Question: (a) (1 mark) In your own words, briefly explain how the immunization technique works. In particular, explain how the concepts of reinvestment risk and interest

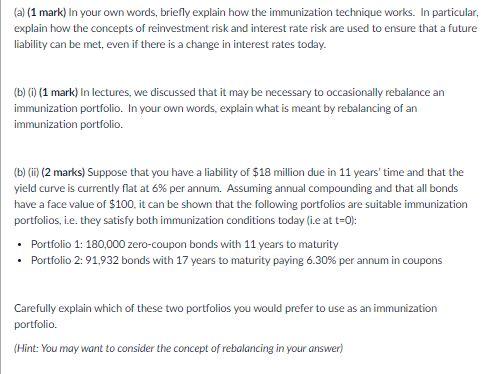

(a) (1 mark) In your own words, briefly explain how the immunization technique works. In particular, explain how the concepts of reinvestment risk and interest rate risk are used to ensure that a future liability can be met, even if there is a change in interest rates today. (b) 0) (1 mark) In lectures, we discussed that it may be necessary to occasionally rebalance an immunization portfolio. In your own words, explain what is meant by rebalancing of an immunization portfolio. (b) (1) (2 marks) Suppose that you have a liability of $18 million due in 11 years' time and that the yield curve is currently flat at 6% per annum. Assuming annual compounding and that all bonds have a face value of $100. it can be shown that the following portfolios are suitable immunization portfolios, i.e. they satisfy both immunization conditions today (ie at t=0): Portfolio 1: 180,000 zero-coupon bonds with 11 years to maturity Portfolio 2: 91,932 bonds with 17 years to maturity paying 6.30% per annum in coupons Carefully explain which of these two portfolios you would prefer to use as an immunization portfolio (Hint: You may want to consider the concept of rebalancing in your answer)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts