Question: a) b) 2 questions. please only answer if you know how todo it. please use excel and show what uou plugged in to get your

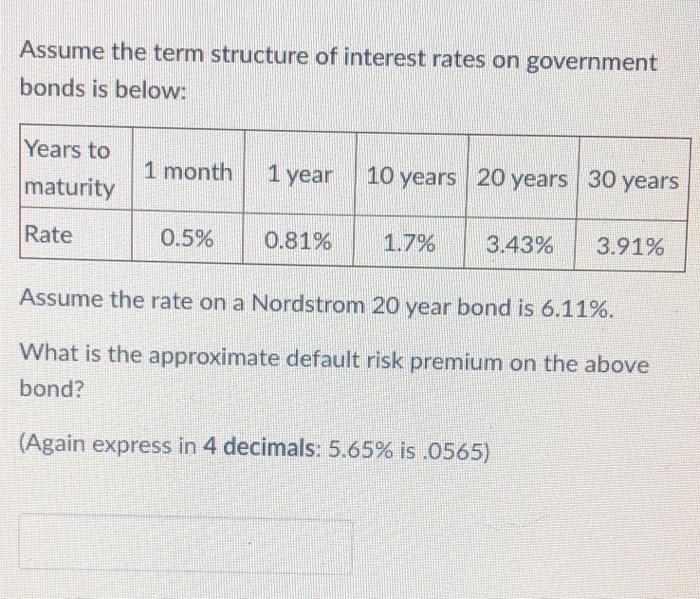

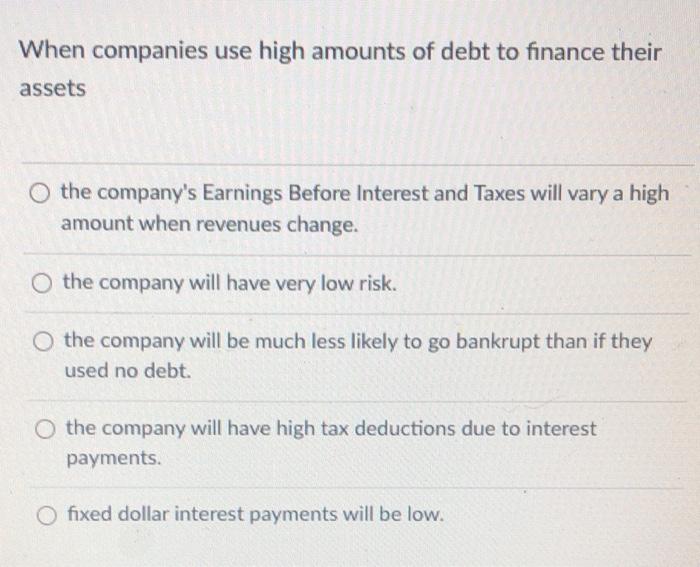

Assume the term structure of interest rates on government bonds is below: Years to 1 month maturity 1 year 10 years 20 years 30 years Rate 0.5% 0.81% 1.7% 3.43% 3.91% Assume the rate on a Nordstrom 20 year bond is 6.11%. What is the approximate default risk premium on the above bond? (Again express in 4 decimals: 5.65% is .0565) When companies use high amounts of debt to finance their assets the company's Earnings Before Interest and Taxes will vary a high amount when revenues change. O the company will have very low risk. O the company will be much less likely to go bankrupt than if they used no debt. O the company will have high tax deductions due to interest payments. O fixed dollar interest payments will be low

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts