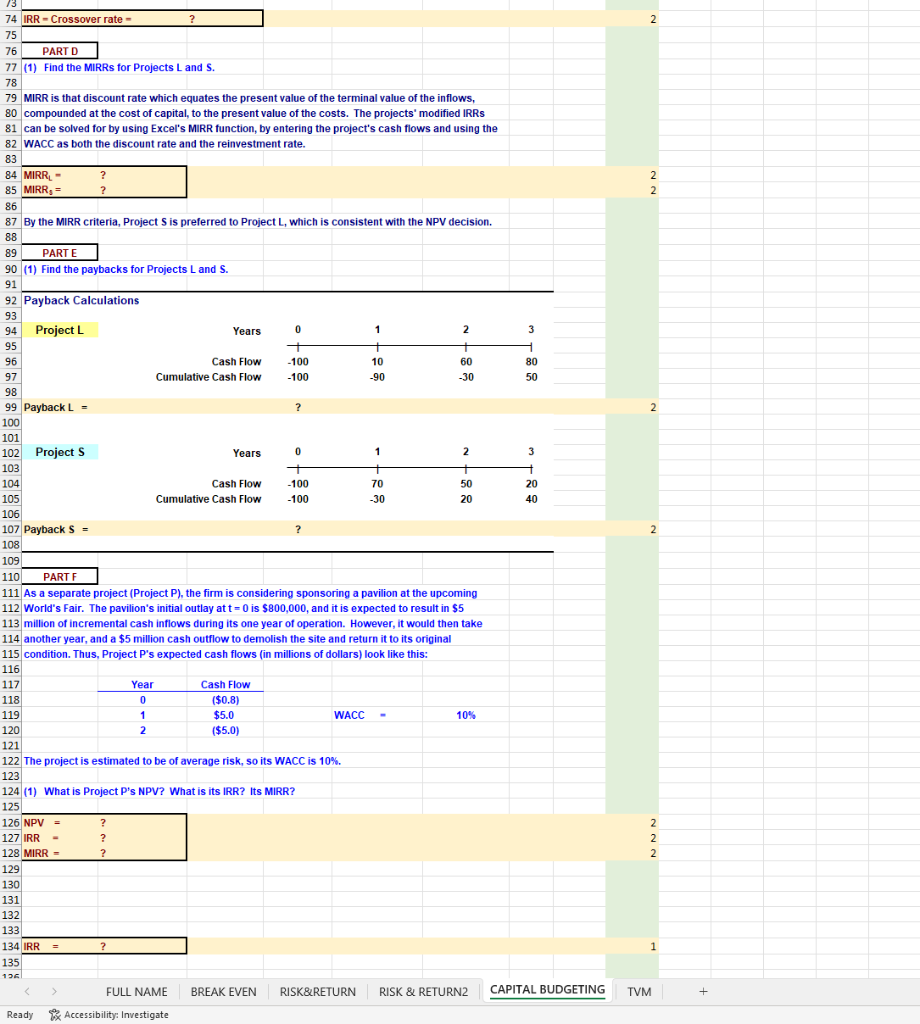

Question: 73 74 IRR - Crossover rate 75 76 PART D 77 (1) Find the MIRRS for Projects L and S. 78 79 MIRR is that

73 74 IRR - Crossover rate 75 76 PART D 77 (1) Find the MIRRS for Projects L and S. 78 79 MIRR is that discount rate which equates the present value of the terminal value of the inflows, 80 compounded at the cost of capital, to the present value of the costs. The projects' modified IRRS 81 can be solved for by using Excel's MIRR function, by entering the project's cash flows and using the 82 WACC as both the discount rate and the reinvestment rate. 83 84 MIRRL- ? ? 85 MIRR = 86 00 87 By the MIRR criteria, Project S is preferred to Project L, which is consistent with the NPV decision. 88 89 PART E 90 (1) Find the paybacks for Projects L and S. 91 92 Payback Calculations 93 94 Project L Years 0 1 2 3 95 + 1 96 Cash Flow -100 10 60 80 97 Cumulative Cash Flow -100 -90 -30 50 98 99 Payback L = ? 100 101 102 Project S Years 0 1 3 103 104 Cash Flow 70 -100 -100 105 Cumulative Cash Flow -30 20 106 107 Payback S = ? 108 109 110 PART F 111 As a separate project (Project P), the firm is considering sponsoring a pavilion at the upcoming 112 World's Fair. The pavilion's initial outlay at t=0 is $800,000, and it is expected to result in $5 113 million of incremental cash inflows during its one year of operation. However, it would then take 114 another year, and a $5 million cash outflow to demolish the site and return it to its original 115 condition. Thus, Project P's expected cash flows (in millions of dollars) look like this: 116 117 Year Cash Flow 118 0 ($0.8) $5.0 119 1 WACC 10% 120 2 ($5.0) 121 122 The project is estimated to be of average risk, so its WACC is 10%. 123 124 (1) What is Project P's NPV? What is its IRR? Its MIRR? 125 126 NPV = ? 127 IRR - 128 MIRR - 129 130 131 435 132 133 134 IRR = ? 135 136 RISK&RETURN RISK & RETURN2 CAPITAL BUDGETING FULL NAME BREAK EVEN Accessibility: Investigate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts