Question: 7 : 3 2 5 G CamScanner 0 3 - 1 3 - 2 0 2 . . . Done This problem consists of four

:

G

CamScanner

Done

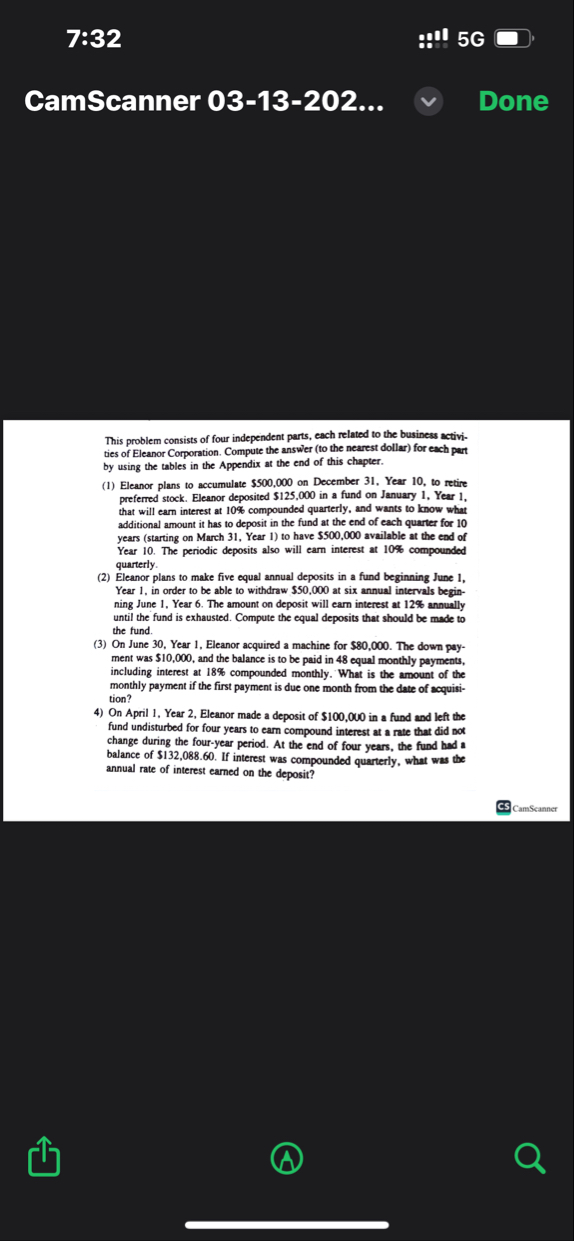

This problem consists of four independent parts, each related to the business activities of Eleanor Corporation. Compute the answer to the nearest dollar for each part by using the tables in the Appendix at the end of this chapter.

Eleanor plans to accumulate $ on December Year to retire preferred stock. Eleanor deposited $ in a fund on January Year that will earn interest at compounded quarterly, and wants to know what additional amount it has to deposit in the fund at the end of each quarter for years starting on March Year to have $ available at the ead of Year The periodic deposits also will earn interest at compounded quarterly.

Eleanor plans to make five equal annual deposits in a fund beginning June Year in order to be able to withdraw $ at six annual intervals beginning June Year The amount on deposit will earn interest at annually until the fund is exhausted. Compute the equal deposits that should be made to the fund.

On June Year Eleanor acquired a machine for $ The down payment was $ and the balance is to be paid in equal monthly payments, including interest at compounded monthly. What is the amount of the monthly payment if the first payment is due one month from the date of acquisition?

On April Year Eleanor made a deposit of $ in a fund and left the fund undisturbed for four years to earn compound interest at a rate that did not change during the fouryear period. At the end of four years, the fund had a balance of $ If interest was compounded quarterly, what was the annual rate of interest earned on the deposit?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock