Question: 89 2 3 5 6 5 6 2 70 4 4 4 2 2 2 9 4 6 4 3 3 6 9 2 9

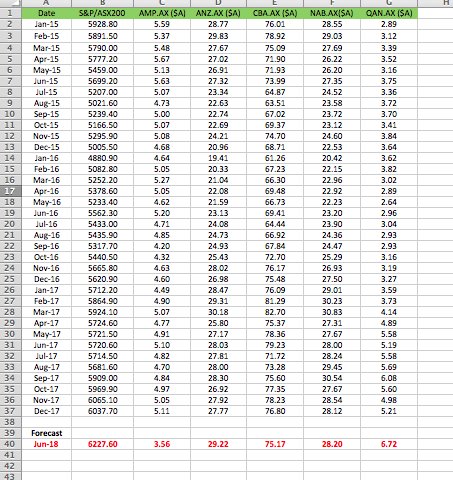

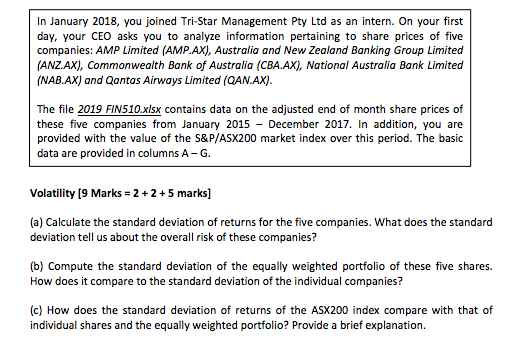

89 2 3 5 6 5 6 2 70 4 4 4 2 2 2 9 4 6 4 3 3 6 9 2 9 7 4 9 5 9 5 60 60 98 LA 534 80 50 00 20 00 20 00 60 40 50 90 50 90 80 20 60 40 30 00 90 70 50 80 90 20 90 10 60 50 60 50 60 00 90 10 70 0 1 0 7 9 9 7 .-9. 6 5 5 0 2 2 8 3 2 3 5 7 0 5 0 2 4 4 4-0419 957 60 st 18 15 1 15 1 5 16 16 16 16-10 16 1.6 16 6 6 6 16 17 17 17 17 17 17 17 17 17 17 7 15 is 15 15 1 2 3 4 5 6 7 8 9 10 1 1 1 1 1 1 89222222222233333333330424 In January 2018, you joined Tri-Star Management Pty Ltd as an intern. On your first day, your CEO asks you to analyze information pertaining to share prices of five companies: AMP Limited (AMP.AX), Australia and New Zealand Banking Group Limited (ANZAX), Commonwealth Bank of Australia (CBA.AX), National Australia Bank Limited (NAB.AX) and Qantas Airways Limited (QAN.AX). The file 2019 FIN510.xlsx contains data on the adjusted end of month share prices of these five companies from January 2015 December 2017. In addition, you are provided with the value of the S&P/ASX200 market index over this period. The basic data are provided in columns A-G. Volatiity [9 Marks 2+2+5 marks] (a) Calculate the standard deviation of returns for the five companies. What does the standard deviation tell us about the overall risk of these companies? (b) Compute the standard deviation of the equally weighted portfolio of these fve shares. How does it compare to the standard deviation of the individual companies? (c) How does the standard deviation of returns of the ASX200 index compare with that of individual shares and the equally weighted portfolio? Provide a brief explanation. 89 2 3 5 6 5 6 2 70 4 4 4 2 2 2 9 4 6 4 3 3 6 9 2 9 7 4 9 5 9 5 60 60 98 LA 534 80 50 00 20 00 20 00 60 40 50 90 50 90 80 20 60 40 30 00 90 70 50 80 90 20 90 10 60 50 60 50 60 00 90 10 70 0 1 0 7 9 9 7 .-9. 6 5 5 0 2 2 8 3 2 3 5 7 0 5 0 2 4 4 4-0419 957 60 st 18 15 1 15 1 5 16 16 16 16-10 16 1.6 16 6 6 6 16 17 17 17 17 17 17 17 17 17 17 7 15 is 15 15 1 2 3 4 5 6 7 8 9 10 1 1 1 1 1 1 89222222222233333333330424 In January 2018, you joined Tri-Star Management Pty Ltd as an intern. On your first day, your CEO asks you to analyze information pertaining to share prices of five companies: AMP Limited (AMP.AX), Australia and New Zealand Banking Group Limited (ANZAX), Commonwealth Bank of Australia (CBA.AX), National Australia Bank Limited (NAB.AX) and Qantas Airways Limited (QAN.AX). The file 2019 FIN510.xlsx contains data on the adjusted end of month share prices of these five companies from January 2015 December 2017. In addition, you are provided with the value of the S&P/ASX200 market index over this period. The basic data are provided in columns A-G. Volatiity [9 Marks 2+2+5 marks] (a) Calculate the standard deviation of returns for the five companies. What does the standard deviation tell us about the overall risk of these companies? (b) Compute the standard deviation of the equally weighted portfolio of these fve shares. How does it compare to the standard deviation of the individual companies? (c) How does the standard deviation of returns of the ASX200 index compare with that of individual shares and the equally weighted portfolio? Provide a brief explanation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts