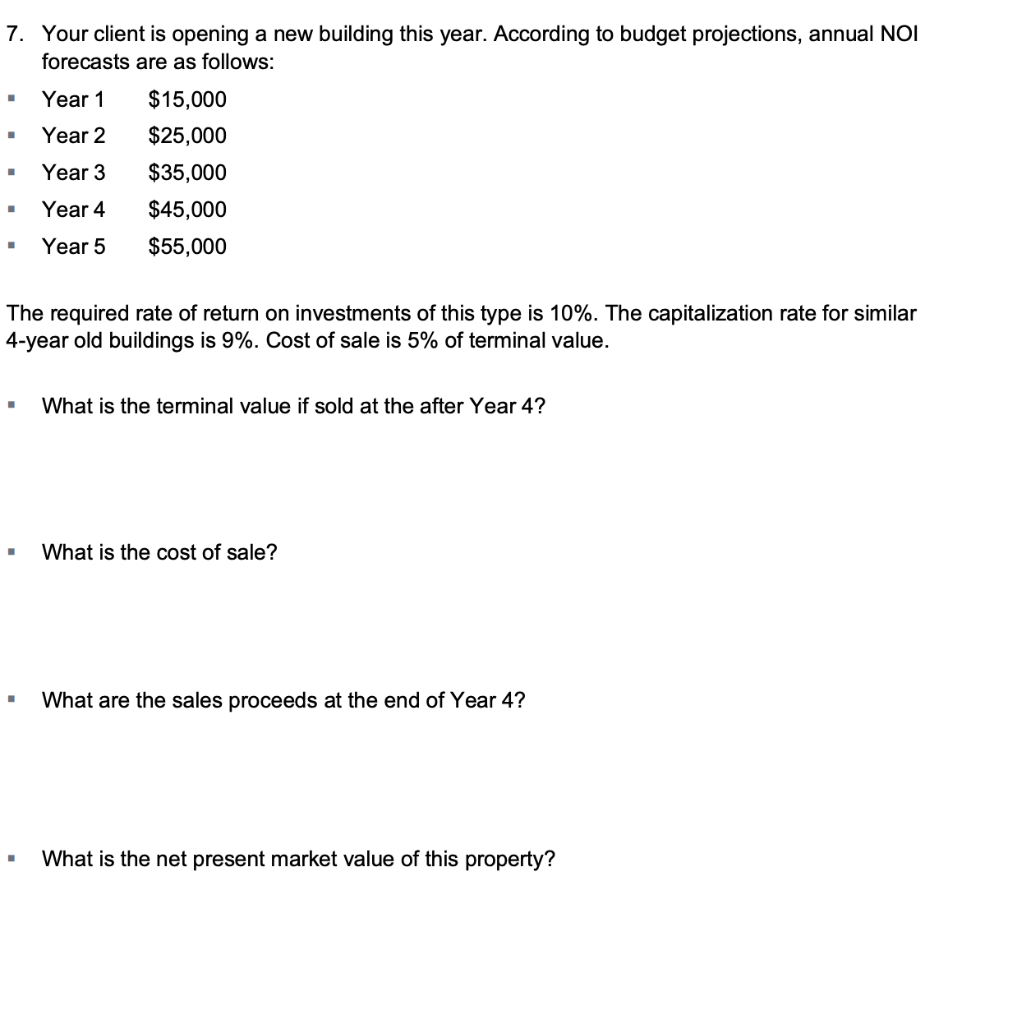

Question: . 7. Your client is opening a new building this year. According to budget projections, annual NOI forecasts are as follows: Year 1 $15,000 Year

. 7. Your client is opening a new building this year. According to budget projections, annual NOI forecasts are as follows: Year 1 $15,000 Year 2 $25,000 Year 3 $35,000 Year 4 $45,000 Year 5 $55,000 . . The required rate of return on investments of this type is 10%. The capitalization rate for similar 4-year old buildings is 9%. Cost of sale is 5% of terminal value. What is the terminal value if sold at the after Year 4? What is the cost of sale? . What are the sales proceeds at the end of Year 4? What is the net present market value of this property

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts