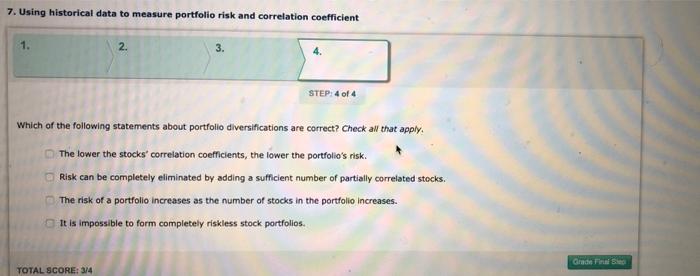

Question: 7. Using historical data to measure portfolio risk and correlation coefficient 1. 2. 3. STEP: 4 of 4 Which of the following statements about portfolio

7. Using historical data to measure portfolio risk and correlation coefficient 1. 2. 3. STEP: 4 of 4 Which of the following statements about portfolio diversifications are correct? Check aw that apply. The lower the stocks' correlation coefficients, the lower the portfolio's risk. Risk can be completely eliminated by adding a sufficient number of partially correlated stocks. The risk of a portfolio Increases as the number of stocks in the portfolio Increases. It is impossible to form completely riskless stock portfolios. Grade Finai. TOTAL SCORE: 3/4

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock