Question: Question 1 0.5 pts 61 quarterly return data is provided for three assets: US Equities and Portfolio are provided in Excel file Quiz 2.xlsx tab

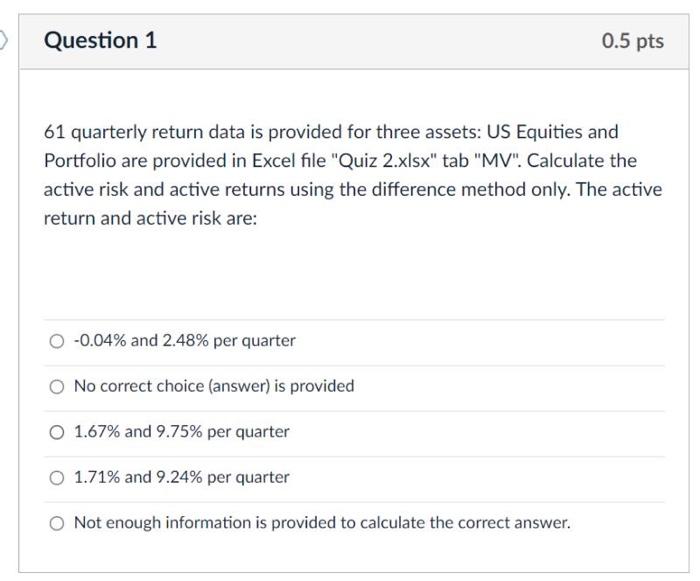

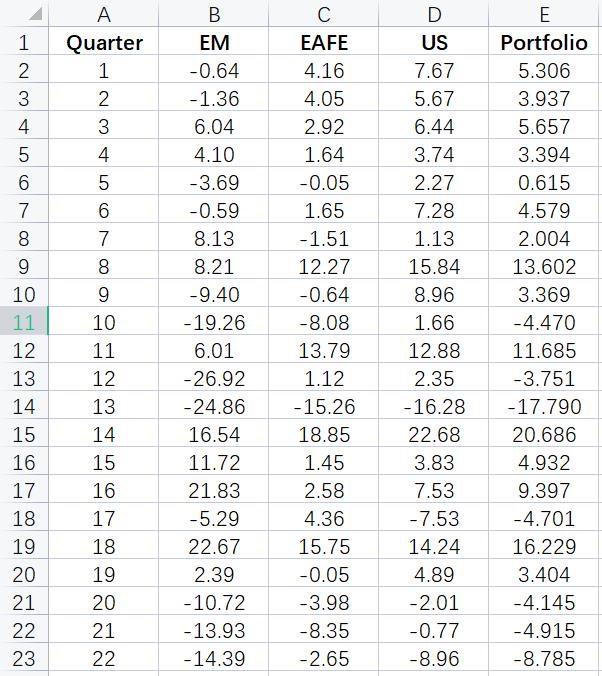

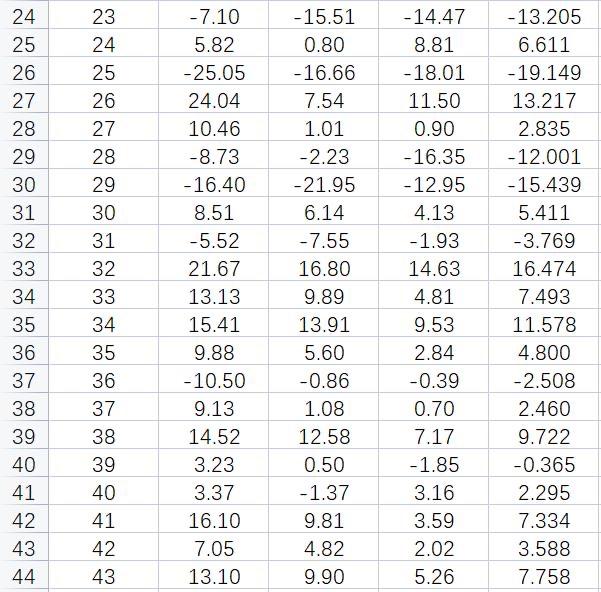

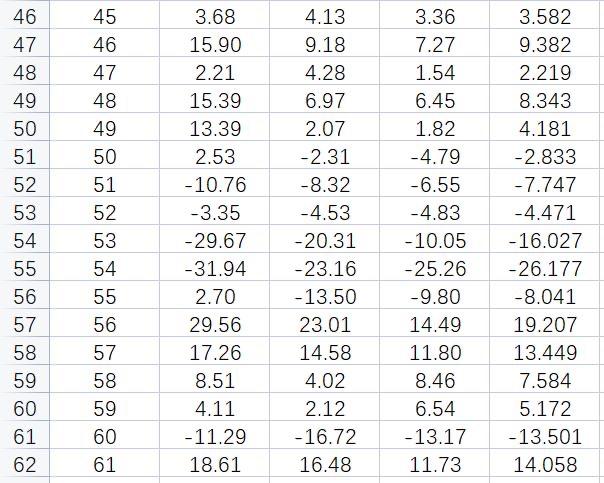

Question 1 0.5 pts 61 quarterly return data is provided for three assets: US Equities and Portfolio are provided in Excel file "Quiz 2.xlsx" tab "MV". Calculate the active risk and active returns using the difference method only. The active return and active risk are: O-0.04% and 2.48% per quarter No correct choice (answer) is provided 1.67% and 9.75% per quarter O 1.71% and 9.24% per quarter Not enough information is provided to calculate the correct answer. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 A Quarter 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 B EM -0.64 -1.36 6.04 4.10 -3.69 -0.59 8.13 8.21 -9.40 -19.26 6.01 -26.92 -24.86 16.54 11.72 21.83 -5.29 22.67 2.39 -10.72 -13.93 -14.39 C EAFE 4.16 4.05 2.92 1.64 -0.05 1.65 -1.51 12.27 -0.64 -8.08 13.79 1.12 -15.26 18.85 1.45 2.58 4.36 15.75 -0.05 -3.98 -8.35 -2.65 D US 7.67 5.67 6.44 3.74 2.27 7.28 1.13 15.84 8.96 1.66 12.88 2.35 -16.28 22.68 3.83 7.53 -7.53 14.24 4.89 -2.01 -0.77 -8.96 E Portfolio 5.306 3.937 5.657 3.394 0.615 4.579 2.004 13.602 3.369 -4.470 11.685 -3.751 -17.790 20.686 4.932 9.397 -4.701 16.229 3.404 -4.145 -4.915 -8.785 WN 23 24 25 26 27 28 29 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 30 31 32 33 34 35 36 37 38 39 40 41 42 43 -7.10 5.82 -25.05 24.04 10.46 -8.73 -16.40 8.51 -5.52 21.67 13.13 15.41 9.88 - 10.50 9.13 14.52 3.23 3.37 16.10 7.05 13.10 -15.51 0.80 - 16.66 7.54 1.01 -2.23 -21.95 6.14 -7.55 16.80 9.89 13.91 5.60 -0.86 1.08 12.58 0.50 -1.37 9.81 4.82 9.90 - 14.47 8.81 - 18.01 11.50 0.90 -16.35 -12.95 4.13 -1.93 14.63 4.81 9.53 2.84 -0.39 0.70 7.17 -1.85 3.16 3.59 2.02 5.26 -13.205 6.611 -19.149 13.217 2.835 -12.001 -15.439 5.411 -3.769 16.474 7.493 11.578 4.800 -2.508 2.460 9.722 -0.365 2.295 7.334 3.588 7.758 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 3.68 15.90 2.21 15.39 13.39 2.53 -10.76 -3.35 -29.67 -31.94 2.70 29.56 17.26 8.51 4.11 - 11.29 18.61 4.13 9.18 4.28 6.97 2.07 -2.31 -8.32 -4.53 -20.31 -23.16 -13.50 23.01 14.58 4.02 2.12 -16.72 16.48 3.36 7.27 1.54 6.45 1.82 -4.79 -6.55 -4.83 -10.05 -25.26 -9.80 14.49 11.80 8.46 6.54 -13.17 11.73 3.582 9.382 2.219 8.343 4.181 -2.833 -7.747 -4.471 - 16.027 -26.177 -8.041 19.207 13.449 7.584 5.172 -13.501 14.058 Question 1 0.5 pts 61 quarterly return data is provided for three assets: US Equities and Portfolio are provided in Excel file "Quiz 2.xlsx" tab "MV". Calculate the active risk and active returns using the difference method only. The active return and active risk are: O-0.04% and 2.48% per quarter No correct choice (answer) is provided 1.67% and 9.75% per quarter O 1.71% and 9.24% per quarter Not enough information is provided to calculate the correct answer. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 A Quarter 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 B EM -0.64 -1.36 6.04 4.10 -3.69 -0.59 8.13 8.21 -9.40 -19.26 6.01 -26.92 -24.86 16.54 11.72 21.83 -5.29 22.67 2.39 -10.72 -13.93 -14.39 C EAFE 4.16 4.05 2.92 1.64 -0.05 1.65 -1.51 12.27 -0.64 -8.08 13.79 1.12 -15.26 18.85 1.45 2.58 4.36 15.75 -0.05 -3.98 -8.35 -2.65 D US 7.67 5.67 6.44 3.74 2.27 7.28 1.13 15.84 8.96 1.66 12.88 2.35 -16.28 22.68 3.83 7.53 -7.53 14.24 4.89 -2.01 -0.77 -8.96 E Portfolio 5.306 3.937 5.657 3.394 0.615 4.579 2.004 13.602 3.369 -4.470 11.685 -3.751 -17.790 20.686 4.932 9.397 -4.701 16.229 3.404 -4.145 -4.915 -8.785 WN 23 24 25 26 27 28 29 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 30 31 32 33 34 35 36 37 38 39 40 41 42 43 -7.10 5.82 -25.05 24.04 10.46 -8.73 -16.40 8.51 -5.52 21.67 13.13 15.41 9.88 - 10.50 9.13 14.52 3.23 3.37 16.10 7.05 13.10 -15.51 0.80 - 16.66 7.54 1.01 -2.23 -21.95 6.14 -7.55 16.80 9.89 13.91 5.60 -0.86 1.08 12.58 0.50 -1.37 9.81 4.82 9.90 - 14.47 8.81 - 18.01 11.50 0.90 -16.35 -12.95 4.13 -1.93 14.63 4.81 9.53 2.84 -0.39 0.70 7.17 -1.85 3.16 3.59 2.02 5.26 -13.205 6.611 -19.149 13.217 2.835 -12.001 -15.439 5.411 -3.769 16.474 7.493 11.578 4.800 -2.508 2.460 9.722 -0.365 2.295 7.334 3.588 7.758 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 3.68 15.90 2.21 15.39 13.39 2.53 -10.76 -3.35 -29.67 -31.94 2.70 29.56 17.26 8.51 4.11 - 11.29 18.61 4.13 9.18 4.28 6.97 2.07 -2.31 -8.32 -4.53 -20.31 -23.16 -13.50 23.01 14.58 4.02 2.12 -16.72 16.48 3.36 7.27 1.54 6.45 1.82 -4.79 -6.55 -4.83 -10.05 -25.26 -9.80 14.49 11.80 8.46 6.54 -13.17 11.73 3.582 9.382 2.219 8.343 4.181 -2.833 -7.747 -4.471 - 16.027 -26.177 -8.041 19.207 13.449 7.584 5.172 -13.501 14.058

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts