Question: 9-month put option contract : TSLA230120P01050000 Use a three-step binomial tree to calculate the option price on a 9-month American put option with a strike

9-month put option contract : TSLA230120P01050000

9-month put option contract : TSLA230120P01050000

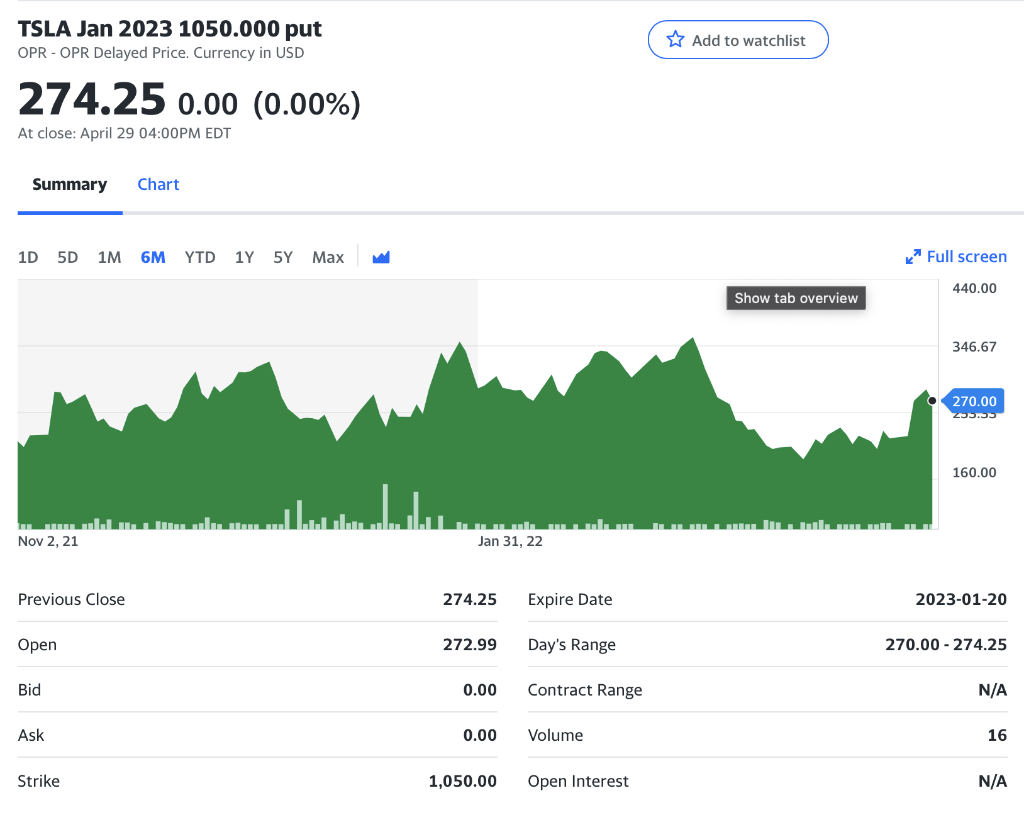

Use a three-step binomial tree to calculate the option price on a 9-month American put option with a strike price at the money and the corresponding risk-free rate and volatility. TSLA Jan 2023 1050.000 put OPR-OPR Delayed Price. Currency in USD 274.25 0.00 (0.00%) At close: April 29 04:00PM EDT Summary Chart 1D 5D 1M 6M YTD 1Y 5Y Max ..... Nov 2, 21 Previous Close Open Bid Ask Strike Jan 31, 22 274.25 272.99 0.00 0.00 1,050.00 Expire Date Day's Range Contract Range Volume Open Interest Add to watchlist Show tab overview Full screen 440.00 346.67 270.00 233.55 160.00 2023-01-20 270.00-274.25 N/A 16 N/A Use a three-step binomial tree to calculate the option price on a 9-month American put option with a strike price at the money and the corresponding risk-free rate and volatility. TSLA Jan 2023 1050.000 put OPR-OPR Delayed Price. Currency in USD 274.25 0.00 (0.00%) At close: April 29 04:00PM EDT Summary Chart 1D 5D 1M 6M YTD 1Y 5Y Max ..... Nov 2, 21 Previous Close Open Bid Ask Strike Jan 31, 22 274.25 272.99 0.00 0.00 1,050.00 Expire Date Day's Range Contract Range Volume Open Interest Add to watchlist Show tab overview Full screen 440.00 346.67 270.00 233.55 160.00 2023-01-20 270.00-274.25 N/A 16 N/A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts