Question: Your analysis should include: 1. A proposal for a new vision and mission that you feel would better represent the company. 2. An IFE and

Your analysis should include:

1. A proposal for a new vision and mission that you feel would better represent the company.

2. An IFE and EFE OR a SWOT Analysis

3. Recommendations on strategic directions for the company that are supported by 2 of the following:

SPACE Matrix

BCG Matrix

IE Matrix

QSPM

4. Rationalization as to why recommendations are being made.

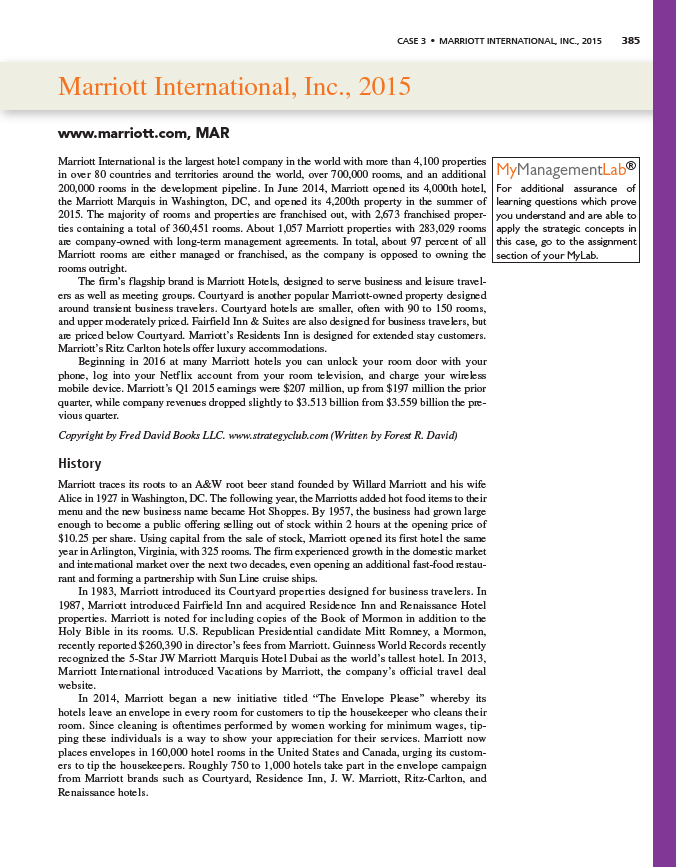

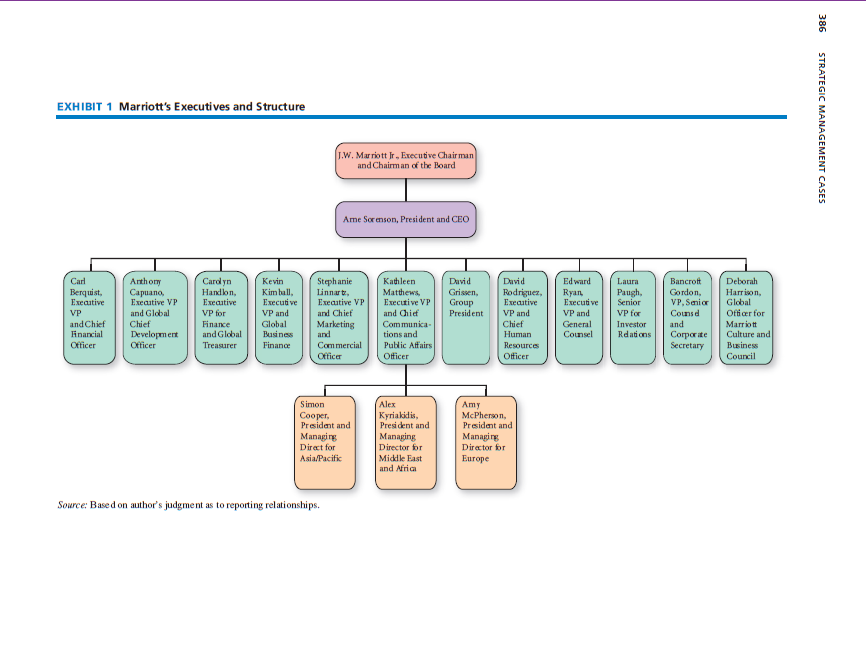

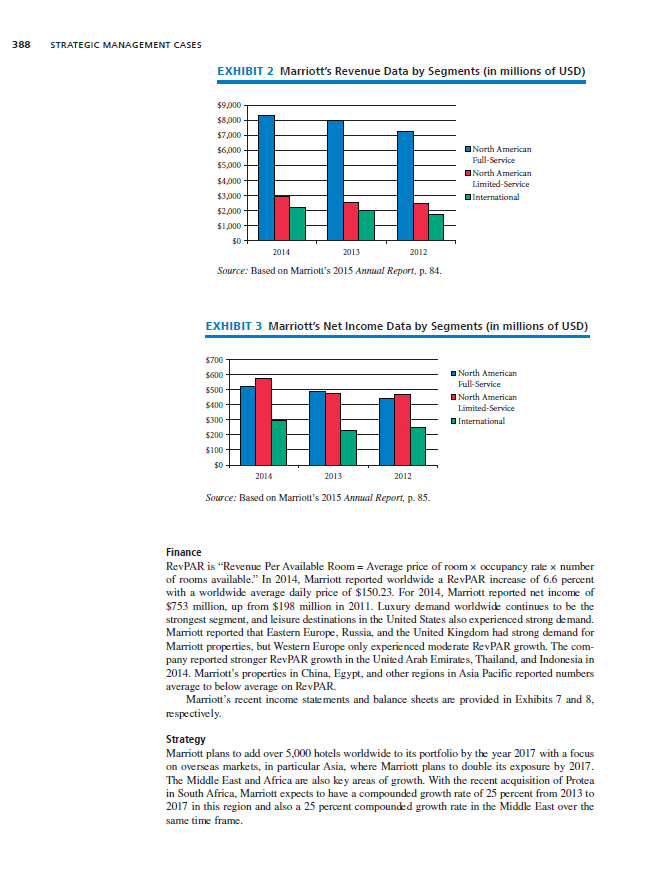

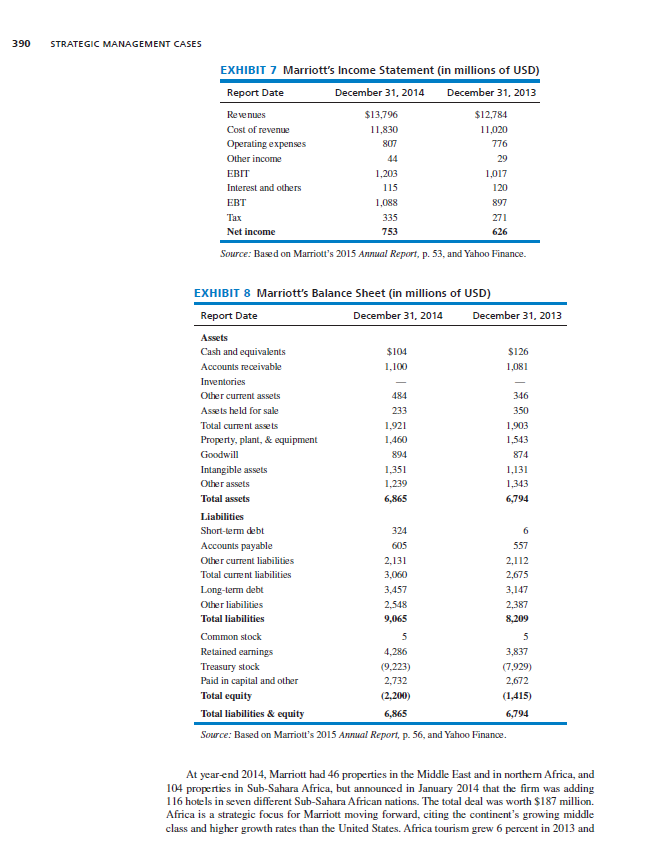

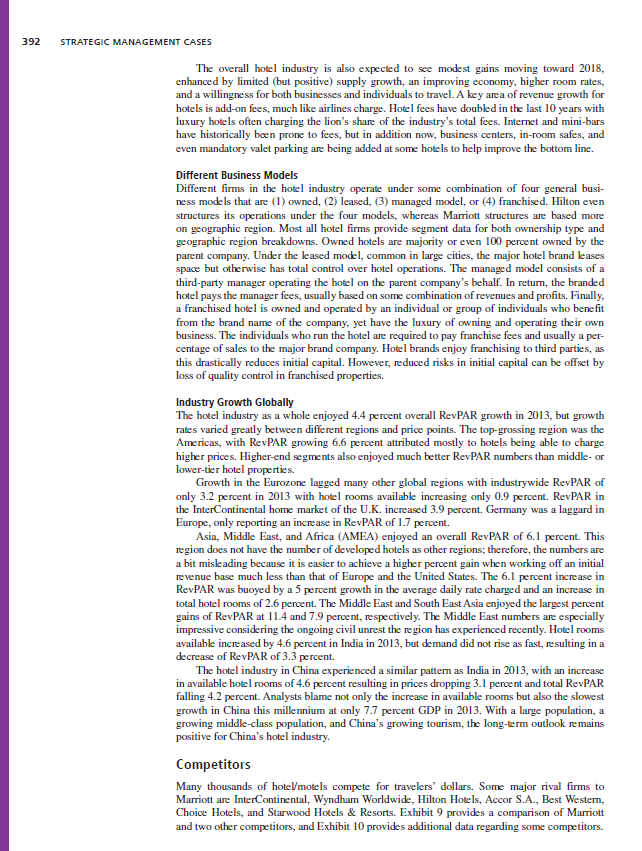

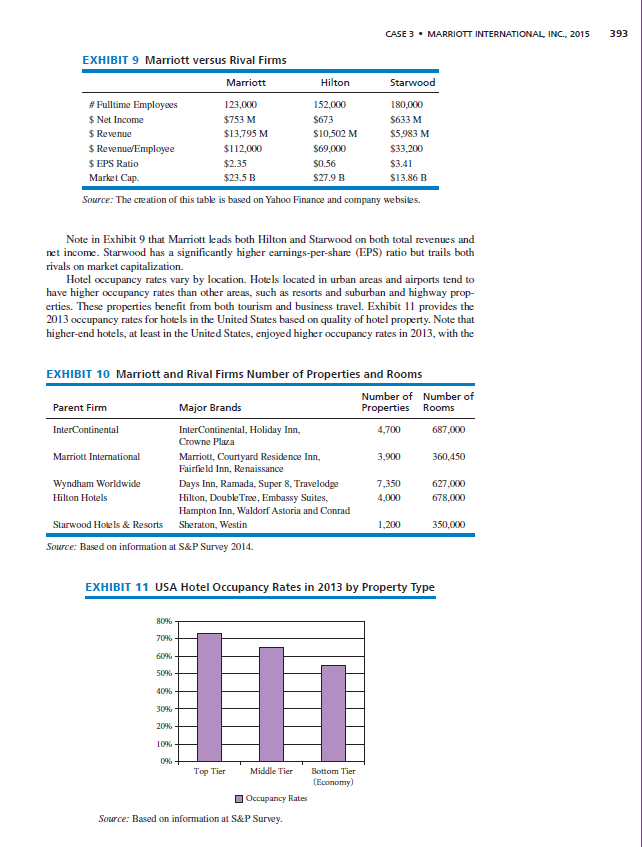

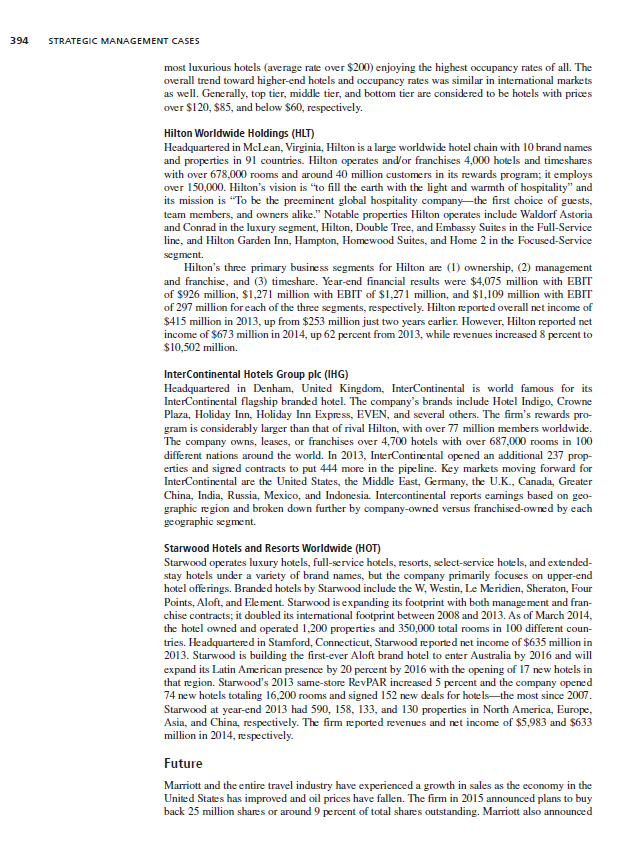

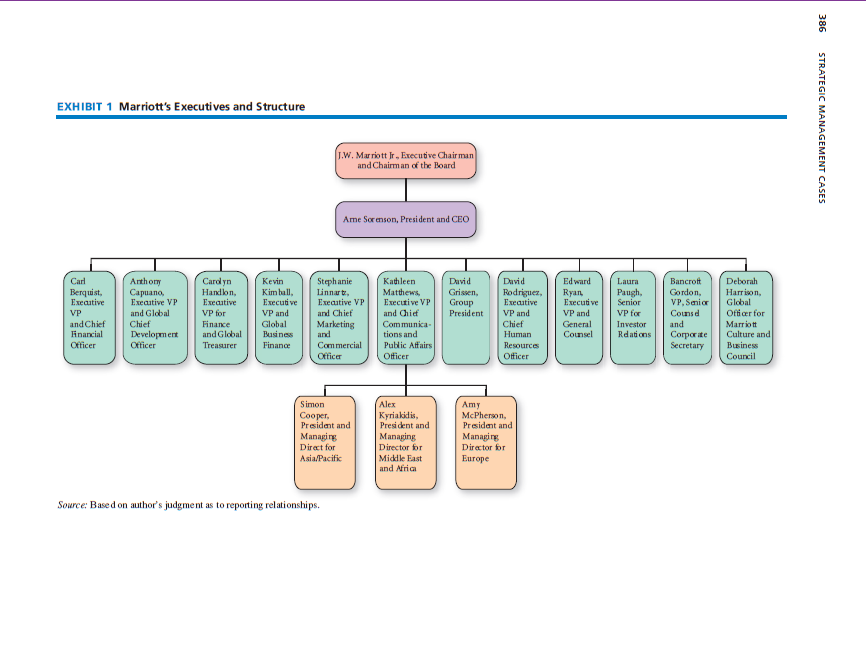

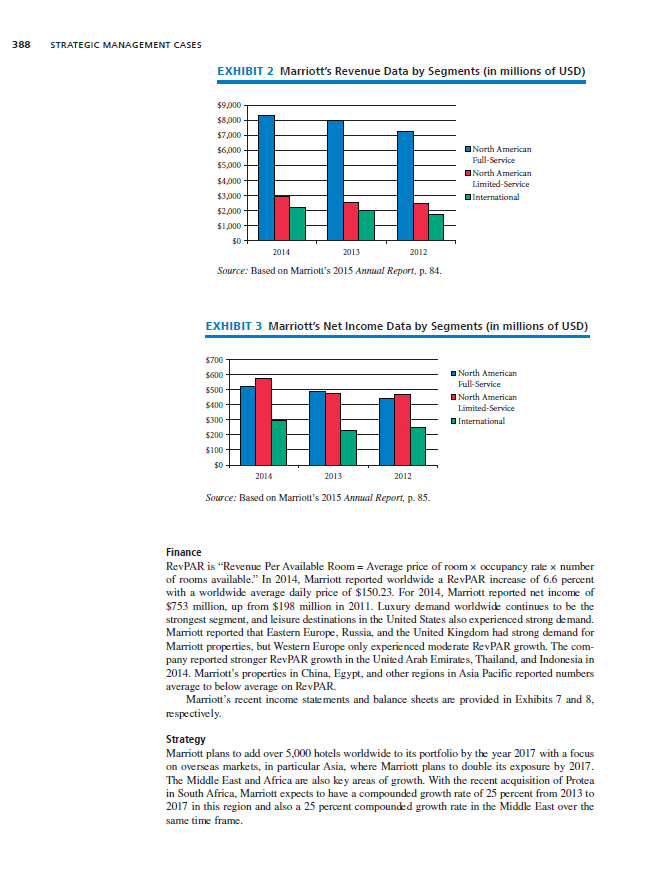

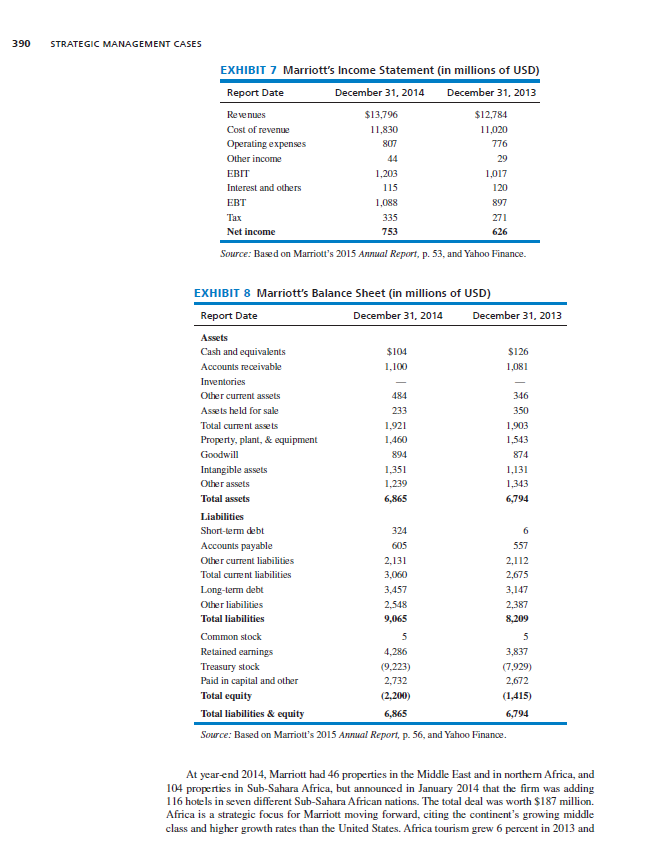

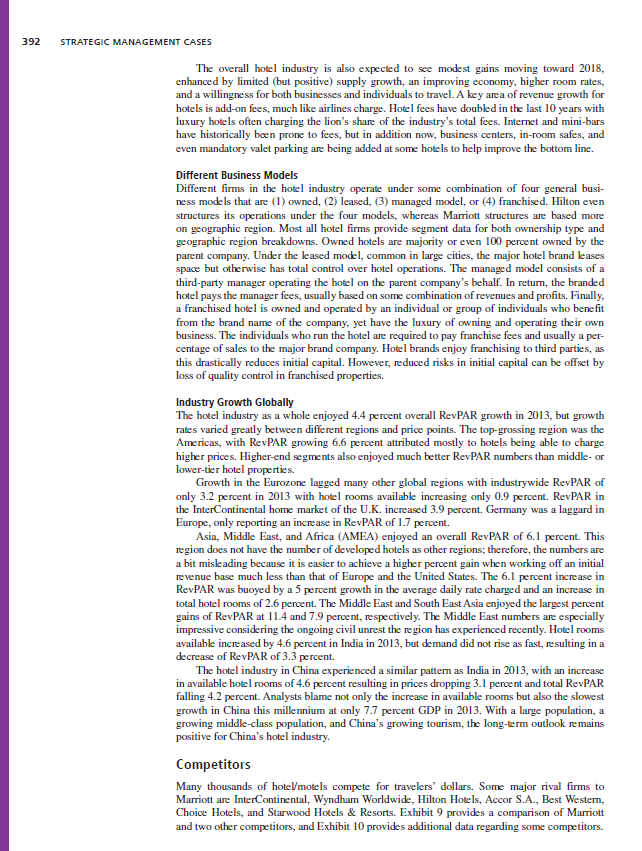

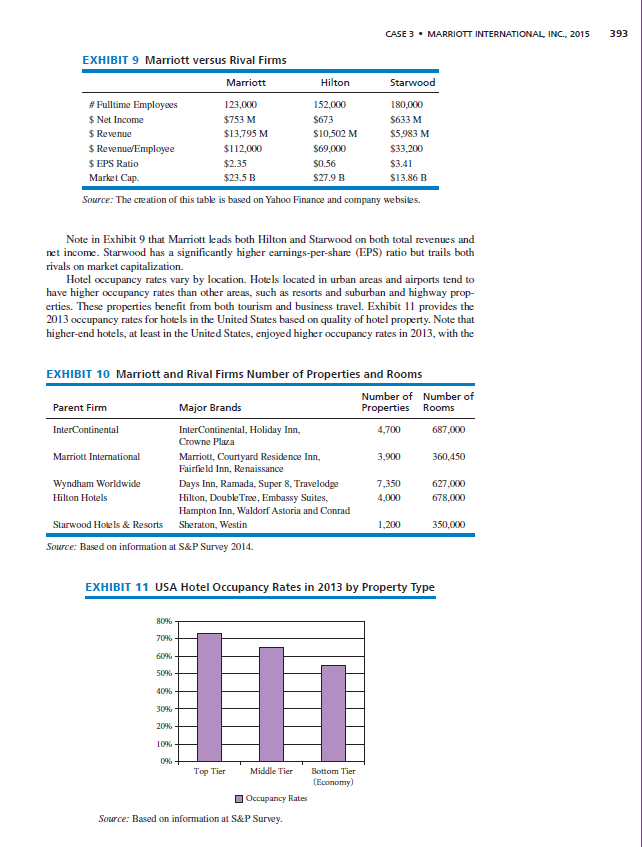

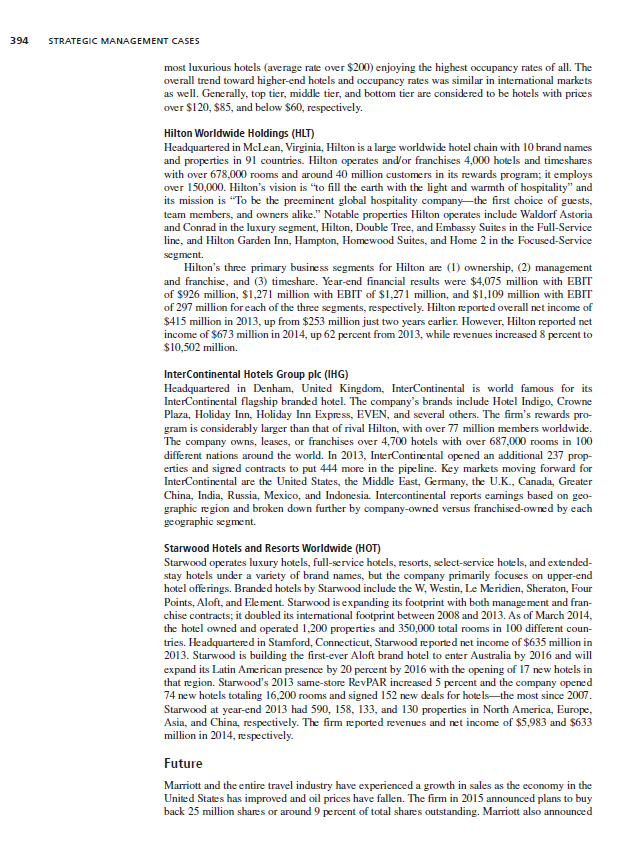

CASE 3 MARRIOTT INTERNATIONAL, INC., 2015 385 Marriott International, Inc., 2015 www.marriott.com, MAR Marriott International is the largest hotel company in the world with more than 4,100 properties in over 80 countries and territories around the world, over 700,000 rooms, and an additional MyManagementLab 200,000 rooms in the development pipeline. In June 2014, Marriott opened its 4,000th hotel, the Marriott Marquis in Washington, DC, and opened its 4,200th property in the summer of 2015. The majority of rooms and properties are franchised out, with 2,673 franchised proper- ties containing a total of 360,451 rooms. About 1,057 Marriott properties with 283,029 rooms are company-owned with long-term management agreements. In total, about 97 percent of all Marriott rooms are either managed or franchised, as the company is opposed to owning the rooms outright. For additional assurance of learning questions which prove you understand and are able to apply the strategic concepts in this case, go to the assignment section of your MyLab. The firm's flagship brand is Marriott Hotels, designed to serve business and leisure travel- ers as well as meeting groups. Courtyard is another popular Marriott-owned property designed around transient business travelers. Courtyard hotels are smaller, often with 90 to 150 rooms, and upper moderately priced. Fairfield Inn & Suites are also designed for business travelers, but are priced below Courtyard. Marriott's Residents Inn is designed for extended stay customers. Marriott's Ritz Carlton hotels offer luxury accommodations. Beginning in 2016 at many Marriott hotels you can unlock your room door with your phone, log into your Netflix account from your room television, and charge your wireless mobile device. Marriott's Q1 2015 camings were $207 million, up from $197 million the prior quarter, while company revenues dropped slightly to $3.513 billion from $3.559 billion the pre- vious quarter. Copyright by Fred David Books LLC. www.strategyclub.com (Written by Forest R. David) History Marriott traces its roots to an A&W root beer stand founded by Willard Marriott and his wife Alice in 1927 in Washington, DC. The following year, the Marriotts added hot food items to their menu and the new business name became Hot Shoppes. By 1957, the business had grown large enough to become a public offering selling out of stock within 2 hours at the opening price of $10.25 per share. Using capital from the sale of stock, Marriott opened its first hotel the same year in Arlington, Virginia, with 325 rooms. The firm experienced growth in the domestic market and inte mational market over the next two decades, even opening an additional fast-food restau- rant and forming a partnership with Sun Line cruise ships. In 1983, Marriott introduced its Courtyard properties designed for business travelers. In 1987, Marriott introduced Fairfield Inn and acquired Residence Inn and Renaissance Hotel properties. Marriott is noted for including copies of the Book of Mormon in addition to the Holy Bible in its rooms. U.S. Republican Presidential candidate Mitt Romney, a Mormon, recently reported $260,390 in director's fees from Marriott. Guinness World Records recently recognized the 5-Star JW Marriott Marquis Hotel Dubai as the world's tallest hotel. In 2013, Marriott International introduced Vacations by Marriott, the company's official travel deal website. In 2014, Marriott began a new initiative titled "The Envelope Please" whereby its hotels leave an envelope in every room for customers to tip the housekeeper who cleans their room. Since cleaning is oftentimes performed by women working for minimum wages, tip- ping these individuals is a way to show your appreciation for their services. Marriott now places envelopes in 160,000 hotel rooms in the United States and Canada, urging its custom- ers to tip the housekeepers. Roughly 750 to 1,000 hotels take part in the envelope campaign from Marriott brands such as Courtyard, Residence Inn, J. W. Marriott, Ritz-Carlton, and Renaissance hotels. EXHIBIT 1 Marriott's Executives and Structure Carl Berquist, Executive VP and Chief Financial Officer Anthony Capuano, Executive VP and Global Chief Development Officer Cardyn Handlon, Executive VP for Finance and Global Treasurer Kevin Kimball, Executive VP and Global Business Finance Simon Cooper, President and Managing Direct for Asia/Pacific Source: Based on author's judgment as to reporting relationships. J.W. Marriott Jr, Executive Chairman and Chairman of the Board Ame Sorenson, President and CEO Kathleen Matthews, Executive VP and Chief Communica- tions and Public Affairs Officer Alex Kyriakidis, President and Managing Director for Middle East and Africa Stephanie Linnart, Executive VP and Chief Marketing and Commercial Officer David Grissen, Group President David Rodriguez, Executive VP and Chief Human Resources. Officer Amy McPherson, President and aging Director for Europe Edward Ryan, Executive VP and General Counsel Laura Paugh, Senior VP for Investor Rdations Bancroft Deborah Gordon, Harrison, Global Officer for Marriott Culture and Business VP, Senior Couns d and Corporate Secretary Council 386 STRATEGIC MANAGEMENT CASES CASE 3. MARRIOTT INTERNATIONAL, INC., 2015 387 Mission, Vision, Values Marriott does not report a vision or mission statement. However, the firm does state its core val- ues and the founder's philosophy. Marriott's philosophy is to "Take care of associates and they will take care of the customers." Marriott's values are as follows: 1. We put people first. 2. We pursue excellence. 3. We embrace change. 4. We act with integrity. 5. We serve our world. Internal Issues Exhibit 1 Organizational Structure As illustrated in Exhibit 1, Marriott operates from a divisional-by-region organizational chart. Notice the firm has numerous female executives, consistent with its exemplary record on workplace equality. New Policy On January 1, 2015, Marriott, and rival Hilton Worldwide, implemented a new policy that re- quires customers to notify them the day before their scheduled arrival to avoid having to pay for the room. This policy reverses a long tradition of allowing customers to cancel their reservation "up to 6 pm the day of arrival without penalty." Bob Gilbert, CEO of the Hospitality Sales and Marketing Association International, a hotel industry group, said of the Marriott move: "It's not surprising. The hotel business is one of the last places where you can hold inventory with no commitment." Hotel demand in 2014-2015 has exceeded supply in many cities, giving hoteliers the upper hand. Another motivation for the new policy is hoteliers' desire to stifle the use of apps such as Yapta or Hotel Tonight that track hotel prices and, whenever a rate dips, apparently a grow- ing number of travelers rebook at a lower rate and cancel the costlier reservation, literally right up until check-in time. Penny-pinching travelers are increasingly using such tools, and Marriott seeks to deter this practice. Big most rival hotels are staying the course with traveler-friendly cancellation policies. Segment Information Marriot provides detailed financial breakdowns based on hotel type and location, with three reporting business segments: North American Full-Service, North American Limited-Service, and International. 1. North American Full-Service includes Ritz-Carlton, EDITION, Marriott Hotels, J. W. Marriott, Renaissance Hotels, Gaylord Hotels, and Autograph Collection Hotels. 2. North American Limited-Service includes AC Hotels by Marriott, Courtyard, Fairfield Inn & Suites, SpringHill Suites, Residence Inn, and Towne Place Suites. 3. International includes Ritz-Carlton, Bulgari Hotels & Resorts, EDITION, Marriott Hotels, J. W. Marriott, Renaissance Hotels, Autograph Collection, Courtyard, AC Hotels by Marriott, Fairfield Inn & Suites, Residence Inn, and Marriott Executive Apartments located outside the United States and Canada. Revenue and net income information for Marriott's various brands and businesses is pro- vided in Exhibits 2 and 3. Note, the North American Full-Service segment has twice the revenue of the Limited-Service segment, yet the Limited-Service segment net income was slightly more in both 2012 and 2014. Exhibit 4 reveals Marriott's hotel ownership type by percent of total properties. Note the majority of Marriott's properties are franchised. Notable brands by property type are provided in Exhibit 5. Note Courtyard is the most common hotel by number of properties followed by Fairfield. Marriott's properties and rooms by geographic region are reported in Exhibit 6. 388 STRATEGIC MANAGEMENT CASES EXHIBIT 2 Marriott's Revenue Data by Segments (in millions of USD) $9,000 $8,000 $7,000 $6,000 $5,000 North American Full-Service LL $4,000 $3,000 North American Limited-Service International $2,000 $1,000 $0 2014 2013 2012 Source: Based on Marriott's 2015 Annual Report, p. 84. EXHIBIT 3 Marriott's Net Income Data by Segments (in millions of USD) $700 $600 $500 $400 North American Full-Service North American Limited-Service International $300 LL $200 $100 $0 2014 2013 2012 Source: Based on Marriott's 2015 Annual Report, p. 85. Finance RevPAR is "Revenue Per Available Room Average price of room x occupancy rate x number of rooms available." In 2014, Marriott reported worldwide a RevPAR increase of 6.6 percent with a worldwide average daily price of $150.23. For 2014, Marriott reported net income of $753 million, up from $198 million in 2011. Luxury demand worldwide continues to be the strongest segment, and leisure destinations in the United States also experienced strong demand. Marriott reported that Eastern Europe, Russia, and the United Kingdom had strong demand for Marriott properties, but Western Europe only experienced moderate RevPAR growth. The com- pany reported stronger RevPAR growth in the United Arab Emirates, Thailand, and Indonesia in 2014. Marriott's properties in China, Egypt, and other regions in Asia Pacific reported numbers average to below average on RevPAR. Marriott's recent income statements and balance sheets are provided in Exhibits 7 and 8, respectively. Strategy Marriott plans to add over 5,000 hotels worldwide to its portfolio by the year 2017 with a focus on overseas markets, in particular Asia, where Marriott plans to double its exposure by 2017. The Middle East and Africa are also key areas of growth. With the recent acquisition of Protea in South Africa, Marriott expects to have a compounded growth rate of 25 percent from 2013 to 2017 in this region and also a 25 percent compounded growth rate in the Middle East over the same time frame. 390 STRATEGIC MANAGEMENT CASES EXHIBIT 7 Marriott's Income Statement (in millions of USD) Report Date December 31, 2014 December 31, 2013 Revenues $13,796 $12,784 Cost of revenue 11,830 11,020 Operating expenses 807 776 Other income 44 29 EBIT 1,203 1,017 Interest and others 115 120 EBT 1,088 897 Tax 335 271 Net income 753 626 Source: Based on Marriott's 2015 Annual Report, p. 53, and Yahoo Finance. EXHIBIT 8 Marriott's Balance Sheet (in millions of USD) Report Date December 31, 2014 December 31, 2013 Assets Cash and equivalents $104 $126 1,100 1,081 Accounts receivable Inventories Other current assets 484 346 Assets held for sale 233 350 Total current assets 1,921 1,903 Property, plant, & equipment 1,460 1,543 Goodwill 894 874 Intangible assets 1,351 1,131 Other assets 1,239 1,343 Total assets 6,865 6,794 Liabilities Short-term debt 324 6 Accounts payable 605 557 Other current liabilities 2,131 2,112 Total current liabilities 3,060 2,675 Long-term debt 3,457 3,147 Other liabilities 2,548 2,387 Total liabilities 9,065 8,209 Common stock 5 5 Retained earnings 4,286 3,837 Treasury stock (9,223) (7,929) Paid in capital and other 2,732 2,672 Total equity (2,200) (1,415) Total liabilities & equity 6,865 6,794 Source: Based on Marriott's 2015 Annual Report, p. 56, and Yahoo Finance. At year-end 2014, Marriott had 46 properties in the Middle East and in northern Africa, and 104 properties in Sub-Sahara Africa, but announced in January 2014 that the firm was adding 116 hotels in seven different Sub-Sahara African nations. The total deal was worth $187 million. Africa is a strategic focus for Marriott moving forward, citing the continent's growing middle class and higher growth rates than the United States. Africa tourism grew 6 percent in 2013 and CASE 3. MARRIOTT INTERNATIONAL, INC., 2015 is expected to continue at this rate over the long term. The acquisition of Protea Hospitality Group makes Marriott the largest hotel company in Africa. However, the Ebola virus outbreak in western Africa is a primary concern for Marriott. Marriott is the largest hotel operator in Beijing and Shanghai, but not in China as a whole. The company plans to open a new hotel in China every few weeks for the next several years. Marriott is more focused on the luxury market in China, but has plans to get into the more middle-class market as this demographic in China grows. External Issues Technology Hotels are rapidly developing smartphone apps to help speed up check-in for travelers, including letting customers go straight to their rooms by using their smartphone to unlock doors. In November 2014, Starwood Hotels and Resorts (HOT) became the first hotel to let guests unlock doors with their phones. The feature is available at 140 Aloft, Element, and W hotels at mid-2015. "Guests want this because it makes their lives simpler," says Mark Vondrasek, who oversees the loyalty program and digital initiatives for Starwood. "The ability to go right to your room gives them back time." In 2013, Marriott International (MAR) launched its check-in app at 330 North American hotels last year. By the end of 2014, that Marriott app was live at all 4,000 of its hotels world- wide. When a room becomes available, a message is sent to the guest's phone. Traditional room keys are preprogrammed and waiting at the front desk. A special express line allows guests to bypass crowds, flash their IDs, and get keys. Marriott guests made $1.25 billion in bookings in 2013 through its mobile app, according to George Corbin, senior vice president of digital for the company. However, Marriott is holding off on using smartphones as keys until security issues can be resolved. With brands Hilton, Waldorf Astoria, Conrad, and Canopy, Hilton Worldwide (H) is the second hotel chain, behind Starwood, to announce plans for mobile room keys, which it plans to roll out at the end of 2015 at some U.S. properties. Guests can use also use maps on the Hilton app to select a specific room. Guests who like personal check-in attention, such as to ask about pool hours, restaurant hours, and so on, can still opt for the traditional check-in. Hotel companies say new technologies are not about cutting jobs. Many hotel chains desire travelers to eventually be comfortable using their mobile apps to interact, such as using an iPad, phone, or smartwatch to request a wakeup call or purchase suite upgrades, spa treatments, and room service. InterContinental Hotels Group (IGH) is testing express check-in at 60 hotels. The top 15 hotel companies have more than 42,000 properties worldwide with a combined 5.2 million rooms, according to travel research firms STR and STR Global. Thus, some hotels have made smart app technology updates over the past few years, but they remain the minor- ity. One reason for reluctance is security. Starwood, for example, requires the phone to actually touch a pad on the outside of the door to open it. This is to assure the guests that if there is knock on the door late at night and guests go to the peephole to see who is there, their phones in their pockets will not accidently unlock the door. Industry Fragmentation The overall hotel industry is quite fragmented with only around 51 percent of the total hotel market being derived from the major brand's properties. The top five hotel brand companies in the world account for only 41 percent of all branded hotels, leaving many other brands (and "mom-and-pop" hotels) divided among the remaining 59 percent of the branded hotel market. However, the future outlook appears much more positive for branded hotel companies in gen- eral, as 72 percent of hotels currently being developed belong to major hotel companies. Hotel industry fragmentation is even much more pronounced in markets outside the United States. For example, in the United States about 70 percent of all hotel rooms available are branded, leaving only 30 percent to independent operators. However, in regions such as China and India, branded penetration can be as low as 20 percent of the total rooms available. Analysts expect a great increase in branded penetration in developing markets such as China and India moving forward, as customers become more affluent, have increased disposable income, and are able to travel more. Many consumers prefer particular brands being assured generally of better security and consistency from one hotel to another of the same brand. 391 392 STRATEGIC MANAGEMENT CASES The overall hotel industry is also expected to see modest gains moving toward 2018, enhanced by limited (but positive) supply growth, an improving economy, higher room rates, and a willingness for both businesses and individuals to travel. A key area of revenue growth for hotels is add-on fees, much like airlines charge. Hotel fees have doubled in the last 10 years with luxury hotels often charging the lion's share of the industry's total fees. Internet and mini-bars have historically been prone to fees, but in addition now, business centers, in-room safes, and even mandatory valet parking are being added at some hotels to help improve the bottom line. Different Business Models Different firms in the hotel industry operate under some combination of four general busi- ness models that are (1) owned, (2) leased, (3) managed model, or (4) franchised. Hilton even structures its operations under the four models, whereas Marriott structures are based more on geographic region. Most all hotel firms provide segment data for both ownership type and geographic region breakdowns. Owned hotels are majority or even 100 percent owned by the parent company. Under the leased model, common in large cities, the major hotel brand leases space but otherwise has total control over hotel operations. The managed model consists of a third-party manager operating the hotel on the parent company's behalf. In return, the branded hotel pays the manager fees, usually based on some combination of revenues and profits. Finally, a franchised hotel is owned and operated by an individual or group of individuals who benefit from the brand name of the company, yet have the luxury of owning and operating their own business. The individuals who run the hotel are required to pay franchise fees and usually a per- centage of sales to the major brand company. Hotel brands enjoy franchising to third parties, as this drastically reduces initial capital. However, reduced risks in initial capital can be offset by loss of quality control in franchised properties. Industry Growth Globally The hotel industry as a whole enjoyed 4.4 percent overall RevPAR growth in 2013, but growth rates varied greatly between different regions and price points. The top-grossing region was the Americas, with RevPAR growing 6.6 percent attributed mostly to hotels being able to charge higher prices. Higher-end segments also enjoyed much better RevPAR numbers than middle- or lower-tier hotel properties. Growth in the Eurozone lagged many other global regions with industrywide RevPAR of only 3.2 percent in 2013 with hotel rooms available increasing only 0.9 percent. RevPAR in the InterContinental home market of the U.K. increased 3.9 percent. Germany was a laggard in Europe, only reporting an increase in RevPAR of 1.7 percent. Asia, Middle East, and Africa (AMEA) enjoyed an overall RevPAR of 6.1 percent. This region does not have the number of developed hotels as other regions; therefore, the numbers are a bit misleading because it is easier to achieve a higher percent gain when working off an initial revenue base much less than that of Europe and the United States. The 6.1 percent increase in RevPAR was buoyed by a 5 percent growth in the average daily rate charged and an increase in total hotel rooms of 2.6 percent. The Middle East and South East Asia enjoyed the largest percent gains of RevPAR at 11.4 and 7.9 percent, respectively. The Middle East numbers are especially impressive considering the ongoing civil unrest the region has experienced recently. Hotel rooms available increased by 4.6 percent in India in 2013, but demand did not rise as fast, resulting in a decrease of RevPAR of 3.3 percent. The hotel industry in China experienced a similar pattern as India in 2013, with an increase in available hotel rooms of 4.6 percent resulting in prices dropping 3.1 percent and total RevPAR falling 4.2 percent. Analysts blame not only the increase in available rooms but also the slowest growth in China this millennium at only 7.7 percent GDP in 2013. With a large population, a growing middle-class population, and China's growing tourism, the long-term outlook remains positive for China's hotel industry. Competitors Many thousands of hotel/motels compete for travelers' dollars. Some major rival firms to Marriott are InterContinental, Wyndham Worldwide, Hilton Hotels, Accor S.A., Best Western, Choice Hotels, and Starwood Hotels & Resorts. Exhibit 9 provides a comparison of Marriott and two other competitors, and Exhibit 10 provides additional data regarding some competitors. CASE 3 MARRIOTT INTERNATIONAL, INC., 2015 393 EXHIBIT 9 Marriott versus Rival Firms Marriott Hilton Starwood # Fulltime Employees 123,000 152,000 180,000 $ Net Income $753 M $673 $633 M $ Revenue $13,795 M $10,502 M $5,983 M $ Revenue/Employee $112,000 $69,000 $33,200 $ EPS Ratio $2.35 $0.56 $3.41 Market Cap. $23.5 B $27.9 B $13.86 B Source: The creation of this table is based on Yahoo Finance and company websites. Note in Exhibit 9 that Marriott leads both Hilton and Starwood on both total revenues and net income. Starwood has a significantly higher earnings-per-share (EPS) ratio but trails both rivals on market capitalization. Hotel occupancy rates vary by location. Hotels located in urban areas and airports tend to have higher occupancy rates than other areas, such as resorts and suburban and highway prop- erties. These properties benefit from both tourism and business travel. Exhibit 11 provides the 2013 occupancy rates for hotels in the United States based on quality of hotel property. Note that higher-end hotels, at least in the United States, enjoyed higher occupancy rates in 2013, with the EXHIBIT 10 Marriott and Rival Firms Number of Properties and Rooms Number of Number of Properties Rooms Parent Firm Major Brands InterContinental InterContinental, Holiday Inn, 4,700 687,000 Crowne Plaza Marriott International 3,900 360,450 Marriott, Courtyard Residence Inn, Fairfield Inn, Renaissance Days Inn, Ramada, Super 8, Travelodge 7,350 Wyndham Worldwide Hilton Hotels 627,000 4,000 678,000 Hilton, Double Tree, Embassy Suites, Hampton Inn, Waldorf Astoria and Conrad Starwood Hotels & Resorts Sheraton, Westin 1,200 350,000 Source: Based on information at S&P Survey 2014. EXHIBIT 11 USA Hotel Occupancy Rates in 2013 by Property Type 80% 70% 60% 50% 40% 30% 20% 10% Middle Tier Bottom Tier (Economy) Occupancy Rates 0% Top Tier Source: Based on information at S&P Survey. 394 STRATEGIC MANAGEMENT CASES most luxurious hotels (average rate over $200) enjoying the highest occupancy rates of all. The overall trend toward higher-end hotels and occupancy rates was similar in international markets as well. Generally, top tier, middle tier, and bottom tier are considered to be hotels with prices over $120, $85, and below $60, respectively. Hilton Worldwide Holdings (HLT) Headquartered in McLean, Virginia, Hilton is a large worldwide hotel chain with 10 brand names and properties in 91 countries. Hilton operates and/or franchises 4,000 hotels and timeshares with over 678,000 rooms and around 40 million customers in its rewards program; it employs over 150,000. Hilton's vision is "to fill the earth with the light and warmth of hospitality" and its mission is "To be the preeminent global hospitality company the first choice of guests, team members, and owners alike." Notable properties Hilton operates include Waldorf Astoria and Conrad in the luxury segment, Hilton, Double Tree, and Embassy Suites in the Full-Service line, and Hilton Garden Inn, Hampton, Homewood Suites, and Home 2 in the Focused-Service segment. Hilton's three primary business segments for Hilton are (1) ownership, (2) management and franchise, and (3) timeshare. Year-end financial results were $4,075 million with EBIT of $926 million, $1,271 million with EBIT of $1,271 million, and $1,109 million with EBIT of 297 million for each of the three segments, respectively. Hilton reported overall net income of $415 million in 2013, up from $253 million just two years earlier. However, Hilton reported net income of $673 million in 2014, up 62 percent from 2013, while revenues increased 8 percent to $10,502 million. InterContinental Hotels Group plc (IHG) Headquartered in Denham, United Kingdom, InterContinental is world famous for its InterContinental flagship branded hotel. The company's brands include Hotel Indigo, Crowne Plaza, Holiday Inn, Holiday Inn Express, EVEN, and several others. The firm's rewards pro- gram is considerably larger than that of rival Hilton, with over 77 million members worldwide. The company owns, leases, or franchises over 4,700 hotels with over 687,000 rooms in 100 different nations around the world. In 2013, InterContinental opened an additional 237 prop- erties and signed contracts to put 444 more in the pipeline. Key markets moving forward for InterContinental are the United States, the Middle East, Germany, the U.K., Canada, Greater China, India, Russia, Mexico, and Indonesia. Intercontinental reports earnings based on geo- graphic region and broken down further by company-owned versus franchised-owned by each geographic segment. Starwood Hotels and Resorts Worldwide (HOT) Starwood operates luxury hotels, full-service hotels, resorts, select-service hotels, and extended- stay hotels under a variety of brand names, but the company primarily focuses on upper-end hotel offerings. Branded hotels by Starwood include the W, Westin, Le Meridien, Sheraton, Four Points, Aloft, and Element. Starwood is expanding its footprint with both management and fran- chise contracts; it doubled its international footprint between 2008 and 2013. As of March 2014, the hotel owned and operated 1,200 properties and 350,000 total rooms in 100 different coun- tries. Headquartered in Stamford, Connecticut, Starwood reported net income of $635 million in 2013. Starwood is building the first-ever Aloft brand hotel to enter Australia by 2016 and will expand its Latin American presence by 20 percent by 2016 with the opening of 17 new hotels in that region. Starwood's 2013 same-store RevPAR increased 5 percent and the company opened 74 new hotels totaling 16,200 rooms and signed 152 new deals for hotels the most since 2007. Starwood at year-end 2013 had 590, 158, 133, and 130 properties in North America, Europe, Asia, and China, respectively. The firm reported revenues and net income of $5,983 and $633 million in 2014, respectively. Future Marriott and the entire travel industry have experienced a growth in sales as the economy in the United States has improved and oil prices have fallen. The firm in 2015 announced plans to buy back 25 million shares or around 9 percent of total shares outstanding. Marriott also announced CASE 3 MARRIOTT INTERNATIONAL, INC., 2015 in January 2015 that it plans to buy Canadian-based Delta Hotels and Resorts for $125 million. The acquisition of Delta Hotels is in line with Marriott's plans to expand internationally; how- ever, the firm is mostly focused on emerging markets. In 2015, CEO Sorenson reiterated these plans in particular to India, where the firm currently operates 24 hotels with plans to operate 50 by 2020. Currently, Marriott has 40 hotels in the long-term pipeline for India; however, infra- structure issues continue to hamper expansion into India as rapidly as Marriott and other rivals would like. In addition to India, Marriott has 150 properties in Asia (not including China or India), with more than 200 in the pipeline. Chinese properties currently total 70, with more than 80 additional hotels scheduled to be operating by 2020. Marriott is opening a hotel every two weeks in China, and plans to increase the number of its properties in the Middle East and Africa by 75 percent and Latin America by 50 percent through 2020. Currently many emerging markets are struggling and the strong dollar hurts overseas sales that are converted back to dollars. There are also many regions of the world in which Marriott and rivals would like to position their properties. Help CEO Sorenson develop a three-year stra- tegic plan moving forward that most effectively uses Marriott's resources. 395