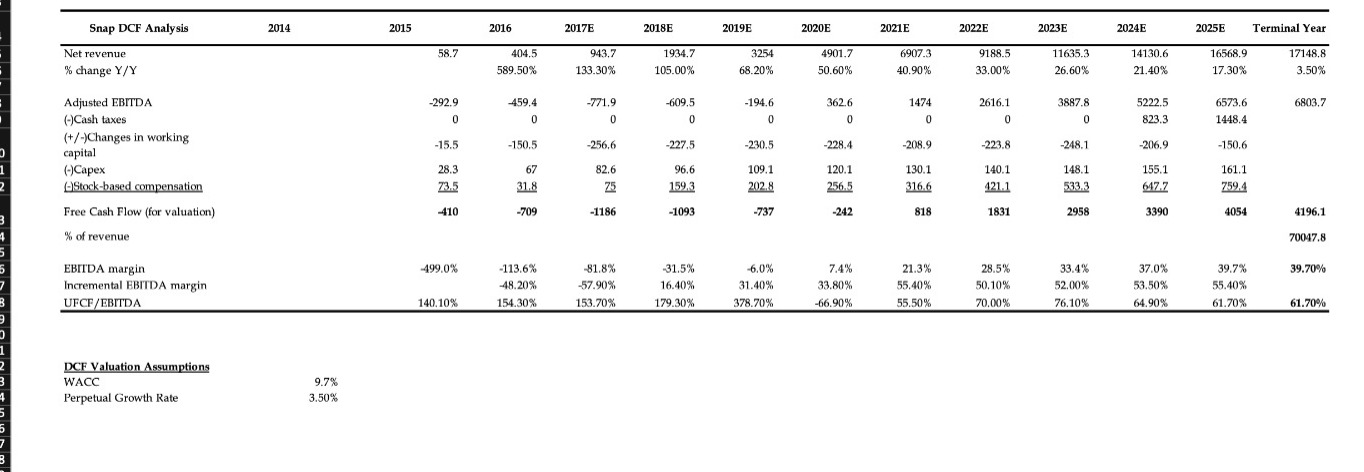

Question: a . A Morgan Stanley analyst produced the financial forecasts provided in the Snap Supplemental Workbook shortly after the offering. The analyst assumed a WACC

a A Morgan Stanley analyst produced the financial forecasts provided in the Snap Supplemental Workbook shortly after the offering. The analyst assumed a WACC of and shares outstanding. Under these assumptions, what would be the discounted cash flow DCF estimate of Snap stocks fair market value on a per share basis?

i How sensitive is this estimate of Snaps stock price to assumptions about growth and WACC?

ii Do these assumptions and forecasts appear reasonable? What data would you use to asses that?

iii. Analyze Snaps DCF value under various alternative assumptions of your own.

What important changes would you make to the forecasts provided in the Snap Supplemental Workbook, if any?

What discount rate would you recommend using in this DCF analysis? Assume a longterm government bond rate of

How, in particular, would you deal with the uncertainty associated with Snaps future growth?

b Do you believe that Snap underpriced its IPO? If so why might it have sone, and would you agree with that decision? If you were the CEO of a company undergoing an IPO, would you agree to underprice it at the time of the offering?DCF Valuation Assumptions

WACC

Perpetual Growth Rate

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock