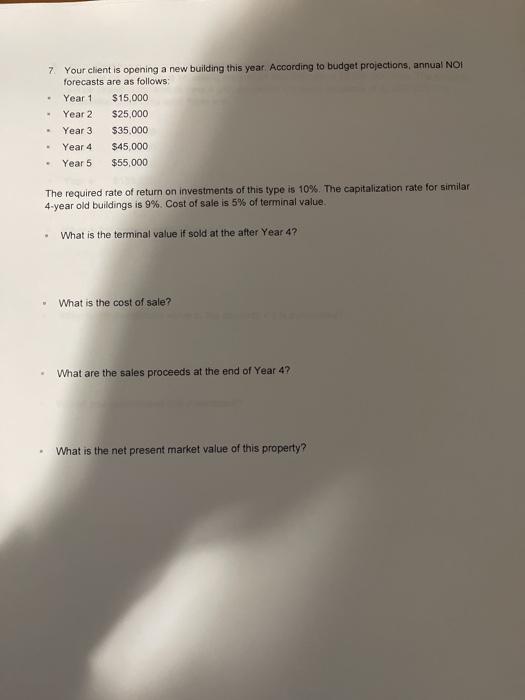

Question: 7. Your client is opening a new building this year. According to budget projections, annual NOI forecasts are as follows Year 1 $15,000 Year 2

7. Your client is opening a new building this year. According to budget projections, annual NOI forecasts are as follows Year 1 $15,000 Year 2 $25,000 Year 3 $35.000 Year 4 $45.000 Year 5 $55,000 The required rate of return on investments of this type is 10%. The capitalization rate for similar 4-year old buildings is 9%. Cost of sale is 5% of terminal value What is the terminal value if sold at the after Year 4? What is the cost of sale? What are the sales proceeds at the end of Year 4? What is the net present market value of this property

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts