Question: 9 and 10 Ben, a cash basis taxpayer, makes the following payments on September 30 of this year: $3, 150 for the next 10 months

9 and 10

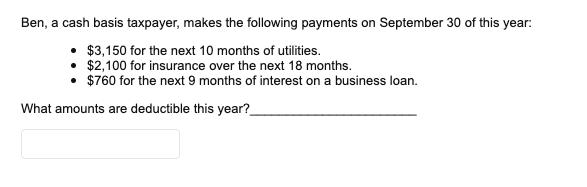

Ben, a cash basis taxpayer, makes the following payments on September 30 of this year: $3, 150 for the next 10 months of utilities. $2, 100 for insurance over the next 18 months. $760 for the next g months of interest on a business loan. What amounts are deductible this year?

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Answer Part 1 Total 6010 is Deductible by May because may is a cash basis taxpayer and in cash basi... View full answer

Get step-by-step solutions from verified subject matter experts