Question: a. Assuming no differences in TFP (ignore the last column) and no differences in the rate of depreciation between the U.S. and Switzerland, use the

a. Assuming no differences in TFP (ignore the last column) and no differences in the rate of depreciation between the U.S. and Switzerland, use the data in the table to predict the ratio of per capita GDP of Switzerland relative to that of the U.S. in the steady states. How much percent richer is Switzerland than the U.S. in steady state?

b. Now do the same exercise assuming TFP is given by the levels in the last column. Now how much percent richer is Switzerland than the U.S. in steady state?

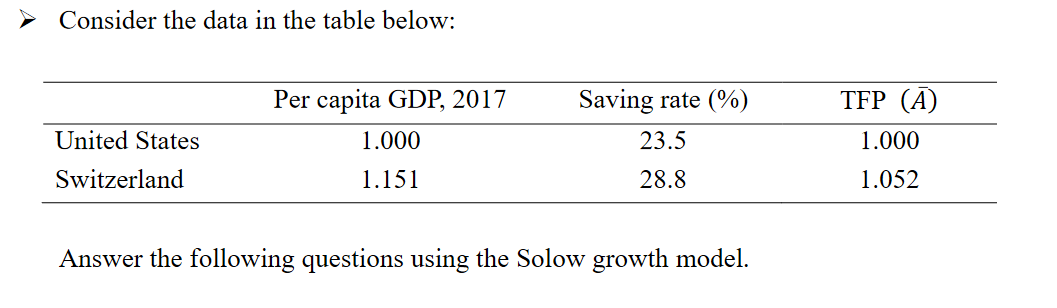

Consider the data in the table below: TFP (A) Per capita GDP, 2017 1.000 Saving rate (%) 23.5 United States 1.000 Switzerland 1.151 28.8 1.052 Answer the following questions using the Solow growth model. Consider the data in the table below: TFP (A) Per capita GDP, 2017 1.000 Saving rate (%) 23.5 United States 1.000 Switzerland 1.151 28.8 1.052 Answer the following questions using the Solow growth model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts