Question: 8.2- *PLEASE ANSWER ALL 5 QUESTIONS* DO NOT ANSWER AT ALL UNLESS ALL 5 QUESTIONS ARE ANSWERED PLEASE 5 multiple choice questions. 1. 2. 3.

8.2-*PLEASE ANSWER ALL 5 QUESTIONS* DO NOT ANSWER AT ALL UNLESS ALL 5 QUESTIONS ARE ANSWERED PLEASE

5 multiple choice questions.

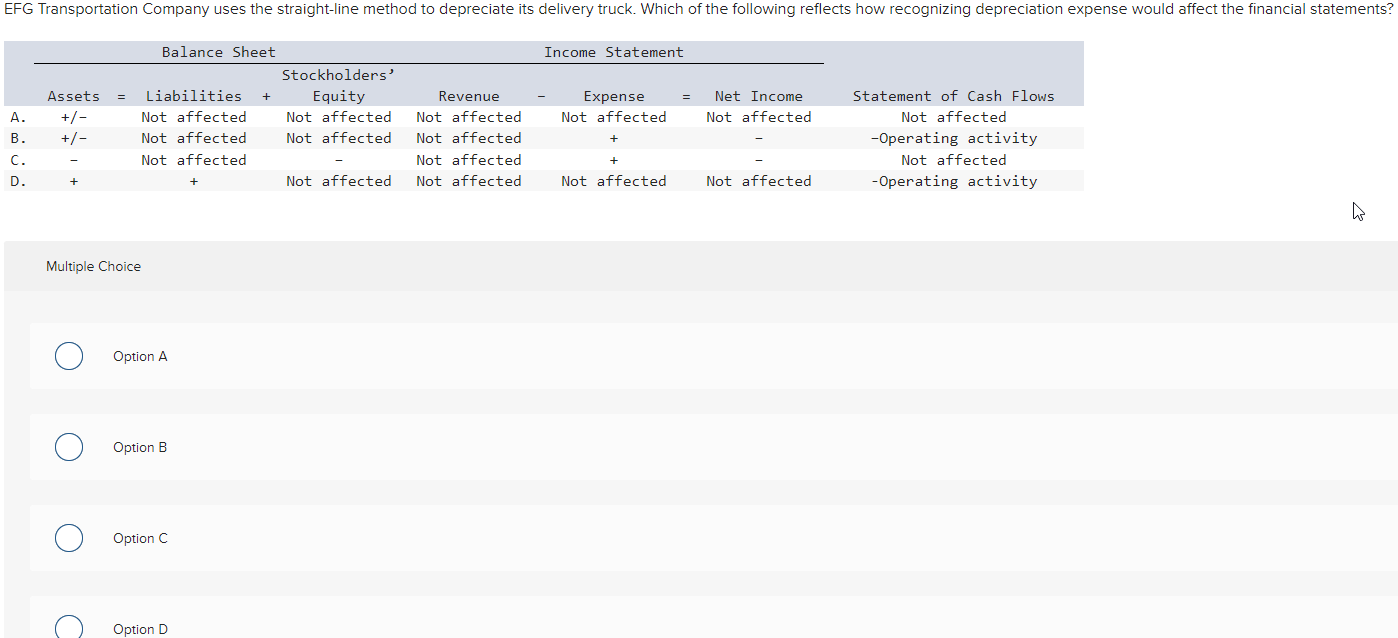

1.

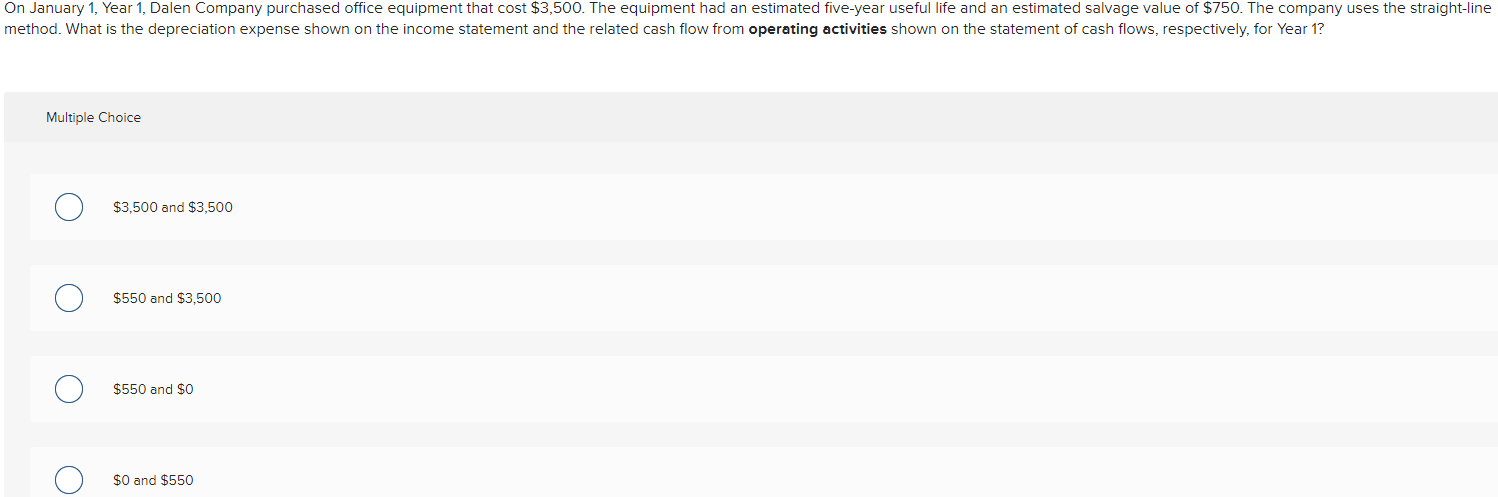

2.

3.

4.

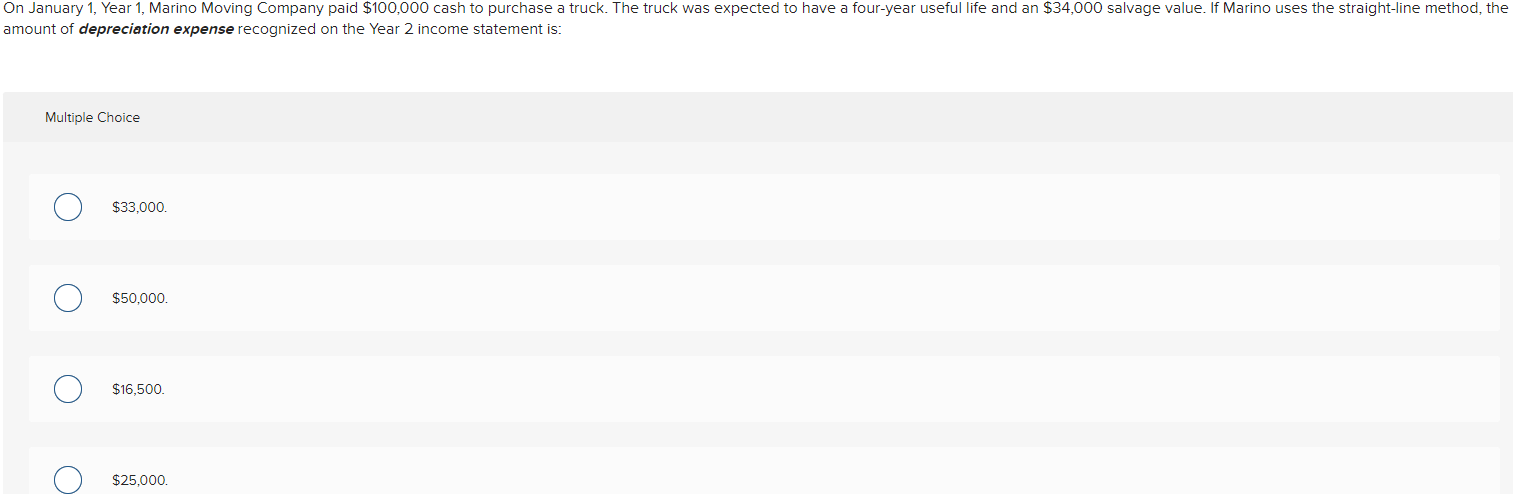

5.

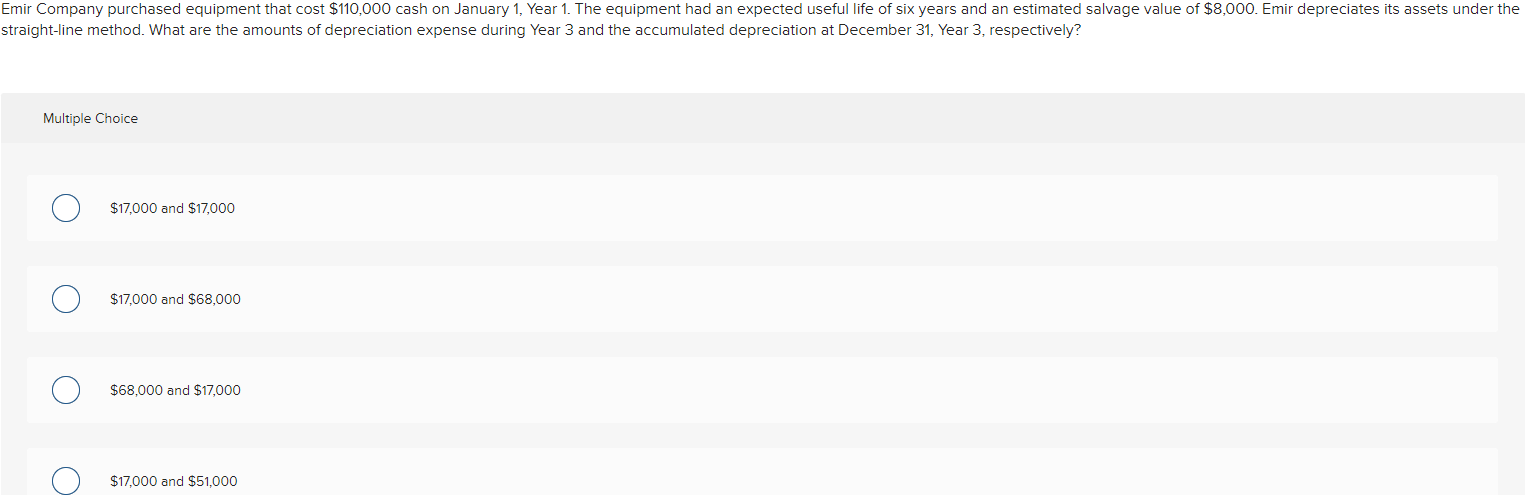

Multiple Choice $3,500 and $3,500 $550 and $3,500 $550 and \$0 $0 and $550 traight-line method. What are the amounts of depreciation expense during Year 3 and the accumulated depreciation at December 31, Year 3 , respectively? Multiple Choice $17,000 and $17,000 $17,000 and $68,000 $68,000 and $17,000 $17,000 and $51,000 Recognizing depreciation expense on equipment or a building is an asset use transaction. True or False amount of depreciation expense recognized on the Year 2 income statement is: Multiple Choice $33,000. $50,000. $16,500. $25,000. Multiple Choice Option A Option B Option C Option D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts