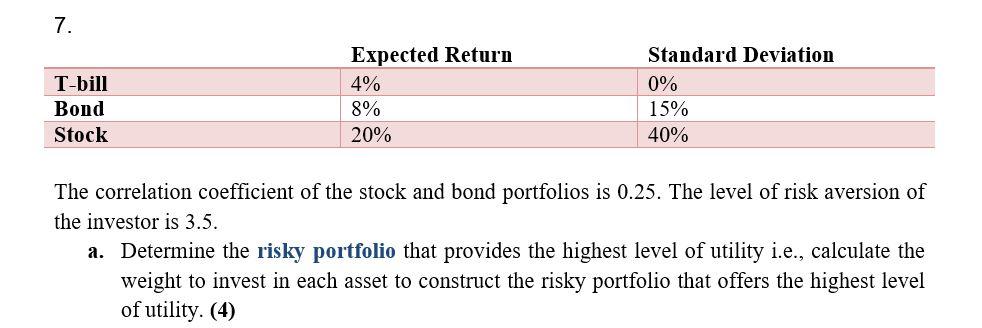

Question: 7. T-bill Bond Stock Expected Return 4% 8% 20% Standard Deviation 0% 15% 40% The correlation coefficient of the stock and bond portfolios is 0.25.

7. T-bill Bond Stock Expected Return 4% 8% 20% Standard Deviation 0% 15% 40% The correlation coefficient of the stock and bond portfolios is 0.25. The level of risk aversion of the investor is 3.5. a. Determine the risky portfolio that provides the highest level of utility i.e., calculate the weight to invest in each asset to construct the risky portfolio that offers the highest level of utility. (4) 7. T-bill Bond Stock Expected Return 4% 8% 20% Standard Deviation 0% 15% 40% The correlation coefficient of the stock and bond portfolios is 0.25. The level of risk aversion of the investor is 3.5. a. Determine the risky portfolio that provides the highest level of utility i.e., calculate the weight to invest in each asset to construct the risky portfolio that offers the highest level of utility. (4)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts