Question: 7. simple finance, please answer 3. Peter purchases a 6 month call option on 1,000 shares of Apple Inc., with a strike price of $490

7. simple finance, please answer

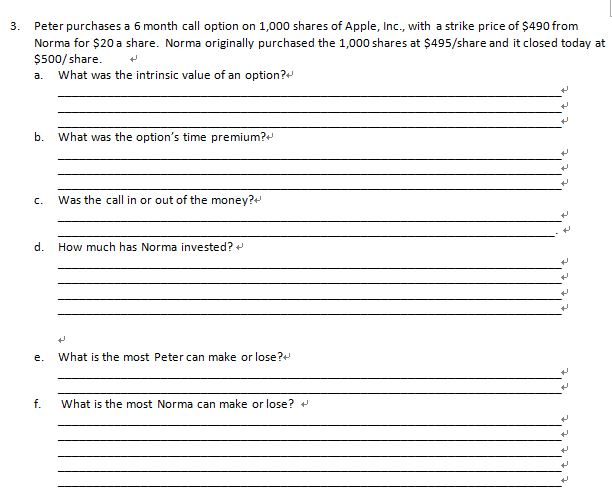

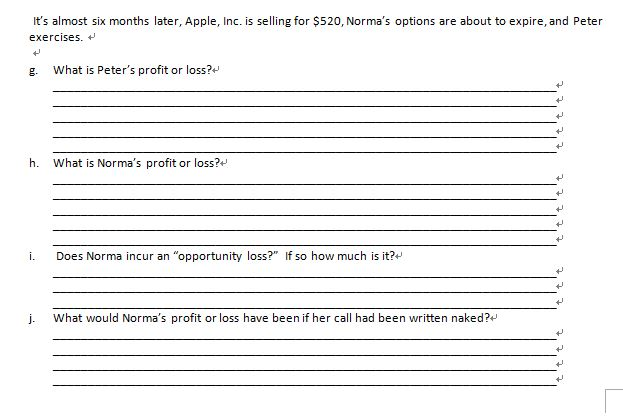

3. Peter purchases a 6 month call option on 1,000 shares of Apple Inc., with a strike price of $490 from Norma for $20 a share. Norma originally purchased the 1,000 shares at $495/share and it closed today at $500/ share. a. What was the intrinsic value of an option b. What was the option's time premium? c. Was the call in or out of the money? d. How much has Norma invested? e. What is the most Peter can make or lose f. What is the most Norma can make or lose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts