Question: 8. What is not a problem with regression beta? A. It has high standard error B. It reflects the firm's business mix over the period

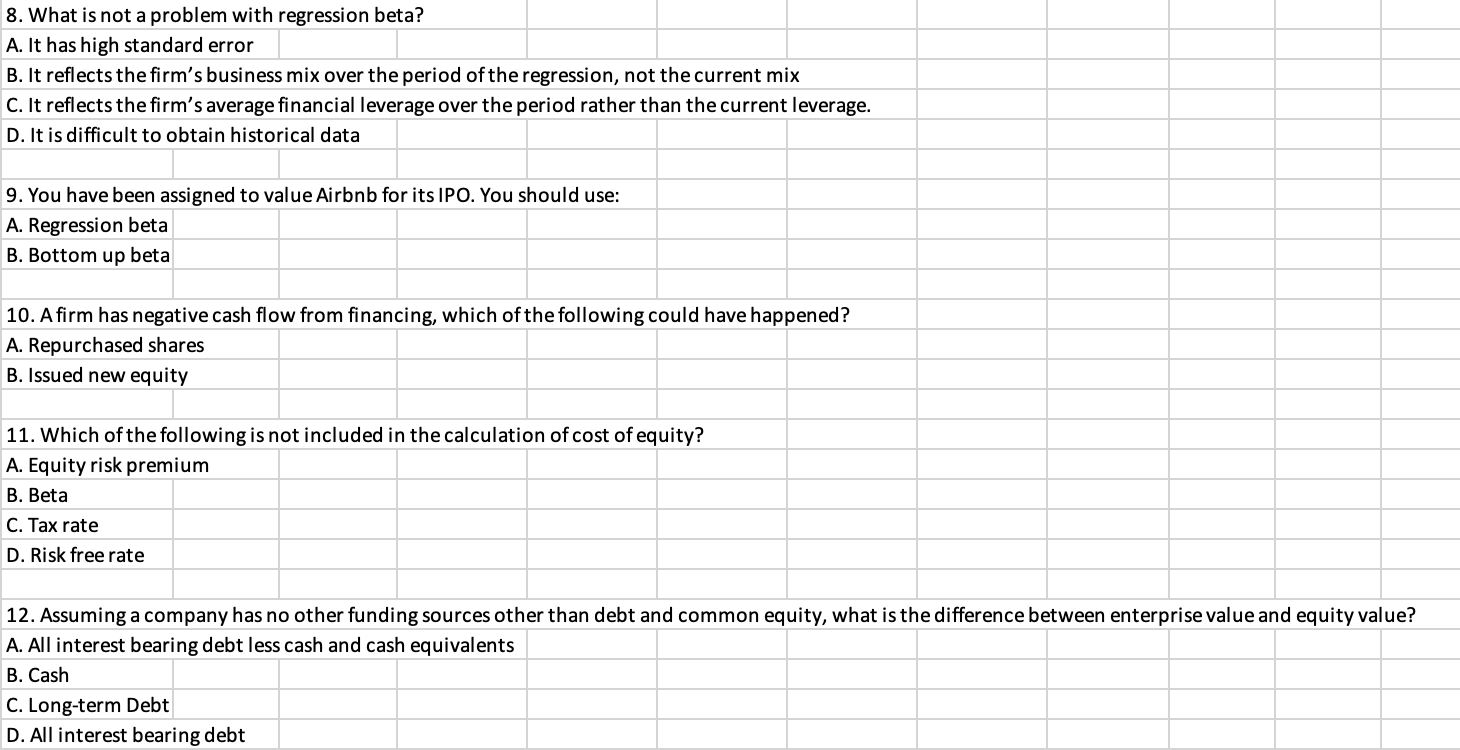

8. What is not a problem with regression beta? A. It has high standard error B. It reflects the firm's business mix over the period of the regression, not the current mix C. It reflects the firm's average financial leverage over the period rather than the current leverage. D. It is difficult to obtain historical data 9. You have been assigned to value Airbnb for its IPO. You should use: A. Regression beta B. Bottom up beta 10. A firm has negative cash flow from financing, which of the following could have happened? A. Repurchased shares B. Issued new equity 11. Which of the following is not included in the calculation of cost of equity? A. Equity risk premium B. Beta C. Tax rate D. Risk free rate 12. Assuming a company has no other funding sources other than debt and common equity, what is the difference between enterprise value and equity value? A. All interest bearing debt less cash and cash equivalents B. Cash C. Long-term Debt D. All interest bearing debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts