Question: 7. Correcting for negative externalities - Taxes versus tradable permits Nuclear facilides enit radioactive waste as a waste product. This generates a cost to society

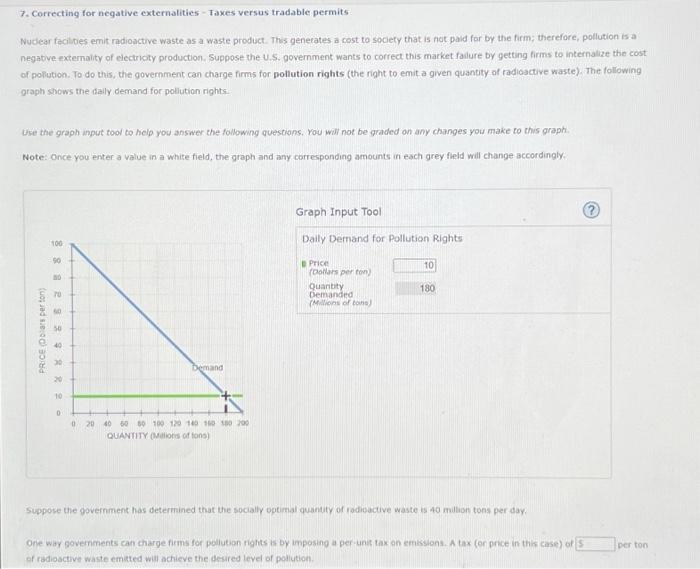

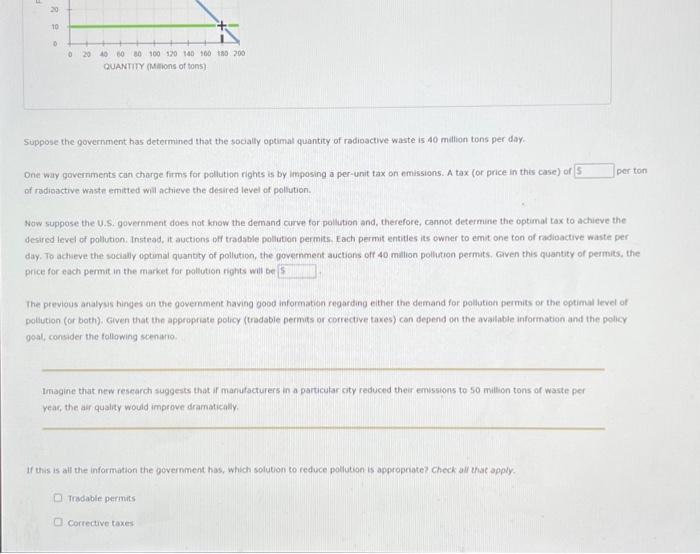

7. Correcting for negative externalities - Taxes versus tradable permits Nuclear facilides enit radioactive waste as a waste product. This generates a cost to society that is not pald for by the firm; therefore, pollution is a negative externality of electrioty production. Suppose the U.S, government wants to correct this market failure by getting firms to internalize the cost. of pollution. To do this, the government can charge firms for pollution rights (the right to emit a given quantity of radioactive waste), The following graph shows the dally demand for pollution rights. Wse the graph input tool to help you answer the following questions, You will not be graded on any changes you make to this graph. Wote: once you enter a value in a white field, the graph and any carresponding amounts in eseh grey ficld will ehange accordingly. Graph Input Tool (?) Dally Demand for Pollution Rights E Price (Cowlars per ton) quantity guantity Demanded (Millons of tone) Suppose the government has determined that the socially optimal quantity of yodioactive waste is 40 million tons per day. One war governments can charge firms for poilution rights is by imposing a per-unit tax on ertiksions. A tax (or price in this case) of perton of radiosctive waste emitted will achieve the desired level of pollution. Suppose the government has determined that the socially optimat quantity of radioactive waste is 40 milfion tons per day. One way governments can charge firms for poliution rights is by imposing a per-unit tax on emissions. A tax (or price in this case) of perton of radionactive waste emitted wil achieve the desired level of pollution. Naw suppose the U.S. government does not know the demand curve for pollution and, therefore, cannot determine the optimat tax to achieve the desired level of pollution. Instead, it auctions off tradable poliution permits. Each permit entities its owner to emit one ton of radioactive waste per day. To achueve the socially optumal quantity of pollution, the government auctions off 40 mallion pollution permats. Given this quantity of permits, the price for each permit in the market for pallution rights will be The previous analyus hinges an the government having oood information regarding either the demand for poliution permits or the optimal level of pollution (or both). Given that the appropriate policy (tradable permits or corrective taxes) can depend on the available inforination and the policy goal, consider the following scenario. Imagine that new research suggests that if manufacturers in a particular city reduced their emissions to 50 million tons of waste per vear, the air quality would impeove dramatically. If this is all the information the government has, which solution to reduce pollution is appropriate? Check all thac apply. Tradable permits corrective taxes 7. Correcting for negative externalities - Taxes versus tradable permits Nuclear facilides enit radioactive waste as a waste product. This generates a cost to society that is not pald for by the firm; therefore, pollution is a negative externality of electrioty production. Suppose the U.S, government wants to correct this market failure by getting firms to internalize the cost. of pollution. To do this, the government can charge firms for pollution rights (the right to emit a given quantity of radioactive waste), The following graph shows the dally demand for pollution rights. Wse the graph input tool to help you answer the following questions, You will not be graded on any changes you make to this graph. Wote: once you enter a value in a white field, the graph and any carresponding amounts in eseh grey ficld will ehange accordingly. Graph Input Tool (?) Dally Demand for Pollution Rights E Price (Cowlars per ton) quantity guantity Demanded (Millons of tone) Suppose the government has determined that the socially optimal quantity of yodioactive waste is 40 million tons per day. One war governments can charge firms for poilution rights is by imposing a per-unit tax on ertiksions. A tax (or price in this case) of perton of radiosctive waste emitted will achieve the desired level of pollution. Suppose the government has determined that the socially optimat quantity of radioactive waste is 40 milfion tons per day. One way governments can charge firms for poliution rights is by imposing a per-unit tax on emissions. A tax (or price in this case) of perton of radionactive waste emitted wil achieve the desired level of pollution. Naw suppose the U.S. government does not know the demand curve for pollution and, therefore, cannot determine the optimat tax to achieve the desired level of pollution. Instead, it auctions off tradable poliution permits. Each permit entities its owner to emit one ton of radioactive waste per day. To achueve the socially optumal quantity of pollution, the government auctions off 40 mallion pollution permats. Given this quantity of permits, the price for each permit in the market for pallution rights will be The previous analyus hinges an the government having oood information regarding either the demand for poliution permits or the optimal level of pollution (or both). Given that the appropriate policy (tradable permits or corrective taxes) can depend on the available inforination and the policy goal, consider the following scenario. Imagine that new research suggests that if manufacturers in a particular city reduced their emissions to 50 million tons of waste per vear, the air quality would impeove dramatically. If this is all the information the government has, which solution to reduce pollution is appropriate? Check all thac apply. Tradable permits corrective taxes

Step by Step Solution

There are 3 Steps involved in it

Correcting for Negative Externalities Taxes vs Tradable Permits 1 Problem Overview Pollution Type Radioactive waste from nuclear facilities Externalit... View full answer

Get step-by-step solutions from verified subject matter experts