Question: A) B) C) Please do requirements A-C (I will like!) Thank you ! At the end of the year, overhead applied was $3,665,000. Actual overhead

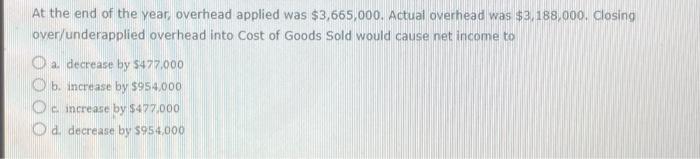

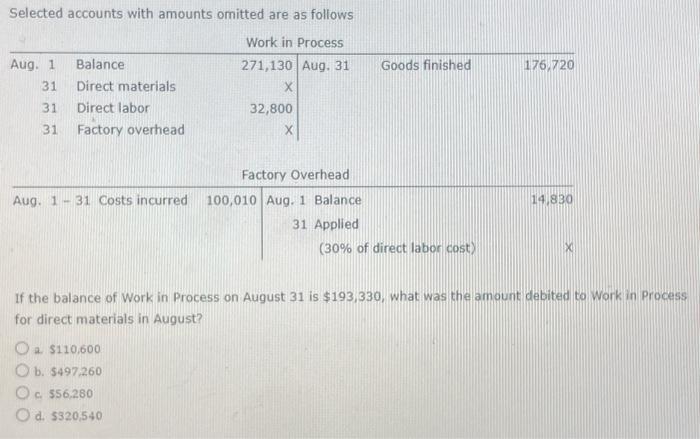

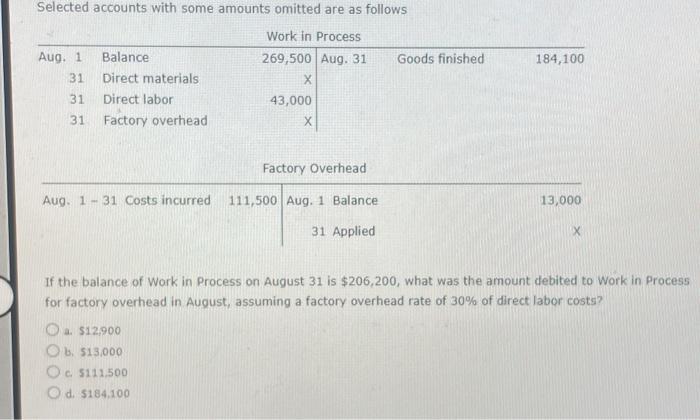

At the end of the year, overhead applied was $3,665,000. Actual overhead was $3,188,000. Closing over/underapplied overhead into Cost of Goods Sold would cause net income to a. decrease by 5477,000 b. increase by $954,000 c. increase by $477,000 d. decrease by $954,000 Selected accounts with amounts omitted are as follows If the balance of Work in Process on August 31 is $193,330, what was the amount debited to Work in Process for direct materials in August? a. $110,600 b. $497,260 c. 556,280 d. 5320,540 Selected accounts with some amounts omitted are as follows If the balance of Work in Process on August 31 is $206,200, what was the amount debited to Work in Process for factory overhead in August, assuming a factory overhead rate of 30% of direct labor costs? a. 512,900 b. 513,000 c. 5111,500 d. 5184,100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts