Question: A $1,000 par value bond was issued five years ago at a 8 percent coupon rate. It currently has 10 years remaining to maturity

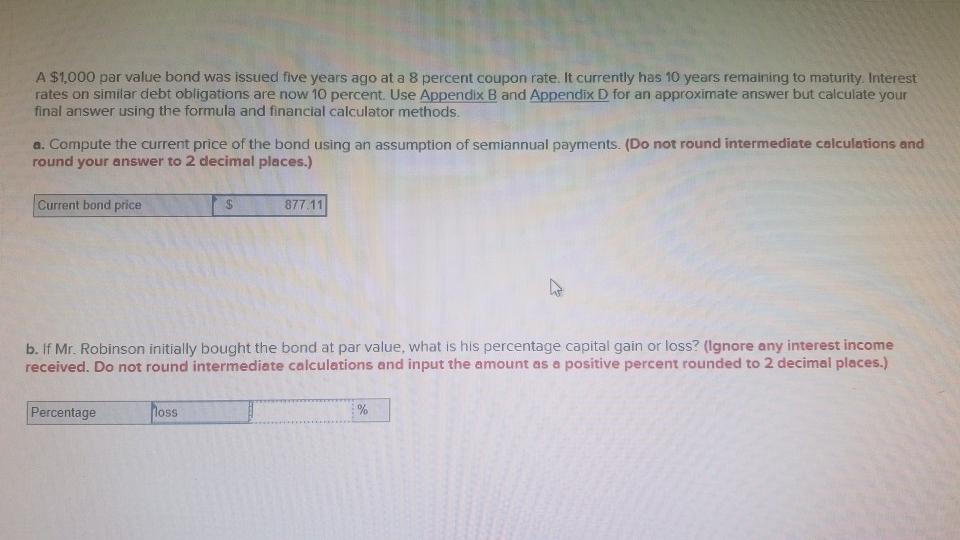

A $1,000 par value bond was issued five years ago at a 8 percent coupon rate. It currently has 10 years remaining to maturity Interest rates on similar debt obligations are now 10 percent. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. a. Compute the current price of the bond using an assumption of semiannual payments. (Do not round intermediate calculations and round your answer to 2 decimal places.) Current bond price 24 877 11 b. If Mr. Robinson initially bought the bond at par value, what is his percentage capital gain or loss? (Ignore any interest income received. Do not round intermediate calculations and input the amount as a positive percent rounded to 2 decimal places.) Percentage hoss

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

As given Fv 1000 Nper Time remaining to maturex 2 102 20 PM... View full answer

Get step-by-step solutions from verified subject matter experts