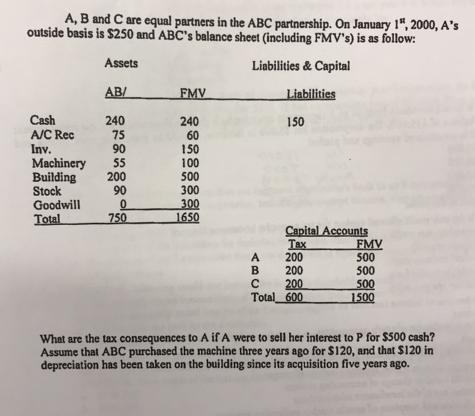

Question: A, B and C are equal partners in the ABC partnership. On January 1, 2000, A's outside basis is $250 and ABC's balance sheet

A, B and C are equal partners in the ABC partnership. On January 1", 2000, A's outside basis is $250 and ABC's balance sheet (including FMV's) is as follow: Assets Liabilities & Capital AB/ Liabilities Cash A/C Rec Inv. 240 75 90 Machinery 55 Building 200 Stock 90 Goodwill Total 0 750 FMV 240 60 150 100 500 300 300 1650 A B C Total 150 Capital Accounts Tax 200 200 200 600 FMV 500 500 500 1500 What are the tax consequences to A if A were to sell her interest to P for $500 cash? Assume that ABC purchased the machine three years ago for $120, and that $120 in depreciation has been taken on the building since its acquisition five years ago.

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

If A were to sell her interest to P for 500 cash the tax consequences ... View full answer

Get step-by-step solutions from verified subject matter experts