Question: 9 . 3 . A process heat recovery study identifies five potential modifications, none of which are mutually exclusive, with the costs and energy savings

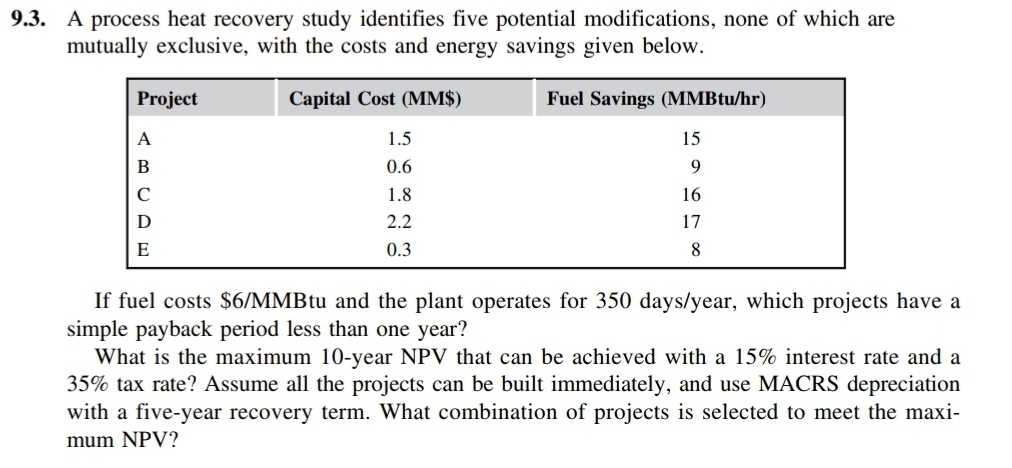

A process heat recovery study identifies five potential modifications, none of which are mutually exclusive, with the costs and energy savings given below.

tableProjectCapital Cost MM$Fuel Savings MMBtuhrABCDE

If fuel costs $ tu and the plant operates for daysyear which projects have a simple payback period less than one year?

What is the maximum year NPV that can be achieved with a interest rate and a tax rate? Assume all the projects can be built immediately, and use MACRS depreciation with a fiveyear recovery term. What combination of projects is selected to meet the maximum NPV

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock