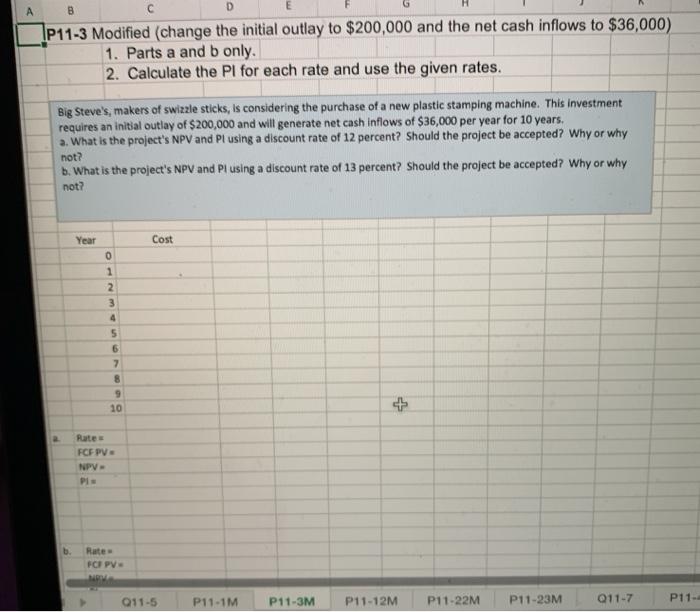

Question: A B D E 1P11-3 Modified (change the initial outlay to $200,000 and the net cash inflows to $36,000) 1. Parts a and b only.

A B D E 1P11-3 Modified (change the initial outlay to $200,000 and the net cash inflows to $36,000) 1. Parts a and b only. 2. Calculate the PI for each rate and use the given rates. Big Steve's, makers of swizzle sticks, is considering the purchase of a new plastic stamping machine. This investment requires an initial outlay of $200,000 and will generate net cash inflows of $36,000 per year for 10 years, a. What is the project's NPV and Pl using a discount rate of 12 percent? Should the project be accepted? Why or why b. What is the project's NPV and Pl using a discount rate of 13 percent? Should the project be accepted? Why or why not? not? Year Cost 0 1 2 3 5 6 7 8 9 10 + Rate FCFPV NPV PIE b Rates FOFPV MV Q11-5 P11-1M P11-3M P11-12M P11-22M P11-23M Q11-7 P11- ( (body) 11 ' = Paste BIU v a. Av lili lil all 11 X & fx A B D F G H Year Cost NO 3 4 5 6 7 8 9 10 Rates FCFPV NPV PIE b Rate FOFPV NPV PL + 011-5 P11-1M P11-3M P11-12M P11-22M P11-23M Q1 Ryan Library unt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts