Question: 6 What is the share price when COGS increases by 5%? 22.71 29.29 30.47 26.87 D2 X fr 2011 D G H 1 L M

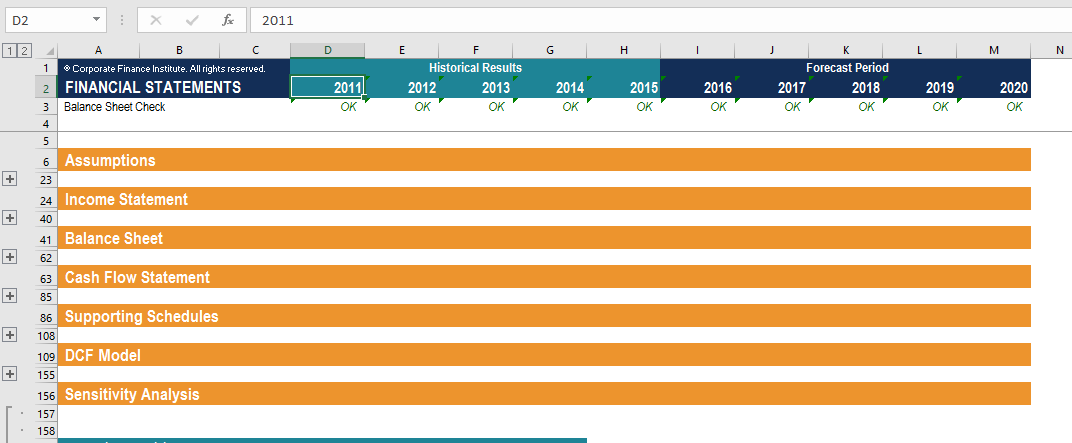

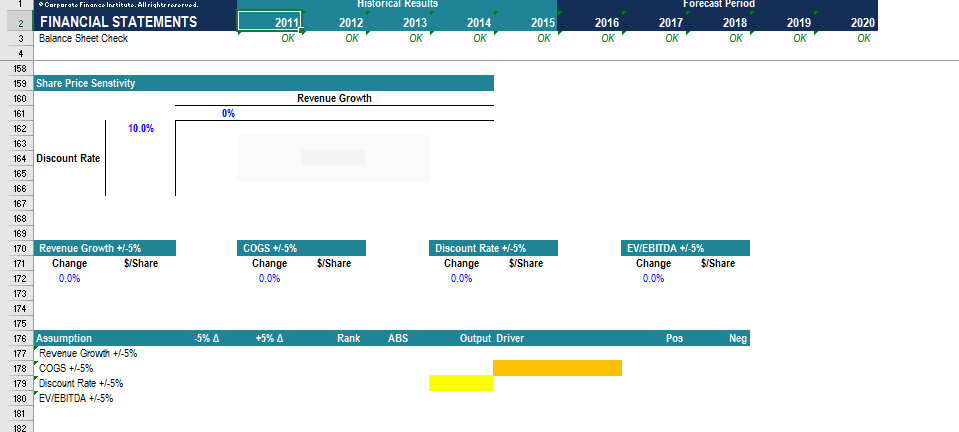

6 What is the share price when COGS increases by 5%? 22.71 29.29 30.47 26.87 D2 X fr 2011 D G H 1 L M N E Historical Results 2012 2013 OK OK K Forecast Period 2017 2018 OK OK 2020 2011 OK 2014 OK 2015 OK 2016 OK 2019 OK OK + + B 1 Corporate Finance Institute. All rights reserved. 2 FINANCIAL STATEMENTS 3 Balance Sheet Check 4 4 5 6 Assumptions 23 24 Income Statement 40 41 Balance Sheet 62 63 Cash Flow Statement 85 86 Supporting Schedules 108 109 DCF Model 155 156 Sensitivity Analysis 157 158 + + + 2011 OK Historical Results 2012 2013 OK OK 2014 OK 2015 OK 2016 OK Forecast Period 2017 2018 OK OK 2019 OK 2020 OK Revenue Growth Corporate Finance Instituto. All rights reserved. 2 FINANCIAL STATEMENTS 3 Balance Sheet Check 4 158 159 Share Price Senstivity 160 161 0% 162 10.0% 163 164 Discount Rate 165 166 167 168 169 170 Revenue Growth +/-5% 171 Change $/Share 172 0.0% 173 174 175 176 Assumption -5% A 177 Revenue Growth +/-5% 178 COGS +/-5% 179 Discount Rate +/-5% 180 EV/EBITDA +/-5% 181 182 COGS +/-5% Change $/Share Discount Rate +/-5% Change $/Share 0.0% EV/EBITDA +/-5% Change $/Share 0.0% 0.0% +5% A Rank ABS Output Driver Pos Neg 6 What is the share price when COGS increases by 5%? 22.71 29.29 30.47 26.87 D2 X fr 2011 D G H 1 L M N E Historical Results 2012 2013 OK OK K Forecast Period 2017 2018 OK OK 2020 2011 OK 2014 OK 2015 OK 2016 OK 2019 OK OK + + B 1 Corporate Finance Institute. All rights reserved. 2 FINANCIAL STATEMENTS 3 Balance Sheet Check 4 4 5 6 Assumptions 23 24 Income Statement 40 41 Balance Sheet 62 63 Cash Flow Statement 85 86 Supporting Schedules 108 109 DCF Model 155 156 Sensitivity Analysis 157 158 + + + 2011 OK Historical Results 2012 2013 OK OK 2014 OK 2015 OK 2016 OK Forecast Period 2017 2018 OK OK 2019 OK 2020 OK Revenue Growth Corporate Finance Instituto. All rights reserved. 2 FINANCIAL STATEMENTS 3 Balance Sheet Check 4 158 159 Share Price Senstivity 160 161 0% 162 10.0% 163 164 Discount Rate 165 166 167 168 169 170 Revenue Growth +/-5% 171 Change $/Share 172 0.0% 173 174 175 176 Assumption -5% A 177 Revenue Growth +/-5% 178 COGS +/-5% 179 Discount Rate +/-5% 180 EV/EBITDA +/-5% 181 182 COGS +/-5% Change $/Share Discount Rate +/-5% Change $/Share 0.0% EV/EBITDA +/-5% Change $/Share 0.0% 0.0% +5% A Rank ABS Output Driver Pos Neg

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts