Question: A B C D E F G H J Problem 1. 1 2 3 5 Consider the Think-Big Development Co. problem presented in Section 3.2,

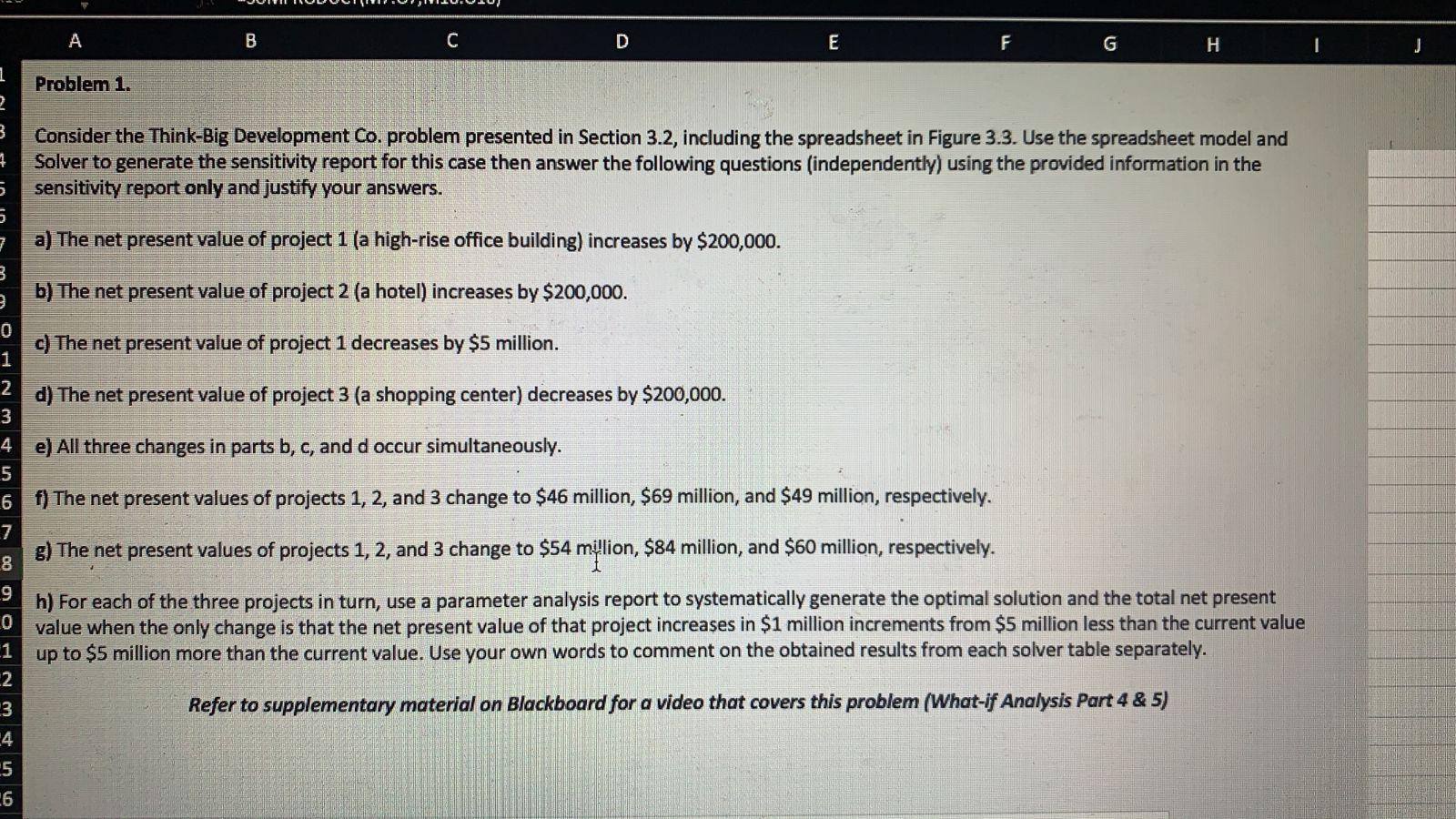

A B C D E F G H J Problem 1. 1 2 3 5 Consider the Think-Big Development Co. problem presented in Section 3.2, including the spreadsheet in Figure 3.3. Use the spreadsheet model and Solver to generate the sensitivity report for this case then answer the following questions (independently) using the provided information in the sensitivity report only and justify your answers. 5 7 a) The net present value of project 1 (a high-rise office building) increases by $200,000. 3 b) The net present value of project 2 (a hotel) increases by $200,000. 3 0 c) The net present value of project 1 decreases by $5 million. 1 4 2 d) The net present value of project 3 (a shopping center) decreases by $200,000. 3 e) All three changes in parts b, c, and d occur simultaneously. 5 6 f) The net present values of projects 1, 2, and 3 change to $46 million, $69 million, and $49 million, respectively. 7 8 g) The net present values of projects 1, 2, and 3 change to $54 million, $84 million, and $60 million, respectively. 9 h) For each of the three projects in turn, use a parameter analysis report to systematically generate the optimal solution and the total net present 0 value when the only change is that the net present value of that project increases in $1 million increments from $5 million less than the current value 1 up to $5 million more than the current value. Use your own words to comment on the obtained results from each solver table separately. 2 3 Refer to supplementary material on Blackboard for a video that covers this problem (What-if Analysis Part 4 & 5) 4 5 26 un A B C D E F G H J Problem 1. 1 2 3 5 Consider the Think-Big Development Co. problem presented in Section 3.2, including the spreadsheet in Figure 3.3. Use the spreadsheet model and Solver to generate the sensitivity report for this case then answer the following questions (independently) using the provided information in the sensitivity report only and justify your answers. 5 7 a) The net present value of project 1 (a high-rise office building) increases by $200,000. 3 b) The net present value of project 2 (a hotel) increases by $200,000. 3 0 c) The net present value of project 1 decreases by $5 million. 1 4 2 d) The net present value of project 3 (a shopping center) decreases by $200,000. 3 e) All three changes in parts b, c, and d occur simultaneously. 5 6 f) The net present values of projects 1, 2, and 3 change to $46 million, $69 million, and $49 million, respectively. 7 8 g) The net present values of projects 1, 2, and 3 change to $54 million, $84 million, and $60 million, respectively. 9 h) For each of the three projects in turn, use a parameter analysis report to systematically generate the optimal solution and the total net present 0 value when the only change is that the net present value of that project increases in $1 million increments from $5 million less than the current value 1 up to $5 million more than the current value. Use your own words to comment on the obtained results from each solver table separately. 2 3 Refer to supplementary material on Blackboard for a video that covers this problem (What-if Analysis Part 4 & 5) 4 5 26 un

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts