Question: a) Assess the information in the table below. Compute the PE ratio for the industry. 1.5 Industry beta Government bond yield Equity risk premium

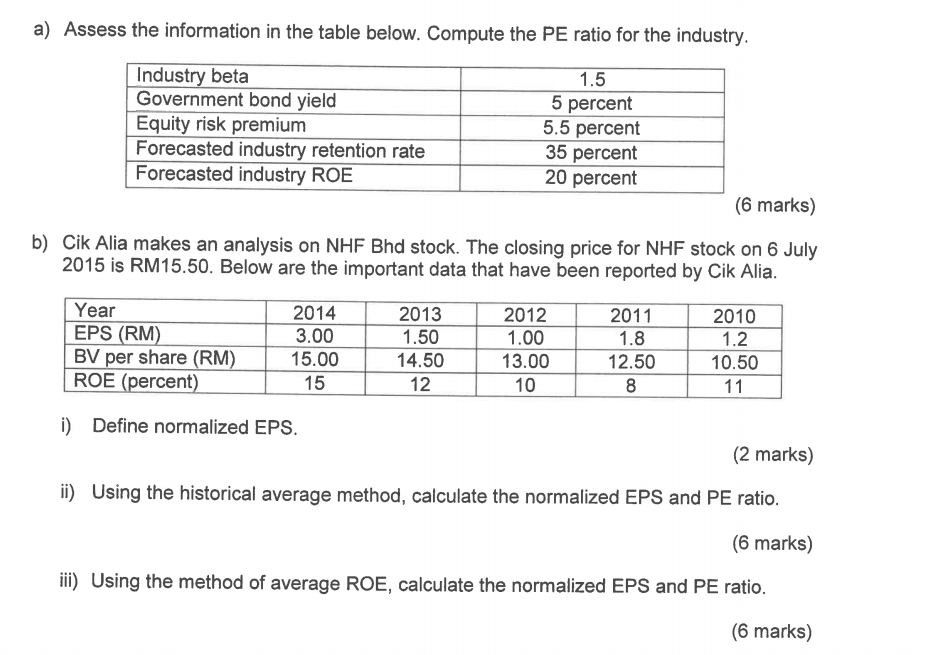

a) Assess the information in the table below. Compute the PE ratio for the industry. 1.5 Industry beta Government bond yield Equity risk premium 5 percent 5.5 percent 35 percent Forecasted industry retention rate Forecasted industry ROE 20 percent (6 marks) b) Cik Alia makes an analysis on NHF Bhd stock. The closing price for NHF stock on 6 July 2015 is RM15.50. Below are the important data that have been reported by Cik Alia. Year EPS (RM) BV per share (RM) ROE (percent) i) Define normalized EPS. 2014 3.00 15.00 15 2013 1.50 14.50 12 2012 1.00 13.00 10 2011 1.8 12.50 8 2010 1.2 10.50 11 (2 marks) ii) Using the historical average method, calculate the normalized EPS and PE ratio. (6 marks) iii) Using the method of average ROE, calculate the normalized EPS and PE ratio. (6 marks)

Step by Step Solution

3.38 Rating (167 Votes )

There are 3 Steps involved in it

a To compute the PricetoEarnings PE ratio for the industry we need to first calculate the required r... View full answer

Get step-by-step solutions from verified subject matter experts