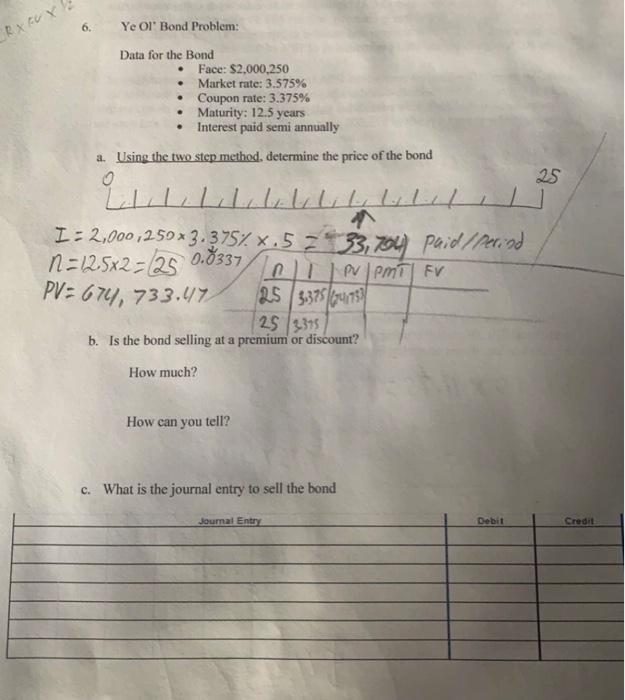

Question: 6. Ye Ol Bond Problem: ORX FUX Data for the Bond Face: $2,000,250 Market rate: 3.575% Coupon rate: 3.375% Maturity: 12.5 years Interest paid semi

6. Ye Ol Bond Problem: ORX FUX Data for the Bond Face: $2,000,250 Market rate: 3.575% Coupon rate: 3.375% Maturity: 12.5 years Interest paid semi annually a. Using the two step method, determine the price of the bond 25 I = 2,000,250*3.3757. X.5 2 33, you paid / Perced n=125x2-25 0.8337 APMT FV PV: 674, 733,47 25 3,375634753 25 2.375 b. Is the bond selling at a premium or discount? How much? How can you tell? c. What is the journal entry to sell the bond Journal Entry Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts