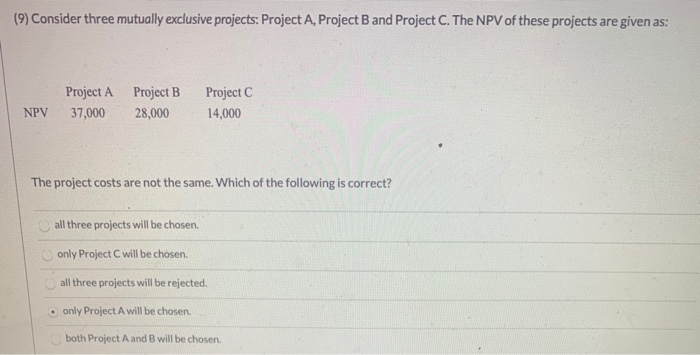

Question: (9) Consider three mutually exclusive projects: Project A, Project B and Project C. The NPV of these projects are given as: Project A 37,000 Project

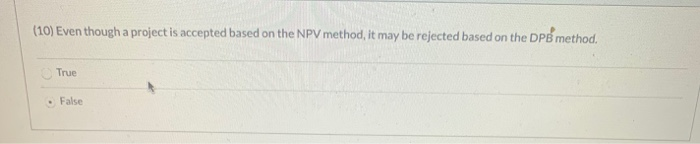

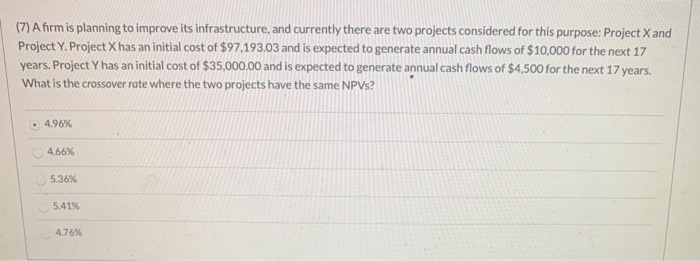

(9) Consider three mutually exclusive projects: Project A, Project B and Project C. The NPV of these projects are given as: Project A 37,000 Project B 28,000 Project C 14,000 NPV The project costs are not the same. Which of the following is correct? all three projects will be chosen only Project C will be chosen. all three projects will be rejected. only Project A will be chosen both Project A and B will be chosen (10) Even though a project is accepted based on the NPV method, it may be rejected based on the DPB method. True False (7) A firm is planning to improve its infrastructure, and currently there are two projects considered for this purpose: Project X and Project Y. Project X has an initial cost of $97,193.03 and is expected to generate annual cash flows of $10,000 for the next 17 years. Project Y has an initial cost of $35,000.00 and is expected to generate annual cash flows of $4,500 for the next 17 years, What is the crossover rate where the two projects have the same NPVS? 4.96% 4.66% 5.36% 5.41% 4.76%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts