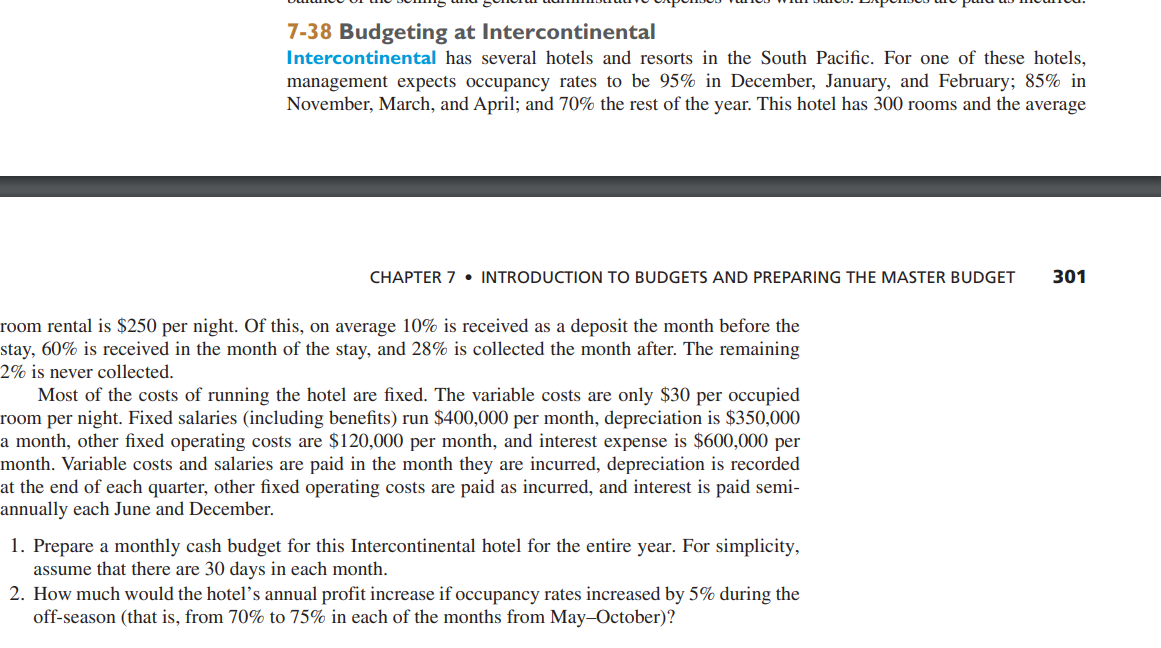

Question: 7 - 3 8 Budgeting at Intercontinental Intercontinental has several hotels and resorts in the South Pacific. For one of these hotels, management expects occupancy

Budgeting at Intercontinental

Intercontinental has several hotels and resorts in the South Pacific. For one of these hotels,

management expects occupancy rates to be in December, January, and February; in

November, March, and April; and the rest of the year. This hotel has rooms and the average

room rental is $ per night. Of this, on average is received as a deposit the month before the

stay, is received in the month of the stay, and is collected the month after. The remaining

is never collected.

Most of the costs of running the hotel are fixed. The variable costs are only $ per occupied

room per night. Fixed salaries including benefits run $ per month, depreciation is $

a month, other fixed operating costs are $ per month, and interest expense is $ per

month. Variable costs and salaries are paid in the month they are incurred, depreciation is recorded

at the end of each quarter, other fixed operating costs are paid as incurred, and interest is paid semi

annually each June and December.

Prepare a monthly cash budget for this Intercontinental hotel for the entire year. For simplicity,

assume that there are days in each month.

How much would the hotel's annual profit increase if occupancy rates increased by during the

offseason that is from to in each of the months from MayOctober

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock