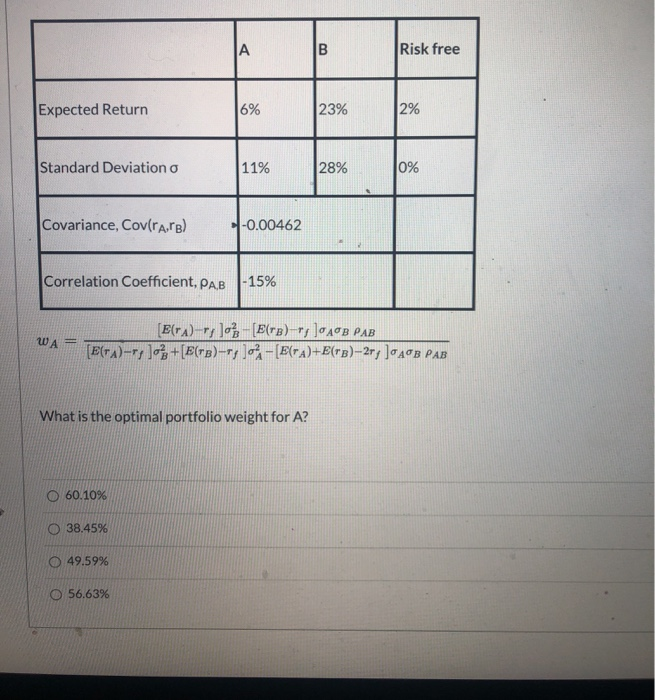

Question: A B Risk free Expected Return 16% 23% 2% Standard Deviation o 11% 28% 0% Covariance, Cov(rare) -0.00462 Correlation Coefficient, PAB -15% WA [E(TA) --

A B Risk free Expected Return 16% 23% 2% Standard Deviation o 11% 28% 0% Covariance, Cov(rare) -0.00462 Correlation Coefficient, PAB -15% WA [E(TA) -- 10% [E(TB)--, JOAB PAB [E(ra)--> 10+[E(TB)--, 10%-[E(TA)+E(TB)-2r; JOAB PAB What is the optimal portfolio weight for A? 60.10% O 38.45% 49.59% O 56.63%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts