Question: 6. Why is there still underutilized manufacturing capacity when the SPx256 is being manufactured? Is the pricing model in fact too aggressive? (600-700 words) Please

6. Why is there still underutilized manufacturing capacity when the SPx256 is being manufactured? Is the pricing model in fact too aggressive? (600-700 words)

Please use the following images for reference.

Background UKM, a semiconductor design and manufacturing company, is a wholly owned subsidiary of Advanced Hardware Systems, Inc. (AHS), a leading manufacturer of client / server systems, workstations and personal computers. During 2021 and 2022, UKM manufactured and sold to AHS a single product - the Server Processor (SPx512) a 512 MHz, 10-nanosecond microprocessor. The SPx512 is a 75-micron device packaged in a 339-pin grid array (PGA) and is used in AHSs servers and workstations. UKM has sold AHS 150,000 units of the SP in each of the past two years. Although UKM sells entirely to its corporate parent, the company was required to establish competitive prices for its devices by Q3 2023. Previously, the SPx512 had been sold to AHS at full cost. Establishing competitive prices was one of many changes AHS required UKM to make. In 2023, AHS planned to change all its major business units into profit centres. UKM management felt each business unit needed flexibility and independence to react to rapidly changing market conditions. UKM believed that if its business units were profit centres, they would be more accountable for their own financial success. Their strategies and annual performance would be more visible and measurable as well. This change meant they could sell their devices to external customers using available manufacturing capacity. UKM could also recover the large development costs for future products and control their destiny. UKM established the competitive market-selling price of the SPx512 at 850, based on industry price / performance comparisons. AHS approved of this market-based method of establishing transfer prices, which ensured that AHS could purchase internally at a competitive price while placing the burden of cost management appropriately on UKM. Adam White, UKMs controller, prepared revised financial statements applying the 850 transfer price to UKMs 2021 and 2022 shipments (see Table 4). John English, UKMs vice-president and general manager, was pleased to see UKM had generated profits of 4.9m and 1.9m for 2021 and 2022, respectively, on annual revenues of 127.5m, after applying the newly established transfer price. The profit decline in 2022 reflected the establishment and staffing of UKMs new marketing department. This department was created to identify and open external market opportunities for new products currently under development. As FY2023 approaches, UKM management is faced with a few pressures. AHS is under severe competitive pressures in their server and workstation product lines and is already demanding a price reduction on the SP. They also insist UKM remain profitable. Sarah Ahmad, head of UKMs new marketing department, determined from industry studies that the price / performance for microprocessors halves every 18 months. To remain competitive, merchant semiconductor companies consistently were offering some combination of price reductions and/or performance improvements, so that their products' price / performance (price per unit of speed) halved every 1.5 years. Thus, for the SPx512 and for every CPU UKM developed and manufactured, Sarah believed the market would require similarly timed price / performance offerings. Sarah knew any price reductions would require offsetting cost reductions if UKM was to remain profitable and wondered what the manufacturing organisation was thinking.As product development was no longer working on any SPx512 performance improvements, Sarah computed the essential price reductions on the SPx512 following the industry model. The SPx512 would continue at the 850 price through Q1 2023, then drop to 637.50 at the start of Q2 2023, drop to 425.00 at the start of Q1 2024 and to 318.75 at the start of Q4 2024. Sarah was troubled by these prices, as she knew AHS was requesting 150,000 units in FY2023, but only 75,000 in FY2024. AHS indicated it expected a customer shift away from workstations and into AHS's new personal computer line. Appendix One presents an overview of the semiconductor manufacturing process typically found in a microprocessor supplier such as UKM. Appendix Two presents an overview of the product costing process used by UKM. Product cost for the SPx512 had remained constant during FY2021 and FY2022 at approximately 665 (see Table 5). Sarah computed cost reductions of approximately 166.25 per year (to 498.75 in FY2023 and 332.50 in 2024) would be necessary to maintain the SPx512's current gross margin of -22%. She wondered if manufacturing could achieve a cost reduction that steep. Concurrent with the SPx512 pricing activities, Dr Khan, head of product development, sent an urgent request to English, Ahmad, Smith and White for 3m in funding. This funding would accelerate the completion of an integer-only microprocessor, the SPx256 and the follow-on CPU, the SPx384. The SPx256, a new product already under development, could be completed with lm of the additional funding and made available for volume shipment by the beginning of FY2023. The remaining 2m would be spent during FY2023 and FY2024 to complete development and ready the SPx384 for volume shipment by the beginning of FY2024. The SPx256, is a 256 MHz, 20 nanosecond CPU, manufactured like the SPx512, using the present 384-micron technology, but unlike the SPx512, the SPx256 does not have a floating-point processor. The elimination of the floating-point processor reduces the size and power requirements of the CPU. The SPx256 and SPx384 can be packaged in a 168-pin grid array (PGA) that costs 15, that is 35 less than the 339 PGA used by the SPx512. However, the testing parameters of the SPx256 and SPx384 are significantly different than for the SPx512 and require a Bonn tester, which MM&M does not currently own. This 2m tester, if purchased, will add 1.2m in annual depreciation and other direct operating costs, and 800,000 in incremental annual support costs to the present level of manufacturing spending. The SPx256 and SPx384 are targeted as entry devices for AHS's personal computer business. Top Telecommunication (TT) Plc, is the market leader in the 384 -micron integer-only microprocessors. Their TT256 CPU (also 256 MHz, 20 nanoseconds) sells for 500. The TT256 has just been announced with volume shipments to coincide with the beginning of UKMs FY2023. UKMs new marketing department estimates the demand for the SPx256 from AHS and potential new external customers could easily exceed 1,000 units per year. To break into this market, Sarah recommended heavy market promotion and a price / performance two times the competitions. Estimates for unit sales potential from advertising are 100,000 for the first 1,000, up to 500,000 for the second 1,000 and over I, m for a third million- advertising expenditure. With this increased pricing pressures from both AHS and the external marketplace, product cost reduction became critical. This fact, coupled with the request from productdevelopment for additional funding, had John English very concerned. He knew it was important to bring out the SPx256 and SPx384 quickly, but the pricing pressures for their market entrance and the pricing pressures from AHS on the SPx512 seemed almost impossible to meet and still achieve a profit in FY2023 and 2024. He knew, however, if he didn't maintain a profitable operation, his tenure would be short. Reduced product costs leading to competitive manufacturing appeared to be the critical factor necessary to sustain UKMs slim profit levels. English asked Smith, the director of operations, to formulate a series of recommendations for developing and manufacturing an expanded CPU product line in FY2023 and FY2024. He asked that the recommendations be completed by the annual two-year budget review, scheduled to commence in a month. English knew that soon after budget review he would have to present a credible business plan to UKM management. He worried how he could develop a viable plan in light of the obstacles. The Smiths plan Simon Smith started his preparation by reviewing the detailed SPx512 product cost (see TABLES below 1, 2 and 3). He immediately assembled a team comprising White from finance, T.Q. Marcel from quality and Dian Ruby from training. The team, led by Mark Spencer, manager of wafer fabrication, conducted a cost review by activity. Simon, like John English, believed significant cost reductions would be necessary to maintain profitability. He had recently taken an executive development course in activity-based costing and knew it was a proven method for better understanding cost structures and cost drivers, and highlighting non-value-added work. Smith was excited, given the size of the assignment and his belief there were both cost reduction opportunities in manufacturing and necessary improvements in the current standard cost system. He felt the current standard cost system did not properly capture the complexity of UKMs production process. He felt an ABC analysis could provide the insight necessary to reduce the SPx512 product cost by the 166 marketing had requested. The team mapped the processes of the entire operation and then reassigned costs to the newly defined activities. The manufacturing support organisations were also better understood. Their key activities were costed, and then each was aligned to the manufacturing operation it supported. UKMs ABC team reset the SPx512 product cost in line with the true practical capacity of the manufacturing process. The team saw capacity utilisation as a major driver of product cost. The old product costing methodology was based on the planned utilisation of each manufacturing process with underutilised manufacturing costs absorbed into product costs. The revised SPx512 product cost was pleasing, but not very surprising to Smith. It confirmed his belief in the inaccuracies of the old costing method. The new SPx512 product cost of 437.50 was 227.61 lower than the 665.11 original cost shown by the old system. It did not make sense to charge the SPx512 for the costs of resources it did not consume. Smith felt he could commit immediately to Sarah's 2023 product cost reduction request of 166. To achieve the 2024 product cost goal of 332.50, Smith and his team looked further into the activity-based costing results. The study clearly showed that wafer fabrication was the largest area of manufacturing cost. Smith computed that if the SPx512 wafer cost was reduced from the 2023 level of 3,000/wafer to 1,866/wafer, the SPx512 total product cost would be lowered by 105, achieving the desired 332.50. To obtain a wafer cost of 1,866, spending reductions of -25.5m or 38 per cent in wafer fabrication would have to be achieved. Smith again asked Spencer to review the fabrication area for further cost reduction opportunities. He asked Spencer to formulate a plan that could reduce direct wafer fabrication spending by -25.5m (from 67.4m to 41.9m).

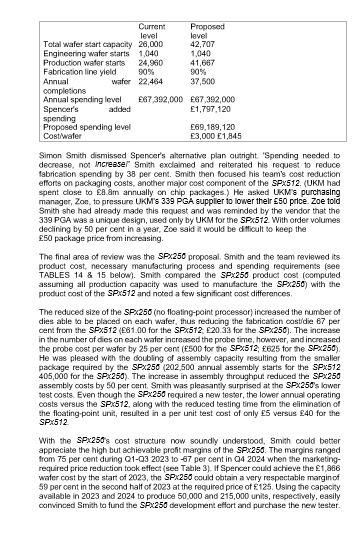

Spencer returned in two weeks with an alternative plan (see Table 2 - image comparing current level and proposed level). His team found nominal spending opportunities by: (l) Reducing monitor wafer usage, (2) Redesigning wafer lot handling procedures and (3) Better placement of inspection stations. Spencer's most significant discovery was the 64 per cent increase in capacity attained by increasing equipment uptime (the time equipment is not undergoing repair or preventive maintenance). Higher uptime, however, required an annual investment of 1.8m in additional equipment engineers. While this investment would increase wafer fabrication spending to 69.2m, wafer fabrication capacity would increase from 26,000 to 42,700 in annual wafer starts. The increased capacity actually decreased the cost / wafer to 1,845, which was 21 lower than Pound had requested.

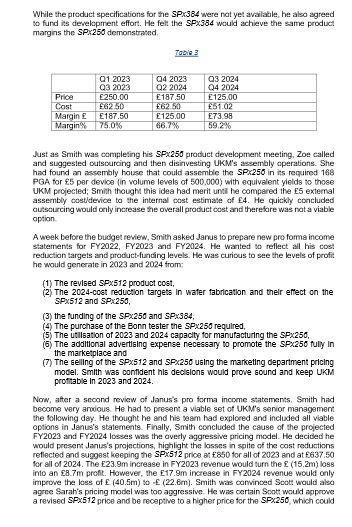

| TABLE 14 | |||

| FY22 PRODUCT COST WORKSHEET SPX256 | |||

| Description | cost/wafer | cost/die | cum.cost/die |

| Yielded raw wafer | 50.00 | 0.33 | 0.33 |

| Wafer production cost | 3,000.00 | 20.00 | 20.33 |

| Probe production cost | 625.00 | 4.17 | 24.50 |

| Probe yield | 70% | 35.00 | |

| 168 PGA package cost | 15.00 | 50.00 | |

| Assembly production cost | 4.00 | 54.00 | |

| Assembly yield | 96% | 56.25 | |

| Test production cost | 5.00 | 61.25 | |

| Test yield | 98% | 62.50 | |

| Tota; SPX256 product cost | 62.50 | ||

| TABLE 15 | |||

| FY22 USED CAPACITY AND PROCESS COSTS WORKSHEET SPX256 | |||

| Operation | Per Year | Mfg spending | Cost/unit |

| Planned wafer capacity | 26,000 | ||

| Engineering test wafers | 1,040 | ||

| Planned wafer starts | 24,960 | ||

| Wafer fabrication yield | 90% | ||

| Planned water production | 22,464.00 | 67,392,000.00 | 3,000.00 |

| Planned probed wafer starts | 20,800.00 | 13,000,000.00 | 625.00 |

| Gross die/wafer | 150 | ||

| Total gross die thru probe | 3,120,000.00 | ||

| Probe yield- for SPX256 | 70% | ||

| SPX256 probed die output | 2,184,000.00 | ||

| Planned assembly starts | 405,000.00 | 1,620,000.00 | 4.00 |

| SPX256 assembly yield | 90% | ||

| Planned assembly completions | 364,500.00 | ||

| Planned test start | 405,000.00 | 2,025,000.00 | 5.00 |

| SPX256 test yield | 96% | ||

| Planned test output | 388,800.00 | ||

| Total Manufacturing Spending | 84,037,000.00 | ||

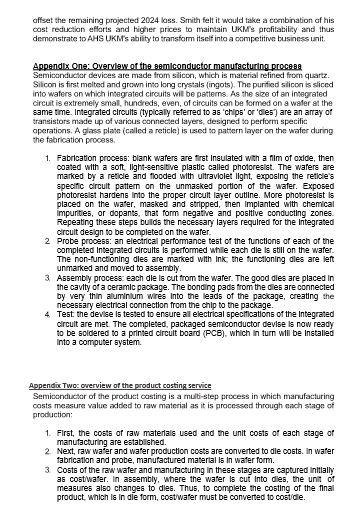

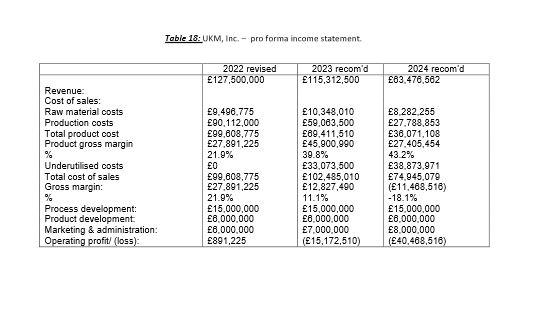

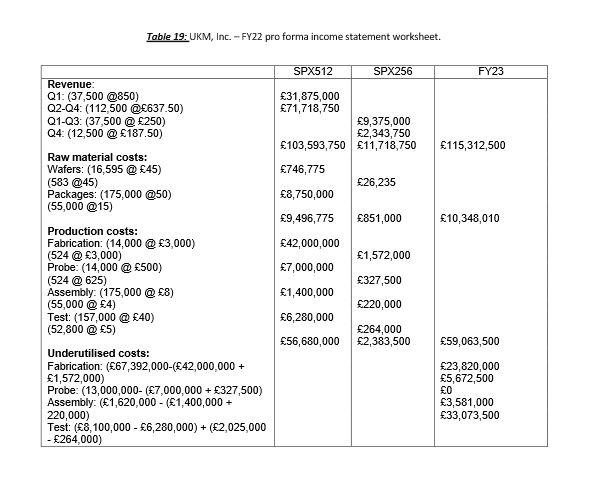

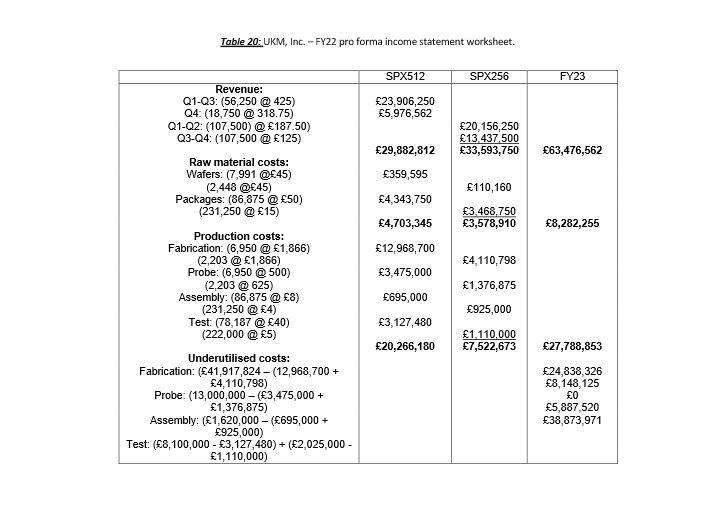

Simon Smith dismissed Spenoer's ahnernative plan oizright 'Spending nended to decrease, not increaser Smith exclaimed end reiterated his request to reduce fabrication spending by 38 per cent. Smith then focused his team's cost reducticn effors on packaging costs, another major cost component of the SPX512. UKM had sperit dose to E.m annually en chip packages.) He asked UKM U purchasing manager, Zon, to pressure UKM's 339 PGA auppler to lower thelr E50 prlce. Zoe told Smith she had already made this request and was reminded by the vendor that the 339 PGA was a unique design, vaed only by UKM for the SPx512. With order volumes declining by 50 per cent in a year, Zoe said i would be dilloult to keep the E50 package price from increasing. The final ares of review was the SPx 250 proposal. Smith and the team reviewed its procuct cost, necessary manulacturing process and spending recuirements (see TABLES 14 \& 15 below). Smith compared the SPX250 product cost computed assurning all production capacity was used to manufacture the SPX250) with the product cost of the SPX:512 and noted a few significant cost differences. The reduced size of the SPx250 (no floating-point processor) increased the number of dies able ta be placed on esch wafer, thus reducing the fabrication oostidie 67 per cent from the SPX512 {@61.00 for the SPX512, 20.33 for the SPx250). The increase in the number of dies on each wafer increased the probe time, however, and increasod the probe oost per wafer by 25 per can (f500 tor the SPX512; f625 tor the SPX250). He was pleased whith the doubing of assembly capacity resulting from the smaller package required by the SPXX250 (202,500 annual assembly starts for the SPX512 405,000 for the SPx250). The increase in assembly throughpu? reduced the SPx250 assembly costs by 50 per oent. Smith was plensantly surprised at the SPX250's kower test costs. Even though the SPX250 required a new testar, the lower annual operating costs versus the SPx512, abong with the recuced testing time from the eliminesion of the floating-point unit, resulted in a per unit test cost of conly 25 versus 240 for the SP: 512 With the SPx250's cost structure now scundly understood, Smith could beter appreciate the high but achievable profit margins of the SPx250. The margins ranged from 75 per cent during Q1-Q3 2023 to -67 ger cent in Q4 2024 when the marketingrequired price reduction tock effect (see Table 3). If Spencer oauld sectieve the E1,866 wafer cost by the start of 2023 , the SPX250 ocuid obtain a very respectatie margin of 59 per cent in the second half of 2023 at the required pnice of 125. Using the capecity avsilable in 2023 and 2024 to produce 50,000 and 215,000 units, respectively, essily convinced Smith to fund the SPX:250 development eftort and purchase the rew sester. While the product specilications for the SPx384 were nat yet avaliable, he also agreed to fund iss develapment effor. He fell the SPxS84 would achieve the same product margens the SPx260 demonstresed. Tobie 3 Just as Smith was comple:ing his SFx250 product development meeting, Zou ealled and suggested cetsourcing and then disinvesting KM 's assembly operations. She had found an assembly houze that could assombic the SPx250 in its required 168 PGA for $5 per devioe (in volume levels of 500,000) with equivalent yields to those UKM projected; Smith thought this idea had merit unsi he compared the E5 extemal assembly costldevice to the internal cost estimase of 4. He quickly concluded autseurcing would only increase the overall product cost and therefore was nat a viable option. A week before the budget review, Smith asked Janus to prepare new pro forms income statements for FY2022, FY2023 and FY2024. He wranted io reflect al his coet reductian targets and product-funcing levels. He was curicus to sae the levels of profit he would generate in 2023 and 2024 from: (1) The revised SPx512 product coet, (2) The 2024-coet reduction targets in wafer fabrication and their effect on the SPx512 and SPx250, (3) the funding of the SPx.250 and SPx384; (4) The purchase of the Eonn tester the SPx250 required, (5) The utilsation of 2023 and 2024 capacity for manufacturing the SPx250, (6) The adalitional advertiaing expense necessary to promote the SPx250 fuly in the marketplace and (7) The selling of the SPx512 and SPx250 using the marketing departnent pricing model. Smlth was contident his declalons would prove aound and keep UKM protitable in 2023 and 2024. Now, atter a scoond reviow of danus's pro forma income satatements, Smith had become very arodous. He had to present a viable set of UKM's senior managament. the following day. He thought he and his ream had explored and incloded all viable options in Janus's statements. Finally, Smith concluded the cause of the projected FY2023 and FY2024 loeses was tha caverly aggressive pricing model. He decided he would present Janias's projections, highlight the ksses in spite of the cost reduations reflected and sugest keeping the SPX512 price an fish0 for all of 2023 and at $637.50 for all or 2024. The E23.9m incresse in FY2023 revenue would turn the q(15.2m) loss into an 28.7m profit. However, the 817.9m incresee in FY2024 revenue would only improwe the lass of (40.5m) so (22.6m). Smith was coninced Seot: would also agree Sarah's pricing model was too argressive. He was certain Sont would eqperve a revised SPXSt2 price and be receptive to a higher price tor the SPX250, which could offset the remairing projected 2024 loss. Smith felt it would take a combination of his cost reduction efforts and higher prices to maintain UKMS's profitability and thus demonstrate tD AHS UKM's abiity to transform itself into a competitive business isit. Appendlx One: Oyervlaw of the gemlconductor manufacturing procese Semicanductor bevices are made from slicon, which is material refined from quartz. Silcon is first meited and grown into kng crysials (ingots). The purified salicon is sliced into wafers on which integated circuits wil be pentems. As the szee of en integrated circut is extremely small, hundreds, even, of circuits can be formed on a waler an the same time. Integrated circults (typicaly referred to a8 'chips' or 'dies') are an anray of transistors made tp of varicus connected layers, designed so perform specific operations. A glass platn (calied a reticla) is izod to pattern layer on the wafer during the fabrication process. 1. Fabrication process: blank wafers are firat insulated whit a film of oxide, then coated with a soft, light-eensitive plastic called photoreslat. The wafers are marked by a rencle and flocded with ultraviolet llght, exposing the retlcle's speclic crcult pattern on the unmasked portion of the wafer. Exposed photoreslat hardens into the proper circult layer outilne. More photoreslat is placed on the wafer, masked and atripped, then Implanted witt chemical Impurities, or dopants, that form negatwe and poslttve conducting zones. Repeating these ateps bulds the necessary layers required for the Integrated circult design to be completed on the wafer. 2 Probe prooeas: an electrical performance teat of the functions of each of the completed Integrated circulti is performed uhile each dle is atill on the waferThe non-functioning dles are marked with Ink the tunctioning dles are left unmarked and moved to assembly. 3 Assembly process: each dle is cut from the wafer. The good dles are placed in the cavity of a ceramlc package. The bonding pads from the dies are connected by very thin aluminium wres into the leads of the package, creating the necesbary electrical connection from the chip to the package. 4. Test. the devise is tested to ensure all electrical specilloations of the Integrated crcult are met. The completed, packaged semiconductor devlse is now ready to be soldered to a printed circult board ( PCB), which in turn will be installed Into a computer aystem. Appendix Two: overview of the product costing service Semiconductor of the product costing is a mult-step process in which marnfacturing costs meneure value added to raw matcrial as it is processed through each siage of production: 1. Frat, the costs of raw materials used and the unit costs of each atage of manufacturing are estabished. 2. Next, raw wafer and wafer production costs are converted to dle ooste. In wafer fabricatlon and probe, manufactured material is in wafer form. 3 Costs of the raw wafer and manufacturing in these stages are captured initially as costhafer. In assembly, where the wafer ls cut Into dles, the unit of measures also changes to dles. Thus, to complete the costing of the final product. which is in dle form, cost/wafer must be converted to costide. Toble 18: UKM, Inc. - pro forma income statement. Table 19: UKM, Inc. - FY22 pro forma income statement worksheet. Table 20: UKM, Inc. - FY22 pro forma income statement worksheet. Simon Smith dismissed Spenoer's ahnernative plan oizright 'Spending nended to decrease, not increaser Smith exclaimed end reiterated his request to reduce fabrication spending by 38 per cent. Smith then focused his team's cost reducticn effors on packaging costs, another major cost component of the SPX512. UKM had sperit dose to E.m annually en chip packages.) He asked UKM U purchasing manager, Zon, to pressure UKM's 339 PGA auppler to lower thelr E50 prlce. Zoe told Smith she had already made this request and was reminded by the vendor that the 339 PGA was a unique design, vaed only by UKM for the SPx512. With order volumes declining by 50 per cent in a year, Zoe said i would be dilloult to keep the E50 package price from increasing. The final ares of review was the SPx 250 proposal. Smith and the team reviewed its procuct cost, necessary manulacturing process and spending recuirements (see TABLES 14 \& 15 below). Smith compared the SPX250 product cost computed assurning all production capacity was used to manufacture the SPX250) with the product cost of the SPX:512 and noted a few significant cost differences. The reduced size of the SPx250 (no floating-point processor) increased the number of dies able ta be placed on esch wafer, thus reducing the fabrication oostidie 67 per cent from the SPX512 {@61.00 for the SPX512, 20.33 for the SPx250). The increase in the number of dies on each wafer increased the probe time, however, and increasod the probe oost per wafer by 25 per can (f500 tor the SPX512; f625 tor the SPX250). He was pleased whith the doubing of assembly capacity resulting from the smaller package required by the SPXX250 (202,500 annual assembly starts for the SPX512 405,000 for the SPx250). The increase in assembly throughpu? reduced the SPx250 assembly costs by 50 per oent. Smith was plensantly surprised at the SPX250's kower test costs. Even though the SPX250 required a new testar, the lower annual operating costs versus the SPx512, abong with the recuced testing time from the eliminesion of the floating-point unit, resulted in a per unit test cost of conly 25 versus 240 for the SP: 512 With the SPx250's cost structure now scundly understood, Smith could beter appreciate the high but achievable profit margins of the SPx250. The margins ranged from 75 per cent during Q1-Q3 2023 to -67 ger cent in Q4 2024 when the marketingrequired price reduction tock effect (see Table 3). If Spencer oauld sectieve the E1,866 wafer cost by the start of 2023 , the SPX250 ocuid obtain a very respectatie margin of 59 per cent in the second half of 2023 at the required pnice of 125. Using the capecity avsilable in 2023 and 2024 to produce 50,000 and 215,000 units, respectively, essily convinced Smith to fund the SPX:250 development eftort and purchase the rew sester. While the product specilications for the SPx384 were nat yet avaliable, he also agreed to fund iss develapment effor. He fell the SPxS84 would achieve the same product margens the SPx260 demonstresed. Tobie 3 Just as Smith was comple:ing his SFx250 product development meeting, Zou ealled and suggested cetsourcing and then disinvesting KM 's assembly operations. She had found an assembly houze that could assombic the SPx250 in its required 168 PGA for $5 per devioe (in volume levels of 500,000) with equivalent yields to those UKM projected; Smith thought this idea had merit unsi he compared the E5 extemal assembly costldevice to the internal cost estimase of 4. He quickly concluded autseurcing would only increase the overall product cost and therefore was nat a viable option. A week before the budget review, Smith asked Janus to prepare new pro forms income statements for FY2022, FY2023 and FY2024. He wranted io reflect al his coet reductian targets and product-funcing levels. He was curicus to sae the levels of profit he would generate in 2023 and 2024 from: (1) The revised SPx512 product coet, (2) The 2024-coet reduction targets in wafer fabrication and their effect on the SPx512 and SPx250, (3) the funding of the SPx.250 and SPx384; (4) The purchase of the Eonn tester the SPx250 required, (5) The utilsation of 2023 and 2024 capacity for manufacturing the SPx250, (6) The adalitional advertiaing expense necessary to promote the SPx250 fuly in the marketplace and (7) The selling of the SPx512 and SPx250 using the marketing departnent pricing model. Smlth was contident his declalons would prove aound and keep UKM protitable in 2023 and 2024. Now, atter a scoond reviow of danus's pro forma income satatements, Smith had become very arodous. He had to present a viable set of UKM's senior managament. the following day. He thought he and his ream had explored and incloded all viable options in Janus's statements. Finally, Smith concluded the cause of the projected FY2023 and FY2024 loeses was tha caverly aggressive pricing model. He decided he would present Janias's projections, highlight the ksses in spite of the cost reduations reflected and sugest keeping the SPX512 price an fish0 for all of 2023 and at $637.50 for all or 2024. The E23.9m incresse in FY2023 revenue would turn the q(15.2m) loss into an 28.7m profit. However, the 817.9m incresee in FY2024 revenue would only improwe the lass of (40.5m) so (22.6m). Smith was coninced Seot: would also agree Sarah's pricing model was too argressive. He was certain Sont would eqperve a revised SPXSt2 price and be receptive to a higher price tor the SPX250, which could offset the remairing projected 2024 loss. Smith felt it would take a combination of his cost reduction efforts and higher prices to maintain UKMS's profitability and thus demonstrate tD AHS UKM's abiity to transform itself into a competitive business isit. Appendlx One: Oyervlaw of the gemlconductor manufacturing procese Semicanductor bevices are made from slicon, which is material refined from quartz. Silcon is first meited and grown into kng crysials (ingots). The purified salicon is sliced into wafers on which integated circuits wil be pentems. As the szee of en integrated circut is extremely small, hundreds, even, of circuits can be formed on a waler an the same time. Integrated circults (typicaly referred to a8 'chips' or 'dies') are an anray of transistors made tp of varicus connected layers, designed so perform specific operations. A glass platn (calied a reticla) is izod to pattern layer on the wafer during the fabrication process. 1. Fabrication process: blank wafers are firat insulated whit a film of oxide, then coated with a soft, light-eensitive plastic called photoreslat. The wafers are marked by a rencle and flocded with ultraviolet llght, exposing the retlcle's speclic crcult pattern on the unmasked portion of the wafer. Exposed photoreslat hardens into the proper circult layer outilne. More photoreslat is placed on the wafer, masked and atripped, then Implanted witt chemical Impurities, or dopants, that form negatwe and poslttve conducting zones. Repeating these ateps bulds the necessary layers required for the Integrated circult design to be completed on the wafer. 2 Probe prooeas: an electrical performance teat of the functions of each of the completed Integrated circulti is performed uhile each dle is atill on the waferThe non-functioning dles are marked with Ink the tunctioning dles are left unmarked and moved to assembly. 3 Assembly process: each dle is cut from the wafer. The good dles are placed in the cavity of a ceramlc package. The bonding pads from the dies are connected by very thin aluminium wres into the leads of the package, creating the necesbary electrical connection from the chip to the package. 4. Test. the devise is tested to ensure all electrical specilloations of the Integrated crcult are met. The completed, packaged semiconductor devlse is now ready to be soldered to a printed circult board ( PCB), which in turn will be installed Into a computer aystem. Appendix Two: overview of the product costing service Semiconductor of the product costing is a mult-step process in which marnfacturing costs meneure value added to raw matcrial as it is processed through each siage of production: 1. Frat, the costs of raw materials used and the unit costs of each atage of manufacturing are estabished. 2. Next, raw wafer and wafer production costs are converted to dle ooste. In wafer fabricatlon and probe, manufactured material is in wafer form. 3 Costs of the raw wafer and manufacturing in these stages are captured initially as costhafer. In assembly, where the wafer ls cut Into dles, the unit of measures also changes to dles. Thus, to complete the costing of the final product. which is in dle form, cost/wafer must be converted to costide. Toble 18: UKM, Inc. - pro forma income statement. Table 19: UKM, Inc. - FY22 pro forma income statement worksheet. Table 20: UKM, Inc. - FY22 pro forma income statement worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts