Question: 3. Question 3 (technical analysis). In technical analysis, there is a pattern called head and shoulders (search it up online). Suppose it is true

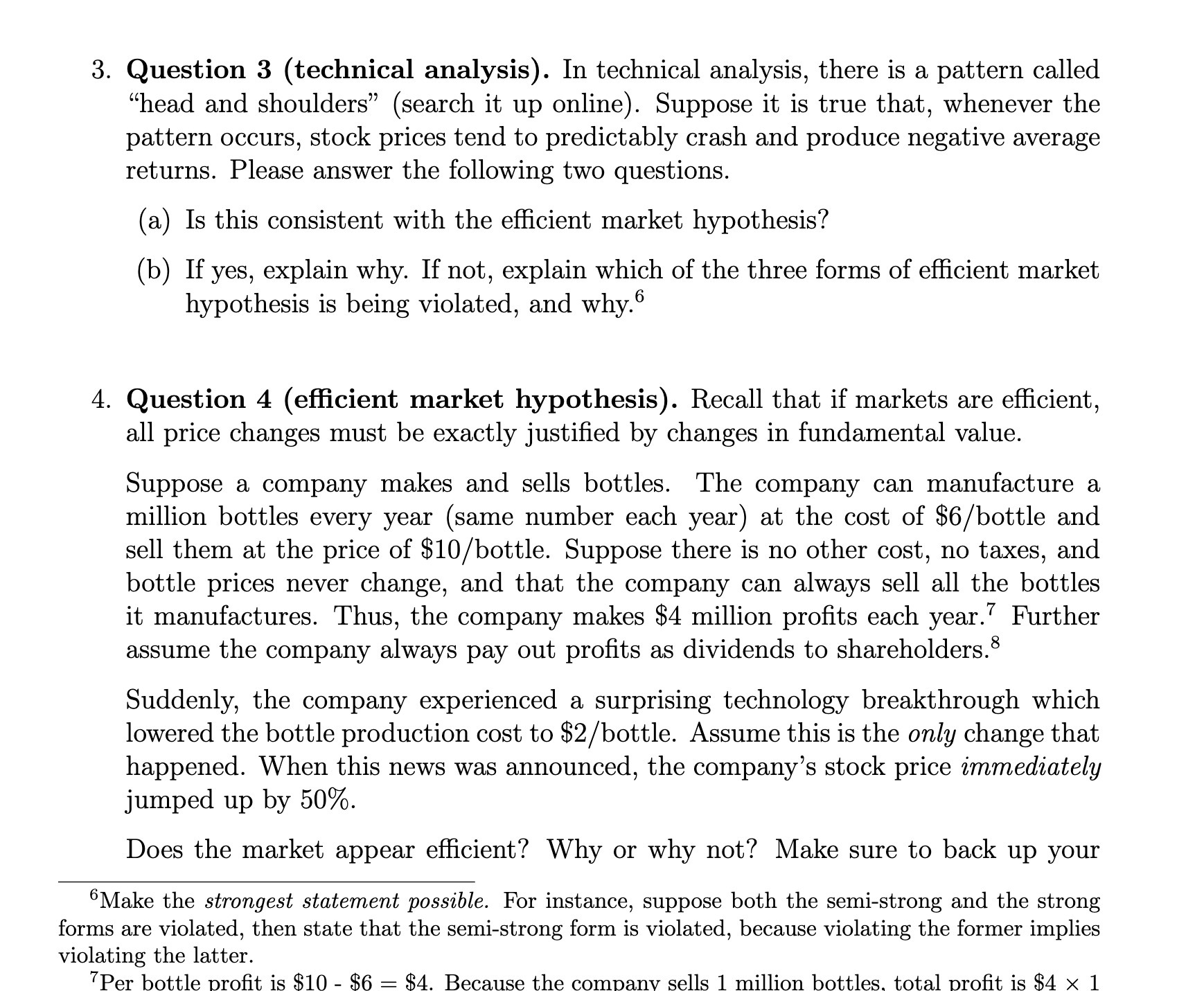

3. Question 3 (technical analysis). In technical analysis, there is a pattern called "head and shoulders" (search it up online). Suppose it is true that, whenever the pattern occurs, stock prices tend to predictably crash and produce negative average returns. Please answer the following two questions. (a) Is this consistent with the efficient market hypothesis? (b) If yes, explain why. If not, explain which of the three forms of efficient market hypothesis is being violated, and why.6 4. Question 4 (efficient market hypothesis). Recall that if markets are efficient, all price changes must be exactly justified by changes in fundamental value. Suppose a company makes and sells bottles. The company can manufacture a million bottles every year (same number each year) at the cost of $6/bottle and sell them at the price of $10/bottle. Suppose there is no other cost, no taxes, and bottle prices never change, and that the company can always sell all the bottles it manufactures. Thus, the company makes $4 million profits each year.7 Further assume the company always pay out profits as dividends to shareholders.8 Suddenly, the company experienced a surprising technology breakthrough which lowered the bottle production cost to $2/bottle. Assume this is the only change that happened. When this news was announced, the company's stock price immediately jumped up by 50%. Does the market appear efficient? Why or why not? Make sure to back up your 6Make the strongest statement possible. For instance, suppose both the semi-strong and the strong forms are violated, then state that the semi-strong form is violated, because violating the former implies violating the latter. Per bottle profit is $10 - $6 = $4. Because the company sells 1 million bottles, total profit is $4 1

Step by Step Solution

There are 3 Steps involved in it

Question 3 a No this is not consistent with the efficient market hypothesis b The efficient market h... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

664237cb8d1e5_984345.pdf

180 KBs PDF File

664237cb8d1e5_984345.docx

120 KBs Word File