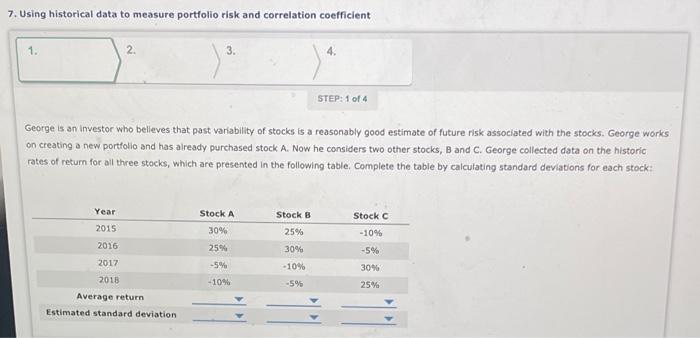

Question: 7. Using historical data to measure portfolio risk and correlation coefficient 1. 2. 3. 4. STEP: 1 of 4 George is an investor who believes

7. Using historical data to measure portfolio risk and correlation coefficient 1. 2. 3. 4. STEP: 1 of 4 George is an investor who believes that past variability of stocks is a reasonably good estimate of future risk associated with the stocks. George works on creating a new portfolio and has already purchased stock A. Now he considers two other stocks, B and C. George collected data on the historic rates of return for all three stocks, which are presented in the following table. Complete the table by calculating standard deviations for each stock: Stock A Stock B Year 2015 2016 25% Stock C -10% -5% 30% 30% 25% -5% -10% 30% 2017 -10% 2018 -5% 25% Average return Estimated standard deviation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts