Question: A 1:0 3D ... bs ljll - assignment_... 1a0da0aa87 > - . TO PER 131 Page 3 INTERNATIONAL ACCOUNTING (020114600). FACULTY OF ADMIENISTRIVE AND FINANCIAL

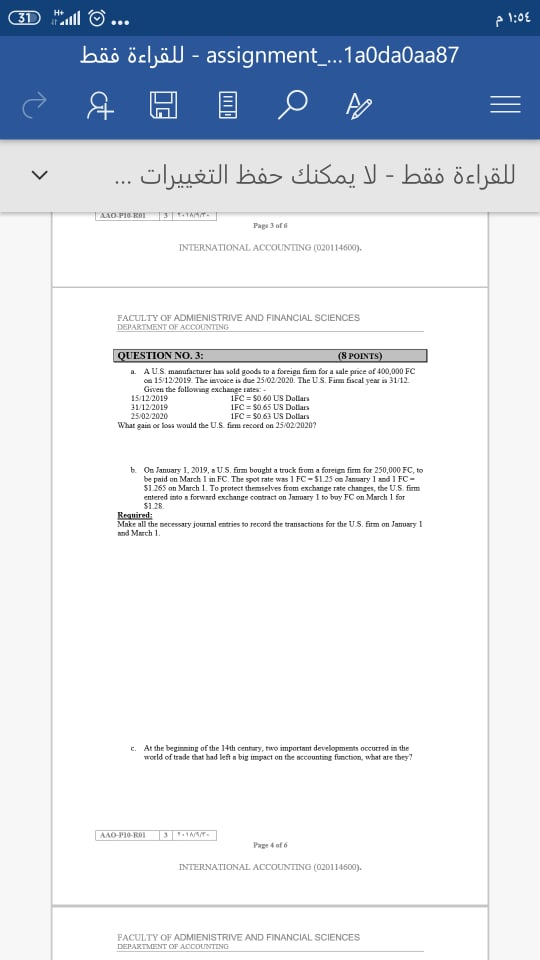

A 1:0 3D ... bs ljll - assignment_... 1a0da0aa87 > - . TO PER 131 Page 3 INTERNATIONAL ACCOUNTING (020114600). FACULTY OF ADMIENISTRIVE AND FINANCIAL SCIENCES DEPARTMENT OF ACCOUNTING QUESTION NO. 3: (8 POINTS) 1. AUS manufacturer has sold goods to a foreign firm for a sale price of 400,000 FC on 15/12 2019. The invoice is due 25/02/2020. The US. Firm fiscal year is 31/12 Given the following exchange rates 15/12/2019 IFC = 50.60 US Dollar 31/12/2019 1FC = 50.65 US Dollar 25/02/2020 1FC = 30.63 US Dollars What gain or loss would the U.S. fimm record on 25/02/20202 b. On January 1, 2019, a U.S. firm bought a truck from a foreign firm for 250,000 FC, to be paid on March 1 in FC. The spot rate was 1 FC - 51.25 January 1 and 1 FC - 51.265 on March 1. To protect themselves from exchange rate changes, the U.S. firm entered into a forward exchange contract on Tummary 1 to buy FC on March 1 for 51.28 Mnke all the necessary journal entries to record the transactions for the U.S. firm on January 1 and March 1 c. At the beginning of the 14th century, two important developments occurred in the world of trade that had left a big impact on the accounting function, what are they? AAD-PO-RDI Pape of INTERNATIONAL ACCOUNTING (020114600). FACULTY OF ADMIENISTRIVE AND FINANCIAL SCIENCES DEPARTMENT OF ACCOUNTING

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts