Question: (8) Now consider the Heston stochastic volatility model dS = rdt + o, dza du = k(0 _ v )dt to judze dze vidz2 =

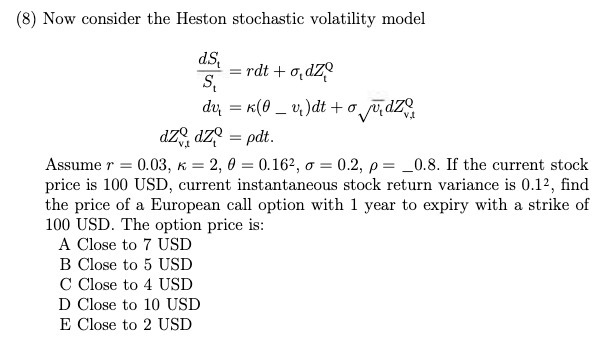

(8) Now consider the Heston stochastic volatility model dS = rdt + o, dza du = k(0 _ v )dt to judze dze vidz2 = pdt. Assume r = 0.03, k = 2, 0 = 0.162, o = 0.2, p = _0.8. If the current stock price is 100 USD, current instantaneous stock return variance is 0.12, find the price of a European call option with 1 year to expiry with a strike of 100 USD. The option price is: A Close to 7 USD B Close to 5 USD C Close to 4 USD D Close to 10 USD E Close to 2 USD

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts