2-country Z market well known but this is a different segment Product may need to be branded differently - how much synergy will there be between the two parts of the business? Lower cost and higher NPV, less risk - seems like a better investment BUT will HH be too dependent on state of country Z market and tourism levels? Is this real diversification? Evaluation Most important factors? Supporting argument required More information would have allowed a wider consideration of factors eg. income levels in P and profit margins of hotel competitors in this country O Judgement might be shown in giving a final decision - but this is not required given the question 0 HH has some employees who have experience abroad - will HH make good use of them? Lower NPV - but how reliable were the cash flow forecasts? Question Answer Marks 6 20 Refer to Table 2 and other information. Evaluate the most important factors HH's directors should consider when making the strategic choice between option 1 and option 2. Note to examiners. Limit to L1 EVAL if only Table 2 or other information considered If only discuss factors in relation to location X and Y then only K and APP (i.e. max 6 marks) Knowledge a Strategic choice is important as decisions are costly, often effect all functional departments and are difficult to reverse Reference to strategic choice techniques Ansoff Matrix Force Field Analysis Investment Appraisa Factors affecting the strategic choice Strengths/weaknesses of the business Cost Retum on investment O Risk Note: List of techniques and list of factors without explanation is 1 mark each Application Limited experience of current employees of working in activity holiday resorts for option 2 D Lower NPV for option 2 Greater cost of option 1 Competition in hotel market in country P Lower capital cost of option 1, link to current gearing level of 42.5% Option 1 is market development Option 1 - hotels and hotel management have been key to HHs success so far Country P something of an unknown quantity Country P is a high-income country, link to 4 star hotels of HH Question Answer Marks Analysis Competition in country P will increase difficulty of breaking into the market Training costs may be greater for option 2 due to inexperience of employees 0 Little info in the case about country P, how much market research has HH done? As a high-income country will HH need to modify product by offering better facilities than currently offered in country Z to appeal to the market? Country P is a competitive market - profit margins may be low 0 As 35% of employees have experience abroad this could reduce the risk of option 1 0 Option 2-country Z market well known but this is a different segment Product may need to be branded differently - how much synergy will there be between the two parts of the business? Lower cost and higher NPV, less risk - seems like a better investment BUT will HH be too dependent on state of country Z market and tourism levels? Is this real diversification? Evaluation Most important factors? Supporting argument required More information would have allowed a wider consideration of factors eg. income levels in P and profit margins of hotel competitors in this country O Judgement might be shown in giving a final decision - but this is not required given the question 0 HH has some employees who have experience abroad - will HH make good use of them? Lower NPV - but how reliable were the cash flow forecastsStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock