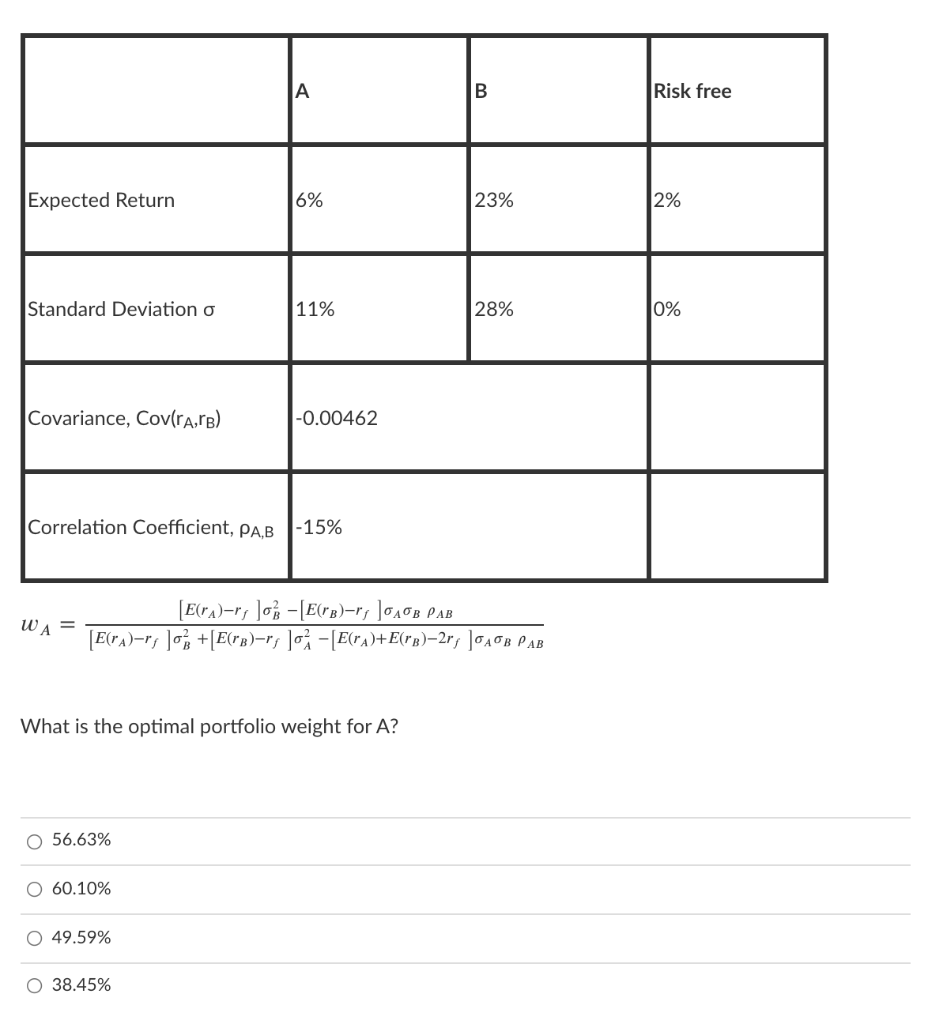

Question: A B Risk free Expected Return 6% 23% 2% Standard Deviation o 11% 28% 0% Covariance, Cov(rare) -0.00462 Correlation Coefficient, PAB -15% WA = [E(x)=rs

A B Risk free Expected Return 6% 23% 2% Standard Deviation o 11% 28% 0% Covariance, Cov(rare) -0.00462 Correlation Coefficient, PAB -15% WA = [E("x)=rs 10% - [E('B)=r; 1040B PAB [E(VA)-r, 10% +[E(B)=rs ] - [E(TA)+E(PB)-2r/ JOAOB PAB What is the optimal portfolio weight for A? O 56.63% O 60.10% O 49.59% O 38.45%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts