Question: a A E SE Shapes Arrange Quick Styles Shape Outline Shape Effects Sc Replace Select Dict IN 6 5 Paragraph 3 4 Drawing 1 Editing

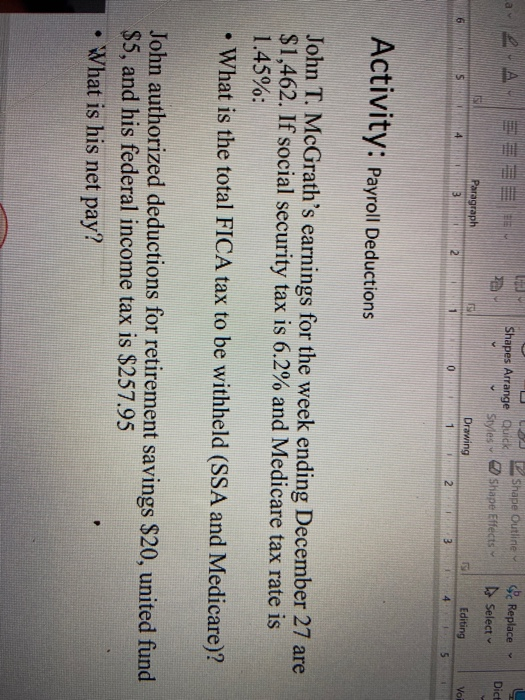

a A E SE Shapes Arrange Quick Styles Shape Outline Shape Effects Sc Replace Select Dict IN 6 5 Paragraph 3 4 Drawing 1 Editing Voi 2 1 0 1 2 1 3 4 5 Activity: Payroll Deductions John T. McGrath's earnings for the week ending December 27 are $1,462. If social security tax is 6.2% and Medicare tax rate is 1.45%: What is the total FICA tax to be withheld (SSA and Medicare)? . John authorized deductions for retirement savings $20, united fund $5, and his federal income tax is $257.95 What is his net pay

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock