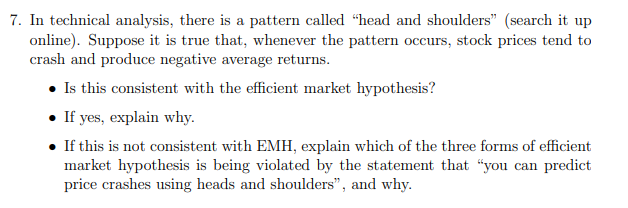

Question: 7. In technical analysis, there is a pattern called head and shoulders (search it up online). Suppose it is true that, whenever the pattern occurs,

7. In technical analysis, there is a pattern called "head and shoulders (search it up online). Suppose it is true that, whenever the pattern occurs, stock prices tend to crash and produce negative average returns. Is this consistent with the efficient market hypothesis? If yes, explain why. If this is not consistent with EMH, explain which of the three forms of efficient market hypothesis is being violated by the statement that "you can predict price crashes using heads and shoulders, and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts