Question: A bank longs a 5-year AA-rated (defaultable) zero coupon bond with face value $1 million and current (annualized) yield of 4%. The bank wants to

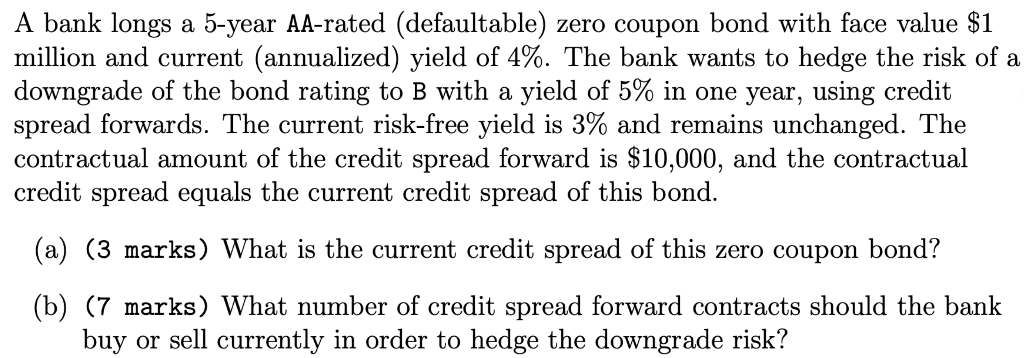

A bank longs a 5-year AA-rated (defaultable) zero coupon bond with face value $1 million and current (annualized) yield of 4%. The bank wants to hedge the risk of a downgrade of the bond rating to B with a yield of 5% in one year, using credit spread forwards. The current risk-free yield is 3% and remains unchanged. The contractual amount of the credit spread forward is $10,000, and the contractual credit spread equals the current credit spread of this bond. (a) (3 marks) What is the current credit spread of this zero coupon bond? (b) (7 marks) What number of credit spread forward contracts should the bank buy or sell currently in order to hedge the downgrade risk? A bank longs a 5-year AA-rated (defaultable) zero coupon bond with face value $1 million and current (annualized) yield of 4%. The bank wants to hedge the risk of a downgrade of the bond rating to B with a yield of 5% in one year, using credit spread forwards. The current risk-free yield is 3% and remains unchanged. The contractual amount of the credit spread forward is $10,000, and the contractual credit spread equals the current credit spread of this bond. (a) (3 marks) What is the current credit spread of this zero coupon bond? (b) (7 marks) What number of credit spread forward contracts should the bank buy or sell currently in order to hedge the downgrade risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts