Question: 7. Consider a four-year zero-coupon bond. Use a binomial tree for this calculation. The probability that the rate moves higher is 70%; it moves lower

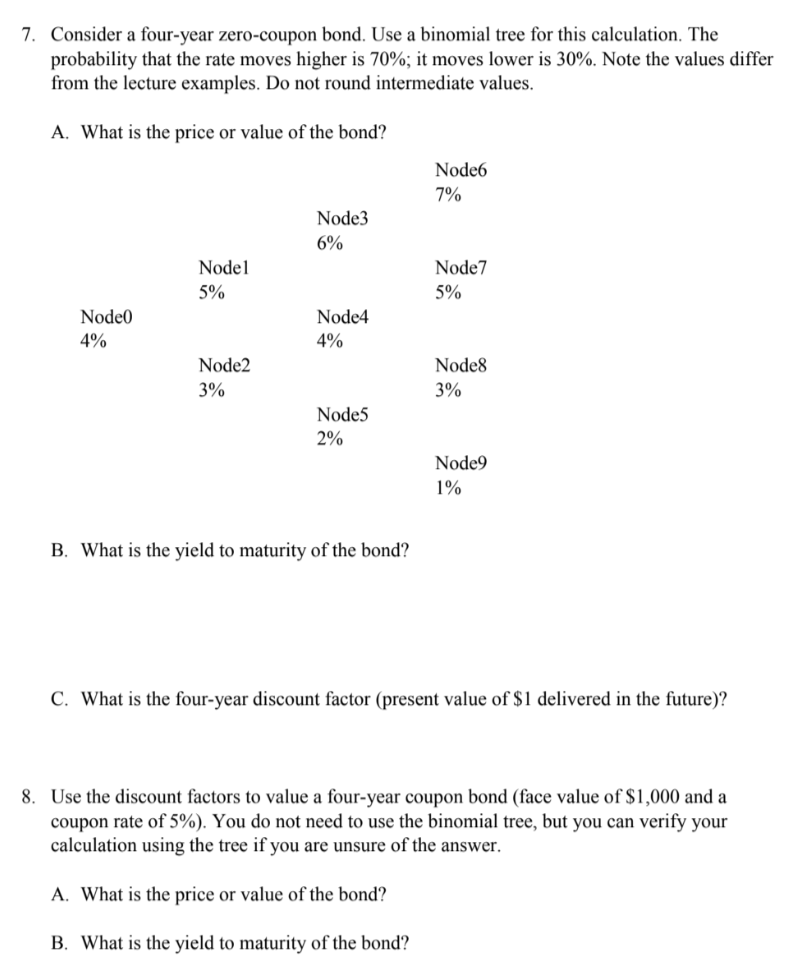

7. Consider a four-year zero-coupon bond. Use a binomial tree for this calculation. The probability that the rate moves higher is 70%; it moves lower is 30%. Note the values differ from the lecture examples. Do not round intermediate values. A. What is the price or value of the bond? B. What is the yield to maturity of the bond? C. What is the four-year discount factor (present value of $1 delivered in the future)? 8. Use the discount factors to value a four-year coupon bond (face value of $1,000 and a coupon rate of 5% ). You do not need to use the binomial tree, but you can verify your calculation using the tree if you are unsure of the answer. A. What is the price or value of the bond? B. What is the yield to maturity of the bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts