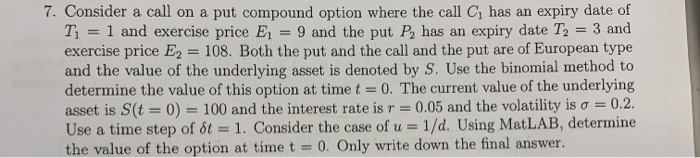

Question: 7. Consider a call on a put compound option where the call C, has an expiry date of T = 1 and exercise price E

7. Consider a call on a put compound option where the call C, has an expiry date of T = 1 and exercise price E = 9 and the put P, has an expiry date T, = 3 and exercise price E2 = 108. Both the put and the call and the put are of European type and the value of the underlying asset is denoted by S. Use the binomial method to determine the value of this option at time t = 0. The current value of the underlying asset is S(t = 0) = 100 and the interest rate is r = 0.05 and the volatility is o = 0.2. Use a time step of 8t = 1. Consider the case of u = 1/d. Using MatLAB, determine the value of the option at time t = 0. Only write down the final answer. 7. Consider a call on a put compound option where the call C, has an expiry date of T = 1 and exercise price E = 9 and the put P, has an expiry date T, = 3 and exercise price E2 = 108. Both the put and the call and the put are of European type and the value of the underlying asset is denoted by S. Use the binomial method to determine the value of this option at time t = 0. The current value of the underlying asset is S(t = 0) = 100 and the interest rate is r = 0.05 and the volatility is o = 0.2. Use a time step of 8t = 1. Consider the case of u = 1/d. Using MatLAB, determine the value of the option at time t = 0. Only write down the final

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts